Region:Middle East

Author(s):Rebecca

Product Code:KRAC8522

Pages:90

Published On:November 2025

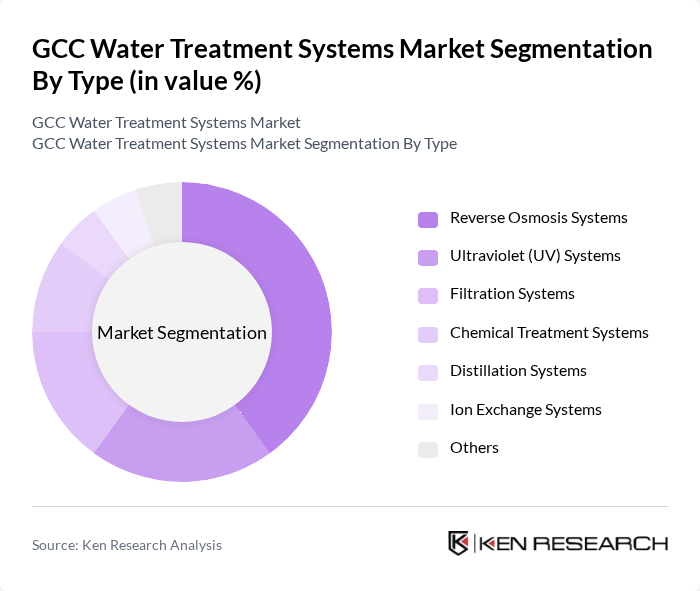

By Type:The market is segmented into various types of water treatment systems, including Reverse Osmosis Systems, Ultraviolet (UV) Systems, Filtration Systems, Chemical Treatment Systems, Distillation Systems, Ion Exchange Systems, and Others. Among these, Reverse Osmosis Systems are the most dominant due to their efficiency in desalination and purification processes, which are critical for regions with limited freshwater resources. The growing adoption of these systems in both residential and industrial sectors is a key factor driving their market share.

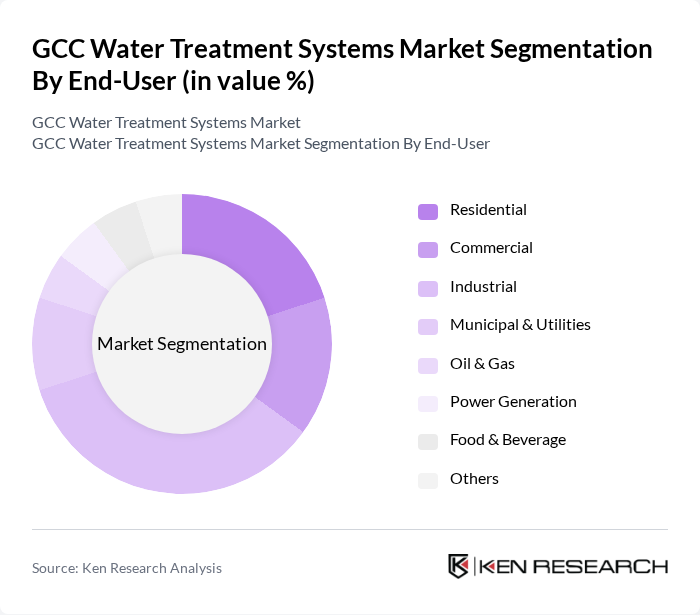

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Municipal & Utilities, Oil & Gas, Power Generation, Food & Beverage, and Others. The Industrial segment is the leading end-user, driven by the need for high-quality water in manufacturing processes and the increasing focus on water recycling and reuse across industries. Ongoing industrial expansion and stricter environmental compliance requirements in the GCC region are major contributors to the demand for advanced water treatment solutions.

The GCC Water Treatment Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Water Technologies, SUEZ Water Technologies & Solutions, Xylem Inc., Pentair plc, Ecolab Inc., Metito Holdings Ltd., IDE Technologies, Kurita Water Industries Ltd., Abengoa Water, Doosan Enerbility (formerly Doosan Heavy Industries & Construction), ACCIONA Agua, Siemens AG, Biwater Holdings Limited, Aqua Engineering GmbH, and Almar Water Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The GCC water treatment systems market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As governments prioritize water security, investments in desalination and wastewater treatment are expected to rise. The integration of smart technologies, such as IoT, will enhance operational efficiency and monitoring capabilities. Furthermore, the focus on circular economy practices will encourage the recycling of water resources, fostering a more sustainable approach to water management in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Reverse Osmosis Systems Ultraviolet (UV) Systems Filtration Systems Chemical Treatment Systems Distillation Systems Ion Exchange Systems Others |

| By End-User | Residential Commercial Industrial Municipal & Utilities Oil & Gas Power Generation Food & Beverage Others |

| By Application | Drinking Water Treatment Wastewater Treatment Industrial Process Water Treatment Desalination Cooling Water Treatment Boiler Water Treatment Others |

| By Technology | Membrane Technology (RO, UF, NF, MF) Biological Treatment Chemical Treatment Thermal Treatment Disinfection (UV, Ozone, Chlorination) Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes Multilateral Funding Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 100 | Plant Managers, Water Quality Analysts |

| Industrial Water Treatment Systems | 60 | Operations Managers, Environmental Compliance Officers |

| Desalination Projects | 50 | Project Engineers, Procurement Managers |

| Wastewater Treatment Plants | 40 | Facility Managers, Regulatory Affairs Specialists |

| Private Sector Water Treatment Solutions | 70 | Business Development Managers, Technical Sales Representatives |

The GCC Water Treatment Systems Market is valued at approximately USD 54 billion, driven by factors such as increasing water scarcity, rapid urbanization, and the need for sustainable water management solutions across the region.