Region:Middle East

Author(s):Rebecca

Product Code:KRAD7568

Pages:81

Published On:December 2025

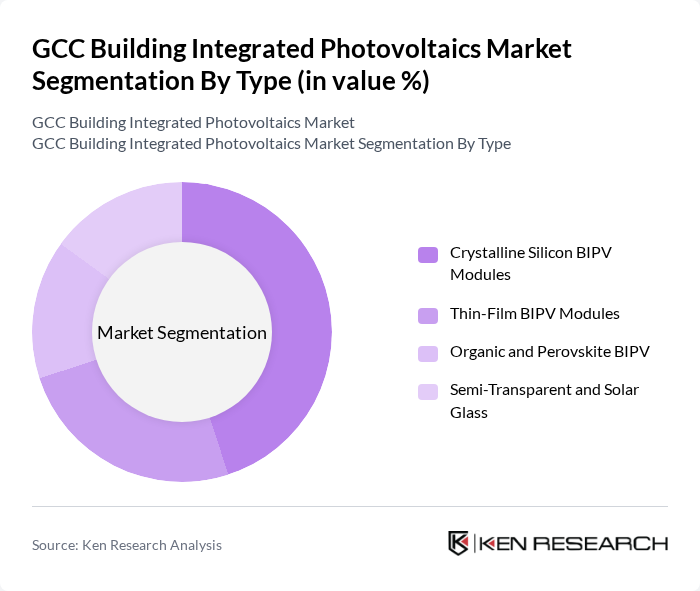

By Type:The market is segmented into four main types of building-integrated photovoltaics, which include Crystalline Silicon BIPV Modules, Thin-Film BIPV Modules, Organic and Perovskite BIPV, and Semi-Transparent and Solar Glass. Each type has unique characteristics and applications, catering to different consumer needs and preferences, ranging from high?efficiency roof and façade systems to advanced solar glazing and colored or design?oriented modules for architects.

The Crystalline Silicon BIPV Modules segment is currently dominating the market due to their high efficiency, established technology, and widespread acceptance among consumers and builders, in line with global trends where crystalline silicon remains the backbone of BIPV installations. These modules are favored for their durability and performance, making them suitable for various building applications such as roofs, façades, canopies, and shading systems. The increasing trend towards energy-efficient buildings, green certifications, and net?zero carbon targets, combined with falling module costs and better aesthetic options (colored, textured, and frameless designs), further bolster the demand for crystalline silicon modules, positioning them as the leading choice in the BIPV market.

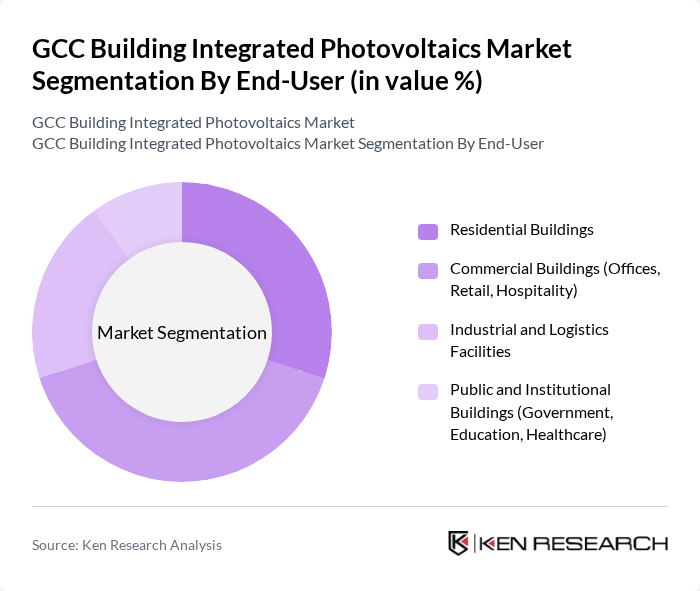

By End-User:The market is segmented based on end-users, including Residential Buildings, Commercial Buildings (Offices, Retail, Hospitality), Industrial and Logistics Facilities, and Public and Institutional Buildings (Government, Education, Healthcare). Each segment has distinct requirements and growth drivers, influenced by building scale, load profiles, design priorities, and policy incentives.

The Commercial Buildings segment is leading the market, driven by the increasing adoption of sustainable practices in the corporate sector and the need for energy-efficient solutions to reduce operational costs, which aligns with global evidence that commercial end?use is the largest adopter of BIPV. Businesses are increasingly investing in BIPV technologies to enhance their green credentials, meet ESG commitments, and comply with government regulations and green-building rating systems. The growing trend of smart buildings, integrated energy management systems, and the use of solar façades, skylights, and canopies in premium commercial, hospitality, and mixed-use projects further contribute to the dominance of this segment.

The GCC Building Integrated Photovoltaics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Insolaire LLC (UAE), Desert Technologies Industries Co. Ltd. (Saudi Arabia), Alsa Solar Systems LLC (UAE), Belectric Gulf Ltd. (UAE / Saudi Arabia), Enova by Veolia (UAE / Saudi Arabia), Masdar (Abu Dhabi Future Energy Company PJSC, UAE), ACWA Power (Saudi Arabia), Qatar Solar Technologies (Qatar), Riyadh Cables Group Company – Solar & BIPV Solutions (Saudi Arabia), Saint-Gobain Glass and Solar Glazing Solutions (Regional), AGC Glass Europe – SunEwat BIPV (Regional), Onyx Solar Group LLC (Regional BIPV Supplier), Hanwha Q CELLS GmbH (Regional Solar Module Supplier), JinkoSolar Holding Co., Ltd. (Regional Solar Module Supplier), Trina Solar Co., Ltd. (Regional Solar Module Supplier) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BIPV market in the GCC appears promising, driven by increasing urbanization and a strong push for sustainable building practices. As cities expand, the integration of BIPV in new constructions is expected to rise significantly. Additionally, the growing trend towards smart buildings, which incorporate energy-efficient technologies, will likely enhance the appeal of BIPV solutions. With supportive government policies and technological advancements, the market is poised for substantial growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Crystalline Silicon BIPV Modules Thin-Film BIPV Modules Organic and Perovskite BIPV Semi-Transparent and Solar Glass |

| By End-User | Residential Buildings Commercial Buildings (Offices, Retail, Hospitality) Industrial and Logistics Facilities Public and Institutional Buildings (Government, Education, Healthcare) |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Technology | Roofing BIPV (Solar Roof Tiles and Shingles) Facade and Curtain Wall BIPV BIPV Skylights, Canopies and Shading Systems BIPV Windows and Solar Glazing |

| By Application | New-Build Construction Retrofit and Renovation Projects Net-Zero Energy and Green-Certified Buildings Iconic / Flagship Smart City and Mega-Projects |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funds and Sovereign Wealth Programs |

| By Policy Support | Capital Subsidies and Grants Tax Exemptions and Accelerated Depreciation Net Metering and Feed-in Tariff Schemes Green Building and Renewable Energy Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Developers | 90 | Project Managers, Development Directors |

| Architectural Firms Specializing in BIPV | 75 | Lead Architects, Sustainability Consultants |

| Energy Consultants and Analysts | 55 | Energy Analysts, Policy Advisors |

| Construction Companies Implementing BIPV | 65 | Construction Managers, Site Supervisors |

| Facility Managers of BIPV-Equipped Buildings | 45 | Facility Managers, Operations Directors |

The GCC Building Integrated Photovoltaics Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by investments in renewable energy and government initiatives promoting sustainable building practices.