Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4027

Pages:82

Published On:December 2025

Market.png)

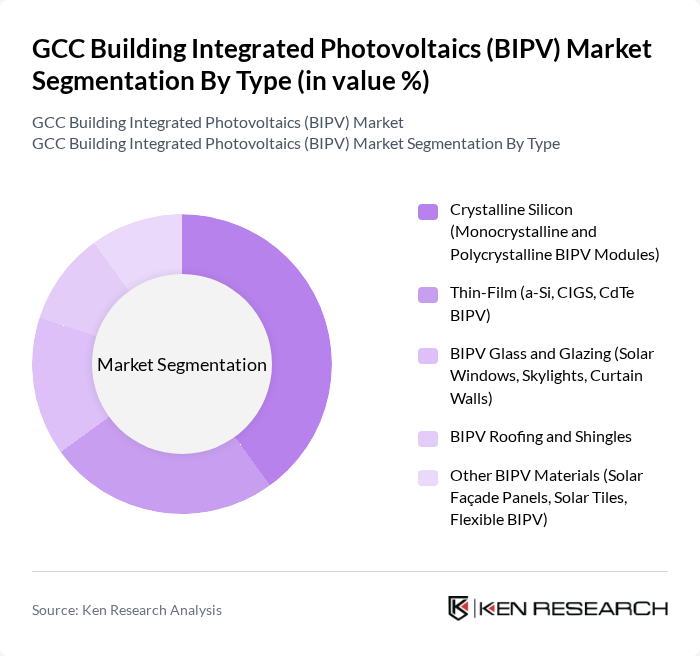

By Type:The BIPV market can be segmented into various types, including Crystalline Silicon (Monocrystalline and Polycrystalline BIPV Modules), Thin-Film (a-Si, CIGS, CdTe BIPV), BIPV Glass and Glazing (Solar Windows, Skylights, Curtain Walls), BIPV Roofing and Shingles, and Other BIPV Materials (Solar Façade Panels, Solar Tiles, Flexible BIPV). Each type serves different applications and consumer needs, contributing to the overall market dynamics.

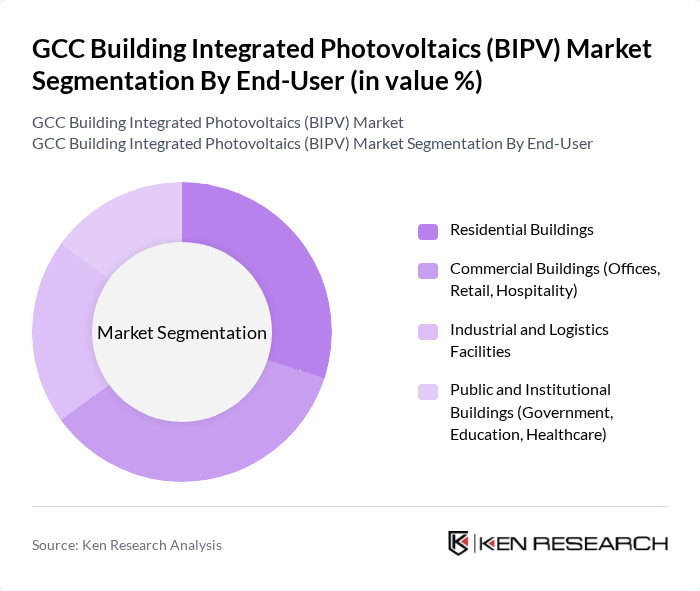

By End-User:The end-user segmentation of the BIPV market includes Residential Buildings, Commercial Buildings (Offices, Retail, Hospitality), Industrial and Logistics Facilities, and Public and Institutional Buildings (Government, Education, Healthcare). Each end-user category has unique requirements and preferences, influencing the adoption of BIPV technologies.

The GCC Building Integrated Photovoltaics (BIPV) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Insolaire LLC (UAE), Dubai Silicon Oasis Authority – Smart Dubai Initiatives (UAE), Alsa Solar Systems LLC (UAE), Desert Technologies Industries (Saudi Arabia), Saudi Arabian Oil Company (Saudi Aramco) – BIPV Pilot and Demonstration Projects, Vision Invest (formerly ACWA Holding) – Distributed Solar and BIPV Initiatives, Qatar Solar Technologies (QSTec) – Solar Materials and Downstream BIPV Opportunities, Masdar (Abu Dhabi Future Energy Company) – Sustainable Real Estate and BIPV Integration, Enova by Veolia (UAE/Saudi Arabia) – ESCO and Building Energy Solutions with BIPV, Huawei Digital Power – Smart Inverters and BIPV-Ready Building Energy Management, Onyx Solar Group LLC – BIPV Glass Solutions Deployed in GCC, AGC Inc. – Solar Control and BIPV Glass for Façades, Saint-Gobain (including SageGlass) – Advanced Glazing and BIPV-Ready Building Envelopes, JinkoSolar Holding Co., Ltd. – High-Efficiency Modules for BIPV Projects in GCC, Hanwha Q CELLS – PV Modules and Solutions for BIPV and Building-Scale Solar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BIPV market in the GCC appears promising, driven by increasing urbanization and a strong push for sustainable building practices. As cities expand, the integration of BIPV systems into new constructions will likely become standard practice. Additionally, advancements in smart technologies will enhance energy management in buildings, making BIPV systems more efficient and appealing to developers and consumers alike. The focus on sustainability will further solidify BIPV's role in the region's energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Crystalline Silicon (Monocrystalline and Polycrystalline BIPV Modules) Thin-Film (a-Si, CIGS, CdTe BIPV) BIPV Glass and Glazing (Solar Windows, Skylights, Curtain Walls) BIPV Roofing and Shingles Other BIPV Materials (Solar Façade Panels, Solar Tiles, Flexible BIPV) |

| By End-User | Residential Buildings Commercial Buildings (Offices, Retail, Hospitality) Industrial and Logistics Facilities Public and Institutional Buildings (Government, Education, Healthcare) |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Technology | Crystalline Silicon BIPV Thin-Film BIPV Organic and Perovskite BIPV Other Emerging BIPV Technologies |

| By Application | BIPV Roofs BIPV Façades and Cladding BIPV Windows, Skylights, and Curtain Walls BIPV Shading Systems, Canopies, and Balconies |

| By Investment Source | Government-Funded Projects Private and Corporate Investments Public-Private Partnerships (PPP) Multilateral and Development Finance |

| By Policy Support Mechanism | Feed-in Tariffs and Net Metering Capital Subsidies and Grants Tax Incentives and Customs Exemptions Green Building Codes and Renewable Portfolio Standards |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Owners | 100 | Facility Managers, Property Developers |

| Architectural Firms | 75 | Lead Architects, Design Engineers |

| Construction Companies | 80 | Project Managers, Site Supervisors |

| Energy Consultants | 60 | Energy Analysts, Sustainability Consultants |

| Government Regulatory Bodies | 50 | Policy Makers, Renewable Energy Officers |

The GCC Building Integrated Photovoltaics (BIPV) Market is valued at approximately USD 1.2 billion, driven by increasing investments in renewable energy and government initiatives promoting sustainable building practices across the region.