Region:Middle East

Author(s):Dev

Product Code:KRAB8622

Pages:92

Published On:October 2025

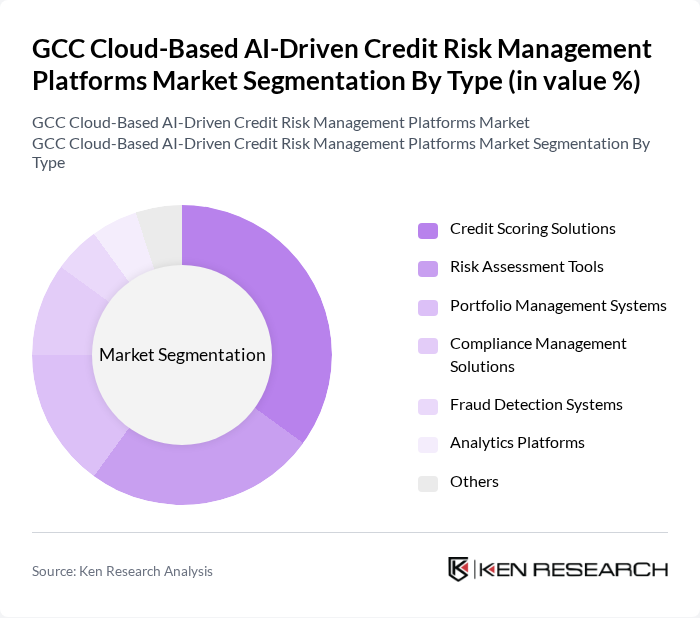

By Type:

The market is segmented into various types, including Credit Scoring Solutions, Risk Assessment Tools, Portfolio Management Systems, Compliance Management Solutions, Fraud Detection Systems, Analytics Platforms, and Others. Among these, Credit Scoring Solutions are leading the market due to their critical role in evaluating borrower creditworthiness and facilitating lending decisions. The increasing reliance on data-driven insights for credit evaluations has made these solutions indispensable for financial institutions. Risk Assessment Tools also hold significant market share as they help organizations identify potential risks and mitigate them effectively, thus ensuring financial stability.

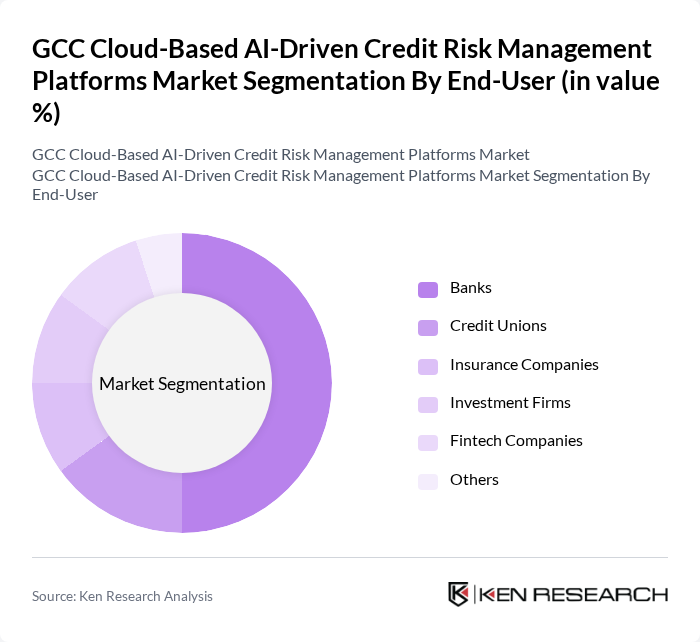

By End-User:

The end-user segmentation includes Banks, Credit Unions, Insurance Companies, Investment Firms, Fintech Companies, and Others. Banks are the dominant end-user in this market, driven by their need for robust credit risk management solutions to comply with regulatory requirements and enhance their lending processes. The increasing competition among banks to offer better services and the growing trend of digital transformation in the financial sector further contribute to the demand for AI-driven credit risk management platforms. Fintech Companies are also emerging as significant users, leveraging these platforms to provide innovative financial solutions.

The GCC Cloud-Based AI-Driven Credit Risk Management Platforms market is characterized by a dynamic mix of regional and international players. Leading participants such as FICO, Experian, Moody's Analytics, SAS Institute, Zoot Enterprises, Credit Karma, Equifax, TransUnion, Finastra, Oracle, SAP, ACI Worldwide, RiskMetrics Group, Kabbage, Upstart contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC cloud-based AI-driven credit risk management platforms market appears promising, driven by technological advancements and increasing regulatory pressures. As financial institutions continue to embrace digital transformation, the demand for innovative solutions will likely rise. Furthermore, the integration of machine learning and big data analytics will enhance credit assessment accuracy, enabling institutions to make informed decisions. The focus on customer experience will also shape product offerings, ensuring that solutions are tailored to meet evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Credit Scoring Solutions Risk Assessment Tools Portfolio Management Systems Compliance Management Solutions Fraud Detection Systems Analytics Platforms Others |

| By End-User | Banks Credit Unions Insurance Companies Investment Firms Fintech Companies Others |

| By Application | Consumer Credit Commercial Credit Mortgage Lending Business Loans Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing Fees Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Credit Risk Management | 150 | Credit Risk Managers, Financial Analysts |

| Fintech AI Solutions | 100 | Product Managers, Technology Officers |

| Regulatory Compliance in Financial Services | 80 | Compliance Officers, Risk Assessment Specialists |

| Insurance Sector Risk Assessment | 70 | Underwriters, Risk Managers |

| Investment Firms Credit Evaluation | 90 | Portfolio Managers, Investment Analysts |

The GCC Cloud-Based AI-Driven Credit Risk Management Platforms market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies in financial services and the demand for enhanced risk assessment capabilities.