Region:Middle East

Author(s):Dev

Product Code:KRAC8699

Pages:99

Published On:November 2025

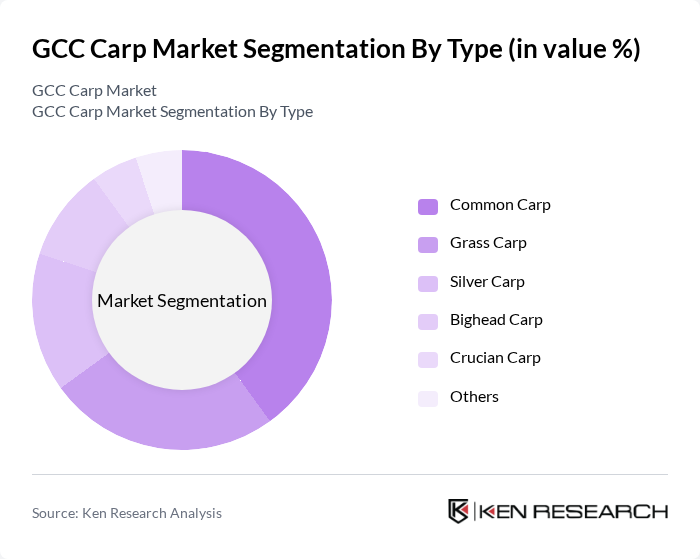

By Type:The market is segmented into various types of carp, including Common Carp, Grass Carp, Silver Carp, Bighead Carp, Crucian Carp, and Others. Among these, Common Carp is the most dominant sub-segment due to its adaptability to diverse farming conditions and high consumer demand. Grass Carp and Silver Carp also hold significant market shares, driven by their popularity in culinary applications and recognized health benefits. The increasing adoption of sustainable aquaculture practices and hybrid seed varieties has further bolstered demand for these species .

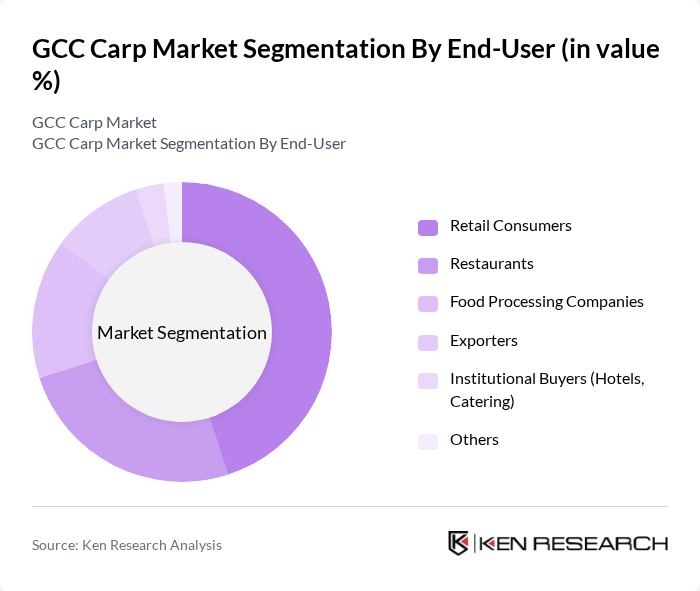

By End-User:The end-user segmentation includes Retail Consumers, Restaurants, Food Processing Companies, Exporters, Institutional Buyers (Hotels, Catering), and Others. Retail Consumers dominate the market, driven by the increasing trend of home cooking, demand for fresh seafood, and the growing popularity of protein-rich diets. Restaurants and food processing companies also play a significant role, as they require a steady supply of high-quality carp for their menus and products. Heightened awareness of the health benefits associated with fish consumption continues to fuel demand across all segments .

The GCC Carp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Fish Farm, Emirates Fish Farm, Almarai Aquaculture, Gulf Fish (Gulf Fish Farming Company), Al Watania Agriculture Company, Al Jazeera Fish Farm, Al Khor Fish, Qatar Fish Company, Saudi Fisheries Company, Oman Fisheries Co. SAOG, National Aquaculture Group (NAQUA), Al Bahar Fisheries, Al Falah Fisheries, Al Qudra Fisheries, and Al Noor Fisheries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC carp market appears promising, driven by increasing investments in sustainable aquaculture practices and technological advancements. As governments continue to support local production, the sector is expected to see enhanced productivity and efficiency. Additionally, the growing trend towards organic and eco-friendly fish farming will likely attract environmentally conscious consumers, further boosting market growth. The focus on traceability and food safety will also play a crucial role in shaping consumer preferences and driving demand for locally sourced products.

| Segment | Sub-Segments |

|---|---|

| By Type | Common Carp Grass Carp Silver Carp Bighead Carp Crucian Carp Others |

| By End-User | Retail Consumers Restaurants Food Processing Companies Exporters Institutional Buyers (Hotels, Catering) Others |

| By Distribution Channel | Direct Sales (Farm Gate) Online Retail Supermarkets and Hypermarkets Fish Markets Wholesale Distributors Others |

| By Region | UAE Saudi Arabia Qatar Oman Kuwait Bahrain Others |

| By Farming Method | Pond Culture Cage Culture Recirculating Aquaculture Systems (RAS) Integrated Multi-Trophic Aquaculture (IMTA) Biofloc Technology Others |

| By Product Form | Fresh (Whole, Gutted) Frozen Processed (Fillets, Semi-fillets, Canned) Dried Smoked Others |

| By Certification | Organic Certification Sustainable Seafood Certification Quality Assurance Certification Halal Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wholesale Carp Distribution | 60 | Wholesale Managers, Supply Chain Coordinators |

| Aquaculture Farm Operations | 50 | Farm Owners, Production Managers |

| Retail Carp Sales | 55 | Store Managers, Fishmongers |

| Consumer Preferences in Carp | 100 | End Consumers, Health-Conscious Shoppers |

| Regulatory Impact Assessment | 40 | Policy Makers, Environmental Consultants |

The GCC Carp Market is valued at approximately USD 210 million, representing a niche segment within the broader GCC fish farming market, which is valued at around USD 5.03 billion. This market has shown steady growth driven by increasing consumer demand for aquaculture products.