Region:Middle East

Author(s):Shubham

Product Code:KRAA8800

Pages:93

Published On:November 2025

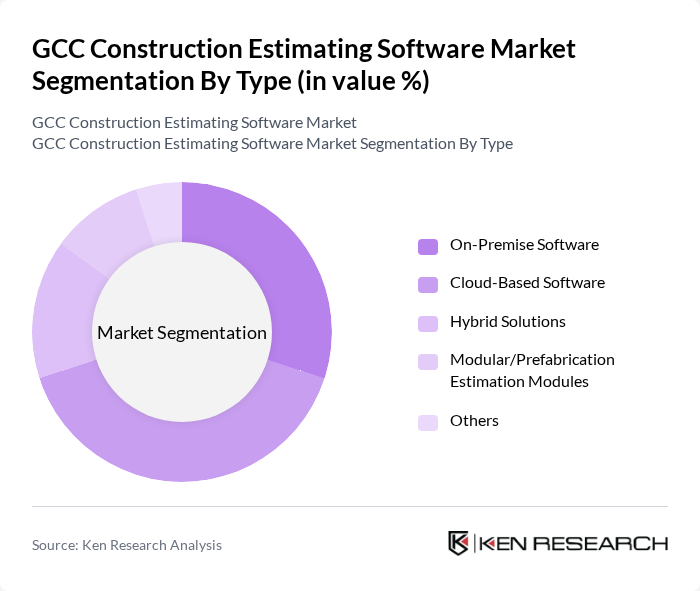

By Type:The market is segmented into On-Premise Software, Cloud-Based Software, Hybrid Solutions, Modular/Prefabrication Estimation Modules, and Others. On-premise solutions are preferred by larger enterprises and government agencies due to data security and integration requirements, while cloud-based software is gaining traction among SMEs for its scalability, remote accessibility, and lower upfront costs. Hybrid models are emerging as a flexible option, and modular/prefabrication estimation modules address the growing trend of offsite construction and industrialized building methods.

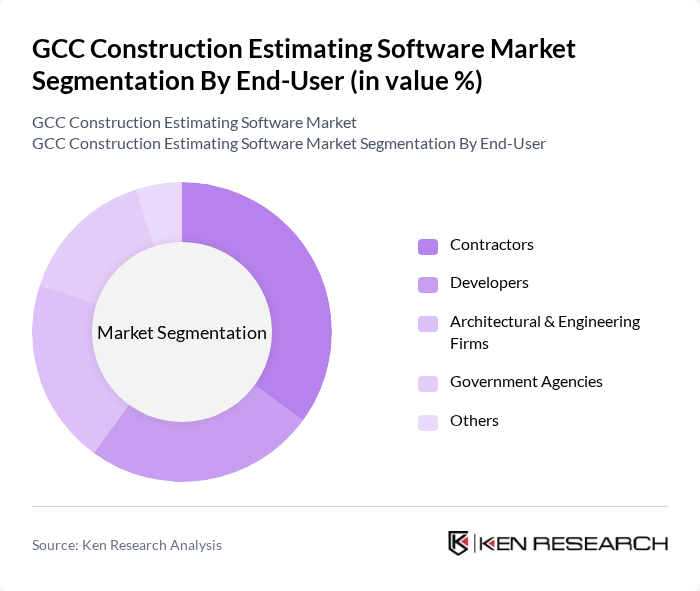

By End-User:The end-user segmentation includes Contractors, Developers, Architectural & Engineering Firms, Government Agencies, and Others. Contractors represent the largest segment, driven by the need for accurate bidding and cost control. Developers and engineering firms are increasingly adopting advanced estimating tools to streamline project workflows and improve collaboration. Government agencies are mandated to use digital estimation solutions for public sector projects, while the “Others” category includes consultants and project management firms seeking integrated cost management capabilities.

The GCC Construction Estimating Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as ProEst, PlanSwift, Sage Estimating, Viewpoint (Trimble), CoConstruct, Buildertrend, e-Builder (Trimble), Bluebeam, Esticom (Autodesk), WinEst (Trimble), B2W Software, CMiC, Trimble, Raken, STACK Estimating, Autodesk (Autodesk Takeoff, Cost Management), Oracle (Primavera, Aconex), BuildSmart (CCS Gulf), Candy (CCS Gulf), Causeway Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC construction estimating software market appears promising, driven by technological advancements and increasing government support for digital transformation. As firms increasingly recognize the importance of accurate cost estimation, the demand for innovative software solutions is expected to rise. Additionally, the integration of AI and machine learning will enhance predictive capabilities, allowing for more efficient project management. This trend, coupled with a focus on sustainability, will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise Software Cloud-Based Software Hybrid Solutions Modular/Prefabrication Estimation Modules Others |

| By End-User | Contractors Developers Architectural & Engineering Firms Government Agencies Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premise Others |

| By Software Features | Cost Estimation Project Management Reporting and Analytics BIM Integration Prefabrication/Modular Tracking Integration Capabilities Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Integration Level | Standalone Solutions Integrated Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Construction Projects | 80 | Project Managers, Estimators |

| Residential Construction Software Usage | 100 | Construction Firm Owners, Architects |

| Infrastructure Development Estimation | 60 | Government Officials, Civil Engineers |

| Specialized Construction Segments (e.g., Oil & Gas) | 40 | Industry Specialists, Procurement Managers |

| Software Development for Construction | 70 | Software Engineers, Product Managers |

The GCC Construction Estimating Software Market is valued at approximately USD 70 million, driven by the rapid expansion of the construction sector and increased investment in infrastructure and real estate projects across the region.