Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4788

Pages:88

Published On:December 2025

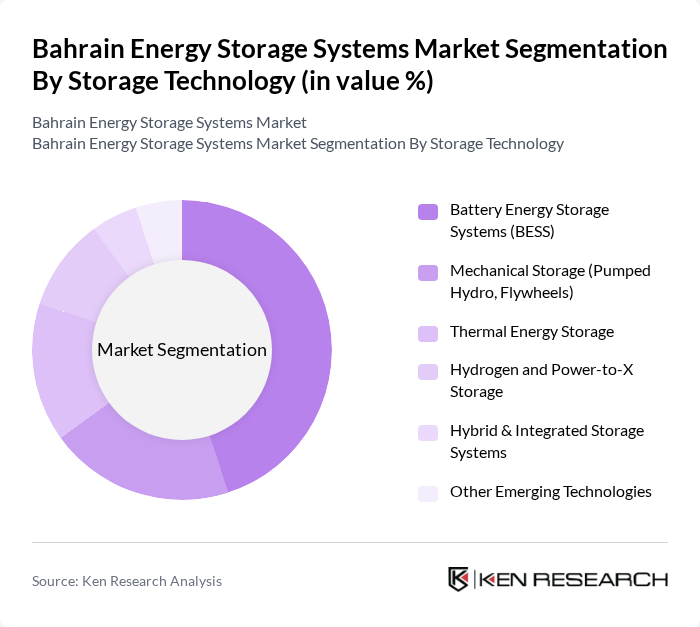

By Storage Technology:The energy storage systems market can be segmented based on various storage technologies, including Battery Energy Storage Systems (BESS), Mechanical Storage, Thermal Energy Storage, Hydrogen and Power-to-X Storage, Hybrid & Integrated Storage Systems, and Other Emerging Technologies. This structure is consistent with regional and global segmentation of energy storage technologies, which typically include electrochemical (battery), electromechanical, thermal, and hydrogen-based options. Among these, Battery Energy Storage Systems (BESS) are currently leading the market due to their versatility, high round?trip efficiency, fast response time, and rapidly decreasing costs driven by global lithium?ion supply chain scale, making them the preferred choice for both residential rooftop solar backup and commercial and utility?scale renewable integration applications.

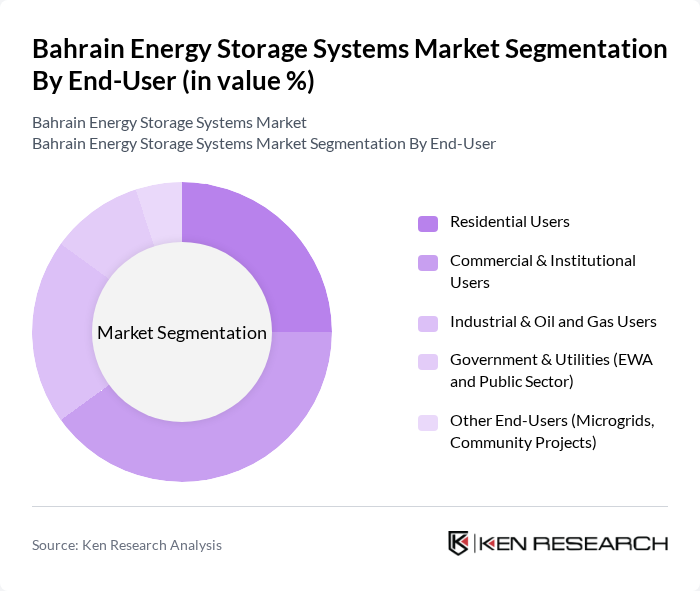

By End-User:The market can also be segmented by end-user categories, including Residential Users, Commercial & Institutional Users, Industrial & Oil and Gas Users, Government & Utilities, and Other End-Users such as Microgrids and Community Projects. This segmentation mirrors broader advanced energy storage and GCC energy storage solution market structures, which typically distinguish residential, non?residential (commercial and industrial), and utility user groups. The Commercial & Institutional Users segment is currently the most dominant, driven by the increasing adoption of energy storage solutions to manage electricity costs under time?of?use or demand?related tariffs, improve power quality and resilience for critical facilities, and enhance sustainability performance through on?site solar?plus?storage systems.

The Bahrain Energy Storage Systems Market is characterized by a dynamic mix of regional and international players, in line with broader GCC trends where utilities, state?owned energy companies, global OEMs, and local EPCs collaborate on renewable and storage projects. Leading participants such as Electricity and Water Authority (EWA), Bahrain, Bapco Energies (formerly Bahrain Petroleum Company), nogaholding (Oil and Gas Holding Company, Bahrain), Bahrain Sustainable Energy Authority (SEA), Bahrain Renewable Energy Association (BREA), Huawei Digital Power (Middle East & Central Asia), Siemens Energy Middle East, ABB Power Grids (Hitachi Energy) Middle East, Tesla Energy (Utility & C&I Storage Solutions), Sungrow Power Supply Co., Ltd. (Middle East), LG Energy Solution (ESS Division), Schneider Electric Gulf, ACWA Power (Regional Renewable & Storage Developer), ACICO Group / EPC and Solar-Storage Integrators in Bahrain, Major Local EPCs and System Integrators (e.g., Solar One, Almoayyed Solar, TruValu) contribute to innovation, geographic expansion, and service delivery in this space by providing battery systems, power electronics, project development, and turnkey solar?plus?storage and grid?support solutions.

The future of the Bahrain energy storage systems market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the country aims to achieve its renewable energy targets, the integration of energy storage solutions will become critical for grid stability and efficiency. Furthermore, advancements in technology and decreasing costs are expected to enhance the viability of energy storage systems, making them more accessible to a broader range of users, including residential and commercial sectors.

| Segment | Sub-Segments |

|---|---|

| By Storage Technology (Battery, Mechanical, Thermal, Hydrogen & Others) | Battery Energy Storage Systems (BESS) Mechanical Storage (Pumped Hydro, Flywheels) Thermal Energy Storage Hydrogen and Power-to-X Storage Hybrid & Integrated Storage Systems Other Emerging Technologies |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Users Commercial & Institutional Users Industrial & Oil and Gas Users Government & Utilities (EWA and Public Sector) Other End-Users (Microgrids, Community Projects) |

| By Region (Capital Governorate, Northern Governorate, Southern Governorate, Muharraq) | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Battery Type (Lithium-ion, Lead-acid, Flow Batteries, Others) | Lithium-ion Batteries Lead-acid Batteries Flow Batteries Other Battery Chemistries (Sodium-based, Solid-state, etc.) |

| By Application (Front-of-the-Meter, Behind-the-Meter, EV Charging & Microgrids) | Front-of-the-Meter Grid Support (Utility-Scale) Behind-the-Meter C&I Applications Residential Backup and Rooftop Solar Coupled Storage EV Charging Infrastructure and Mobility Storage Microgrids and Remote/Islanded Systems |

| By Investment Source (Domestic, FDI, PPP, Government Programs) | Domestic Private Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government and Sovereign Fund Programs Multilateral and Development Finance |

| By Value Proposition (Backup Power, Peak Shaving, Renewable Integration & Others) | Backup Power and Reliability Services Peak Shaving and Demand Charge Management Renewable Energy Integration and Firming Ancillary Services and Grid Stability Other Use Cases (Energy Arbitrage, Resilience, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility-Scale Energy Storage Projects | 110 | Project Managers, Energy Analysts |

| Commercial Energy Storage Solutions | 90 | Facility Managers, Operations Directors |

| Residential Energy Storage Systems | 80 | Homeowners, Solar Installers |

| Regulatory Framework and Policy Impact | 60 | Regulatory Officials, Policy Advisors |

| Research and Development in Energy Storage | 50 | R&D Managers, Technology Developers |

The Bahrain Energy Storage Systems Market is valued at approximately USD 160 million, reflecting significant growth driven by renewable energy integration, government initiatives, and the need for grid stability as variable renewable generation increases.