Region:Middle East

Author(s):Rebecca

Product Code:KRAC1211

Pages:82

Published On:October 2025

By Type:The market is segmented into various types of AI-powered lending platforms, including AI-Driven Personal Loan Platforms, AI-Driven Business Loan Platforms, AI-Based Peer-to-Peer (P2P) Lending, AI-Enabled Microfinance Platforms, AI-Integrated Mortgage/Auto Loan Platforms, AI Credit Scoring & Risk Assessment Solutions, and Others (e.g., BNPL, Invoice Financing). Among these,AI-Driven Personal Loan Platformsdominate the market due to the increasing demand for personal loans among consumers seeking quick access to funds for various needs, such as education, healthcare, and home improvement. The dominance of this segment is reinforced by the region’s high smartphone penetration and the growing preference for digital-first financial solutions.

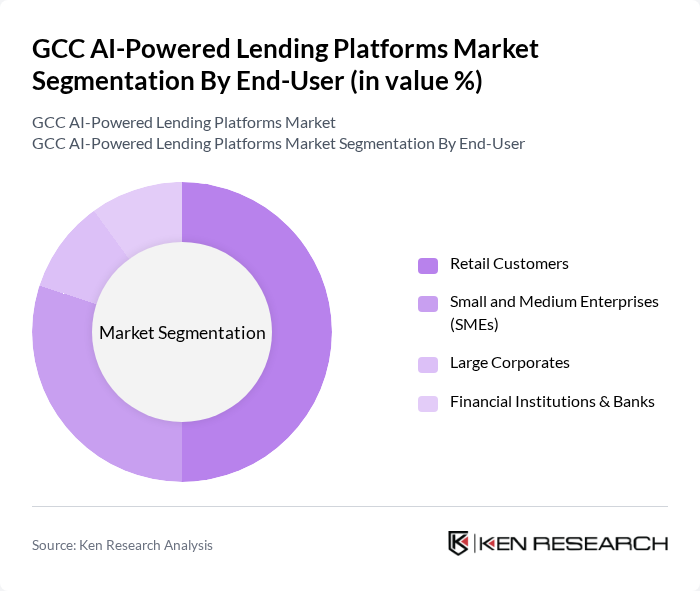

By End-User:The end-user segmentation includes Retail Customers, Small and Medium Enterprises (SMEs), Large Corporates, and Financial Institutions & Banks.Retail Customersrepresent the largest segment, driven by the increasing number of individuals seeking personal loans for various purposes, including education, home renovations, and emergency expenses. The convenience and speed of AI-powered platforms, coupled with the growing digital literacy and smartphone usage in the region, make them particularly appealing to this demographic.

The GCC AI-Powered Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive, Tamam, FinFirst, Raqamyah, RAKBANK, Abu Dhabi Commercial Bank (ADCB), Emirates NBD, Qatar National Bank (QNB), Al Rajhi Bank, Gulf Bank, National Bank of Kuwait (NBK), Bank of Bahrain and Kuwait (BBK), Saudi National Bank (SNB), Arab National Bank (ANB), First Abu Dhabi Bank (FAB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI-powered lending platforms in the GCC appears promising, driven by technological advancements and increasing consumer demand for digital solutions. As platforms continue to innovate, integrating AI and machine learning for enhanced customer experiences, the market is likely to witness a surge in adoption rates. Additionally, the focus on regulatory compliance and data privacy will shape the development of more secure and user-friendly lending solutions, ensuring sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-Driven Personal Loan Platforms AI-Driven Business Loan Platforms AI-Based Peer-to-Peer (P2P) Lending AI-Enabled Microfinance Platforms AI-Integrated Mortgage/Auto Loan Platforms AI Credit Scoring & Risk Assessment Solutions Others (e.g., BNPL, Invoice Financing) |

| By End-User | Retail Customers Small and Medium Enterprises (SMEs) Large Corporates Financial Institutions & Banks |

| By Application | Consumer Lending SME Lending Mortgage & Auto Financing Working Capital & Invoice Financing |

| By Distribution Channel | Online Platforms (Web Portals) Mobile Applications API Integrations with Banks/Partners Direct Partnerships with Financial Institutions |

| By Customer Segment | Salaried Individuals Self-Employed Professionals Startups & Micro-Enterprises Large Enterprises |

| By Pricing Model | Fixed Interest Rate Variable Interest Rate Subscription/Platform Fee-Based |

| By Loan Amount | Micro Loans (? USD 5,000) Small Loans (USD 5,001–50,000) Medium Loans (USD 50,001–500,000) Large Loans (> USD 500,000) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Providers | 60 | Product Managers, Marketing Directors |

| SME Lending Platforms | 50 | Business Development Managers, Financial Analysts |

| Mortgage Lending Institutions | 40 | Loan Officers, Risk Assessment Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-User Experience | 50 | Borrowers, Financial Advisors |

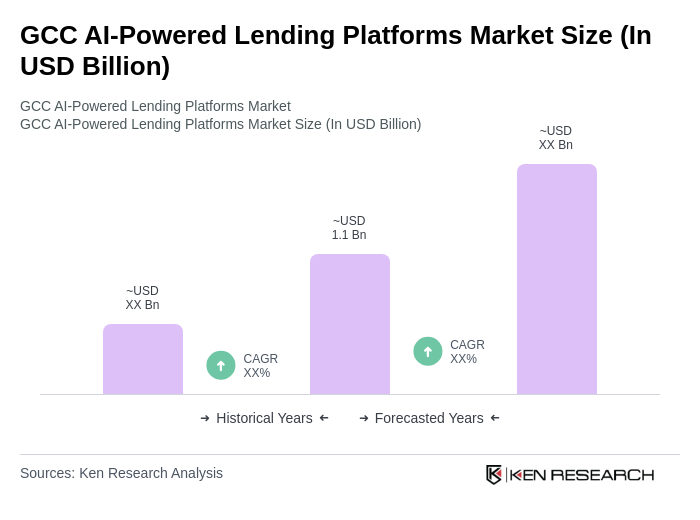

The GCC AI-Powered Lending Platforms Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by the increasing adoption of digital financial services and the demand for efficient loan processing solutions.