Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0650

Pages:82

Published On:December 2025

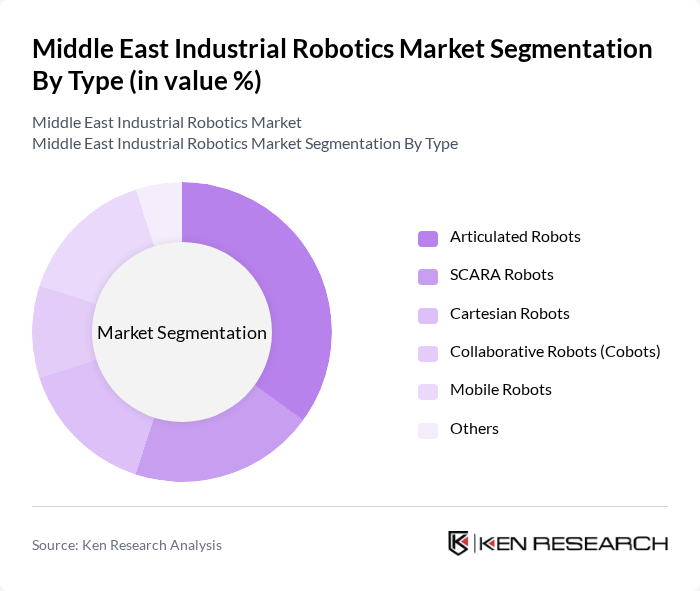

By Type:The market is segmented into various types of industrial robots, including articulated robots, SCARA robots, Cartesian robots, collaborative robots (cobots), mobile robots, and others. Articulated robots are currently dominating the market due to their versatility and ability to perform complex tasks in manufacturing and assembly processes. The increasing demand for automation in various industries is driving the adoption of these robots, as they offer enhanced precision and efficiency.

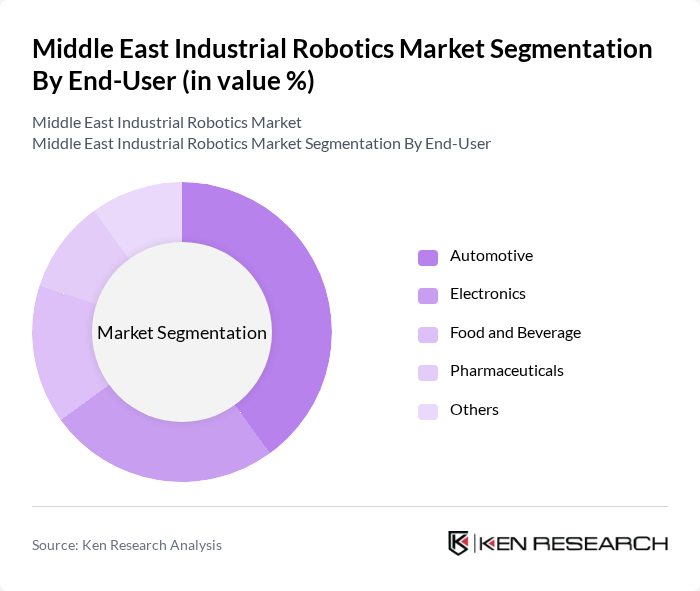

By End-User:The industrial robotics market is also segmented by end-user industries, including automotive, electronics, food and beverage, pharmaceuticals, and others. The automotive sector is the leading end-user, driven by the need for automation in assembly lines and manufacturing processes. The increasing focus on efficiency and quality in automotive production is propelling the demand for industrial robots in this sector.

The Middle East Industrial Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Universal Robots, Omron Corporation, Siemens AG, Rockwell Automation, Schneider Electric, Epson Robots, Denso Robotics, Kawasaki Heavy Industries, Staubli Robotics, Comau S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East industrial robotics market appears promising, driven by technological advancements and increasing investments in automation. As industries embrace digital transformation, the integration of AI and IoT into robotics will enhance operational efficiency and productivity. Furthermore, the region's focus on developing smart factories will likely accelerate the adoption of robotics, creating a more competitive manufacturing landscape. Collaborative efforts between governments and private sectors will also play a crucial role in overcoming existing challenges and fostering innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Cartesian Robots Collaborative Robots (Cobots) Mobile Robots Others |

| By End-User | Automotive Electronics Food and Beverage Pharmaceuticals Others |

| By Industry | Manufacturing Logistics and Warehousing Construction Healthcare Others |

| By Application | Assembly Packaging Material Handling Quality Control Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Technology | AI-Driven Robotics Sensor-Based Robotics Vision-Guided Robotics Others |

| By Investment Source | Private Investments Government Funding Venture Capital Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Robotics | 100 | Production Managers, Automation Engineers |

| Electronics Assembly Automation | 80 | Operations Directors, Quality Assurance Managers |

| Food Processing Robotics | 70 | Plant Managers, Supply Chain Coordinators |

| Logistics and Warehousing Automation | 90 | Warehouse Managers, Logistics Analysts |

| Healthcare Robotics Applications | 60 | Healthcare Administrators, Robotics Specialists |

The Middle East Industrial Robotics Market is valued at approximately USD 20 billion, driven by factors such as the e-commerce boom, warehouse automation, and a shortage of skilled labor, which are prompting increased adoption of robotics across various sectors.