Region:Middle East

Author(s):Dev

Product Code:KRAB7049

Pages:84

Published On:October 2025

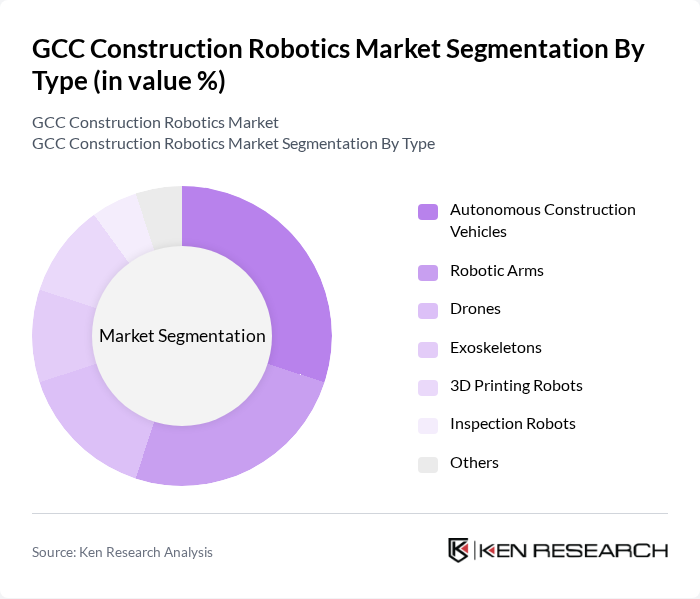

By Type:The market is segmented into various types of construction robotics, including Autonomous Construction Vehicles, Robotic Arms, Drones, Exoskeletons, 3D Printing Robots, Inspection Robots, and Others. Each of these subsegments plays a crucial role in enhancing construction efficiency and safety.

The Autonomous Construction Vehicles segment is currently dominating the market due to their ability to perform tasks such as excavation, grading, and transportation autonomously. This technology significantly reduces labor costs and enhances safety on construction sites. The increasing demand for efficiency and precision in construction processes has led to a surge in the adoption of these vehicles, making them a preferred choice among construction companies.

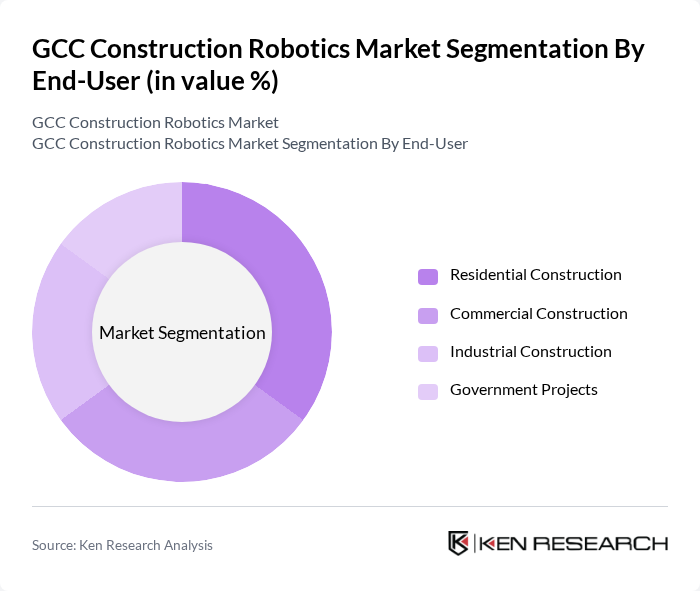

By End-User:The market is segmented by end-user into Residential Construction, Commercial Construction, Industrial Construction, and Government Projects. Each segment has unique requirements and applications for construction robotics.

The Residential Construction segment leads the market, driven by the growing demand for smart homes and sustainable building practices. The integration of robotics in residential projects enhances construction speed and quality, catering to the increasing consumer preference for modern living spaces. Additionally, the rise in urbanization and population growth in GCC countries further fuels this segment's expansion.

The GCC Construction Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Built Robotics, Boston Dynamics, Cyngn, Construction Robotics, LLC, Fastbrick Robotics, Komatsu Ltd., Robot System Products AB, Scaled Robotics, Trimble Inc., XtreeE, 3D Robotics, Doxel, Roin Robotics, Skycatch, Zaha Hadid Architects contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC construction robotics market appears promising, driven by technological advancements and increasing investments in smart infrastructure. As the region continues to prioritize automation, the integration of AI and machine learning into construction processes will enhance efficiency and safety. Additionally, the growing focus on sustainable construction practices will likely lead to the development of eco-friendly robotic solutions, further shaping the market landscape and encouraging wider adoption across various construction projects.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Construction Vehicles Robotic Arms Drones Exoskeletons D Printing Robots Inspection Robots Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Government Projects |

| By Application | Site Preparation Material Handling Construction Monitoring Demolition |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Robotics | 100 | Project Managers, Site Engineers |

| Commercial Building Automation | 80 | Construction Executives, Robotics Specialists |

| Infrastructure Development Robotics | 70 | Urban Planners, Civil Engineers |

| Robotic Process Automation in Construction | 60 | IT Managers, Automation Consultants |

| Robotics in Safety Management | 50 | Safety Officers, Compliance Managers |

The GCC Construction Robotics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of automation technologies aimed at enhancing efficiency and reducing labor costs in the construction sector.