Region:Middle East

Author(s):Shubham

Product Code:KRAB7108

Pages:89

Published On:October 2025

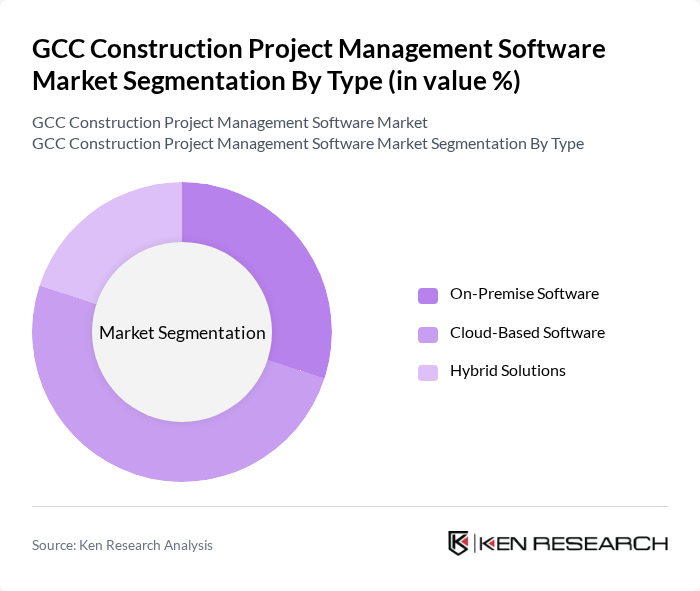

By Type:The market is segmented into On-Premise Software, Cloud-Based Software, and Hybrid Solutions. Among these, Cloud-Based Software is gaining traction due to its flexibility, scalability, and cost-effectiveness, making it the preferred choice for many construction firms. The increasing reliance on remote collaboration tools and the need for real-time data access further enhance the demand for cloud solutions.

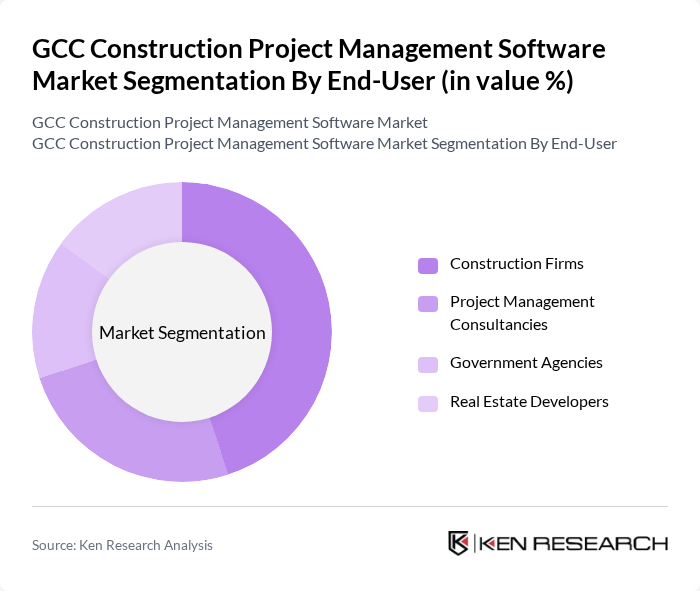

By End-User:The end-user segmentation includes Construction Firms, Project Management Consultancies, Government Agencies, and Real Estate Developers. Construction Firms dominate this segment as they increasingly adopt project management software to streamline operations, enhance collaboration, and improve project delivery timelines. The growing complexity of construction projects necessitates advanced management tools, making this segment a key driver of market growth.

The GCC Construction Project Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, Autodesk, Inc., SAP SE, Procore Technologies, Inc., PlanGrid, Inc., Aconex Limited, Viewpoint, Inc., Trimble Inc., e-Builder, Inc., CMiC, CoConstruct, Buildertrend, Bluebeam, Inc., Deltek, Inc., RIB Software SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC construction project management software market appears promising, driven by technological advancements and increasing government support for digital transformation. As firms prioritize efficiency and sustainability, the integration of AI and machine learning into project management tools is expected to enhance decision-making processes. Additionally, the growing emphasis on real-time data analytics will facilitate better project tracking and resource management, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise Software Cloud-Based Software Hybrid Solutions |

| By End-User | Construction Firms Project Management Consultancies Government Agencies Real Estate Developers |

| By Application | Project Planning Resource Management Budgeting and Cost Control Risk Management |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Geographic Presence | GCC Countries Emerging Markets Developed Markets |

| By Others | Niche Solutions Custom Software Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Management Software Users | 150 | Project Managers, IT Directors |

| Construction Firms' IT Decision Makers | 100 | Chief Technology Officers, Software Procurement Managers |

| End-Users of Project Management Tools | 80 | Site Managers, Field Engineers |

| Software Vendors and Service Providers | 60 | Sales Executives, Product Managers |

| Industry Experts and Consultants | 50 | Construction Analysts, Market Researchers |

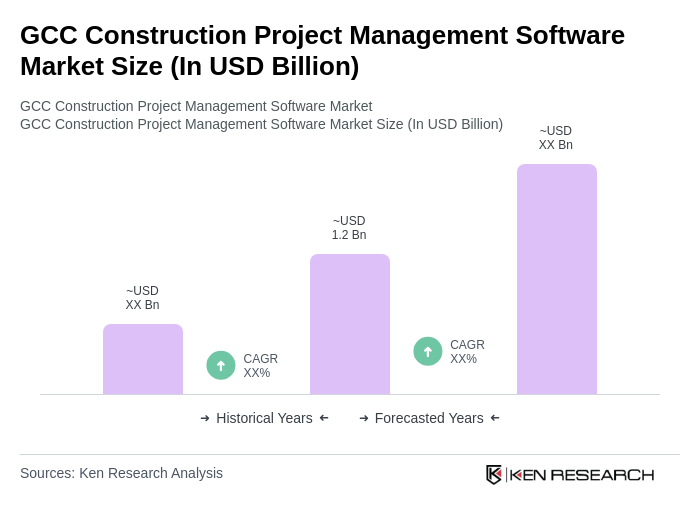

The GCC Construction Project Management Software Market is valued at approximately USD 1.2 billion, driven by infrastructure expansion, urbanization, and the adoption of advanced technologies in construction management.