Region:Middle East

Author(s):Shubham

Product Code:KRAC4313

Pages:82

Published On:October 2025

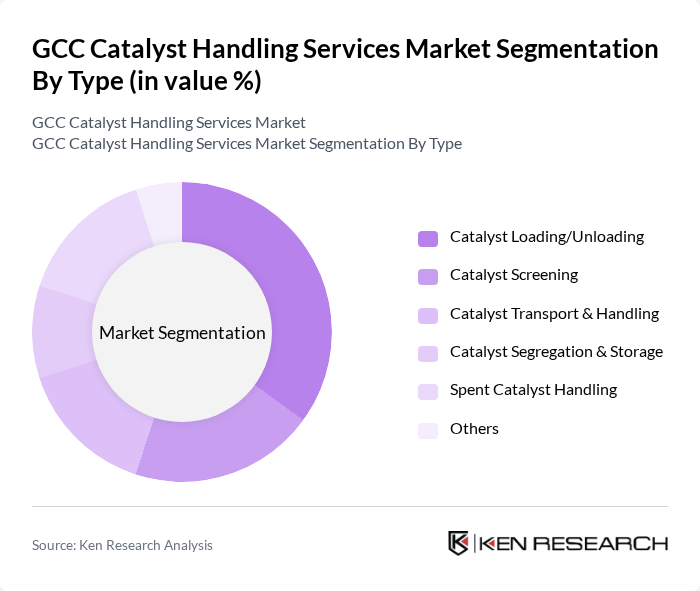

By Type:The market is segmented into various types of catalyst handling services, including Catalyst Loading/Unloading, Catalyst Screening, Catalyst Transport & Handling, Catalyst Segregation & Storage, Spent Catalyst Handling, and Others. Among these,Catalyst Loading/Unloadingis the most prominent sub-segment, driven by the increasing need for efficient and safe handling of catalysts in refining and petrochemical processes. The demand for these services is influenced by the growing complexity of catalyst systems, the adoption of automated and robotic handling technologies, and the need for specialized techniques to ensure optimal performance and safety in high-throughput industrial environments .

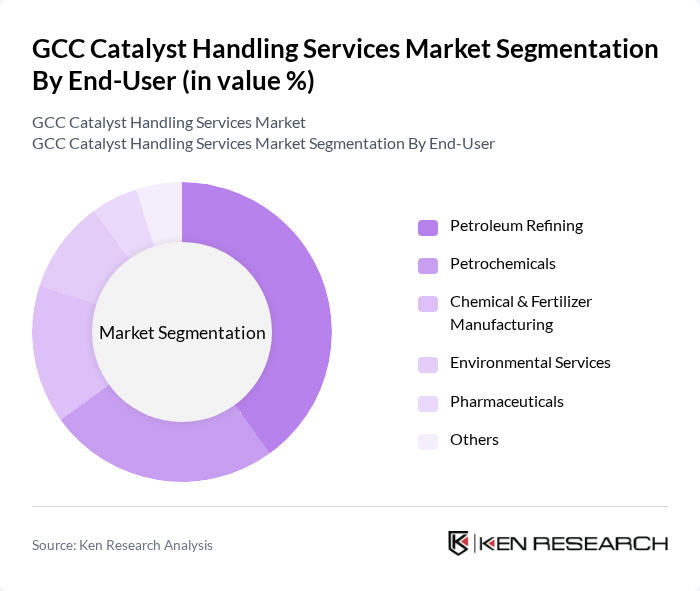

By End-User:The end-user segmentation includes Petroleum Refining, Petrochemicals, Chemical & Fertilizer Manufacturing, Environmental Services, Pharmaceuticals, and Others. ThePetroleum Refiningsector is the leading end-user, primarily due to the high volume of catalysts used in refining processes and the continuous need for catalyst replacement and management. This sector's growth is fueled by the increasing global demand for refined petroleum products, ongoing refinery upgrades, and the need for efficient catalyst handling to optimize production processes and comply with environmental standards .

The GCC Catalyst Handling Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Matthey PLC, BASF SE, Shell Catalysts & Technologies, Honeywell UOP, Clariant AG, Haldor Topsoe A/S, Albemarle Corporation, Axens, W.R. Grace & Co., CRI Catalyst Company, Cat Tech International Ltd., Mourik International B.V., Technivac Ltd., Buchen-ICS GmbH, Group Peeters contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC catalyst handling services market appears promising, driven by ongoing technological innovations and a strong emphasis on sustainability. As companies increasingly adopt digital solutions and automation, operational efficiencies are expected to improve significantly. Furthermore, the rising focus on environmental regulations will likely propel investments in eco-friendly catalyst management practices, ensuring compliance and enhancing corporate responsibility. This evolving landscape presents a unique opportunity for service providers to innovate and expand their offerings in response to market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Catalyst Loading/Unloading Catalyst Screening Catalyst Transport & Handling Catalyst Segregation & Storage Spent Catalyst Handling Others |

| By End-User | Petroleum Refining Petrochemicals Chemical & Fertilizer Manufacturing Environmental Services Pharmaceuticals Others |

| By Service Type | Catalyst Management Services Catalyst Regeneration Services Catalyst Recycling Services Catalyst Disposal Services Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Application | Refining Chemical Production Environmental Applications Automotive Catalysts Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Catalyst Handling in Oil & Gas | 100 | Operations Managers, Safety Compliance Officers |

| Catalyst Recovery in Petrochemicals | 80 | Logistics Coordinators, Plant Managers |

| Recycling of Catalysts in Specialty Chemicals | 70 | Procurement Managers, Environmental Compliance Specialists |

| Transport Logistics for Catalysts | 50 | Supply Chain Managers, Freight Managers |

| Regulatory Compliance in Catalyst Handling | 90 | Regulatory Affairs Managers, Quality Assurance Leads |

The GCC Catalyst Handling Services Market is valued at approximately USD 900 million, reflecting a significant growth driven by the increasing demand for efficient catalyst management in the petroleum refining and petrochemical sectors.