Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8168

Pages:97

Published On:December 2025

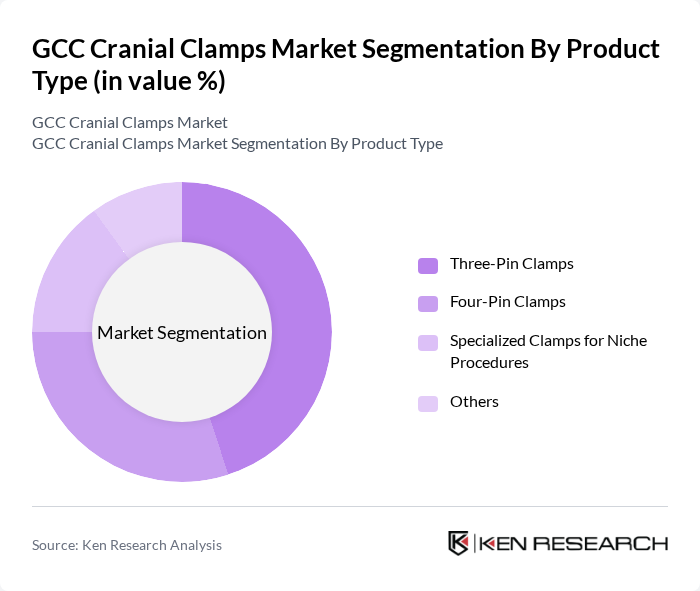

By Product Type:The product type segmentation includes various types of cranial clamps designed for specific surgical needs. The subsegments are Three-Pin Clamps, Four-Pin Clamps, Specialized Clamps for Niche Applications, and Pediatric Cranial Clamps. Among these, the Four-Pin Clamps are currently dominating the market due to their enhanced stability and versatility in various surgical procedures. Surgeons prefer these clamps for their reliability and ease of use, which significantly contributes to their widespread adoption in operating rooms.

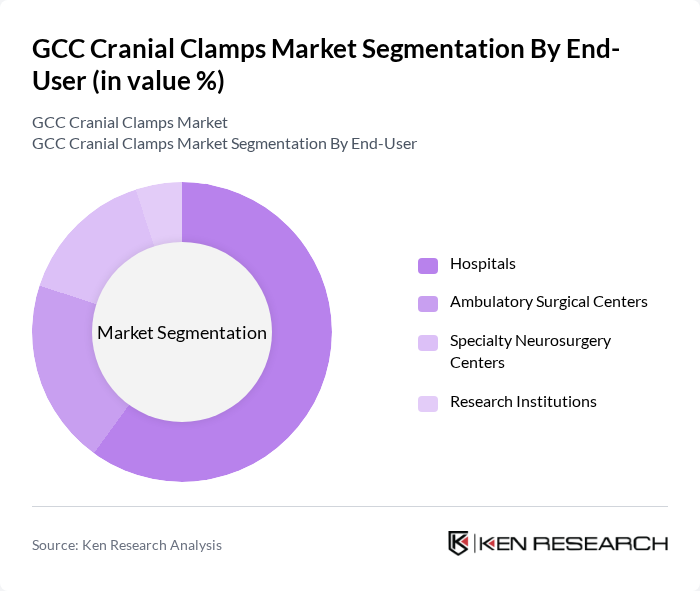

By End-User:The end-user segmentation encompasses Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Research Institutions. Hospitals are the leading end-users of cranial clamps, accounting for a significant portion of the market. This dominance is attributed to the high volume of neurosurgical procedures performed in hospitals, coupled with the availability of advanced surgical facilities and skilled professionals. The increasing number of patients requiring surgical interventions further solidifies hospitals' position as the primary consumers of cranial clamps.

The GCC Cranial Clamps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Stryker Corporation, B. Braun Melsungen AG, Integra LifeSciences Holdings Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., Codman & Shurtleff, Inc. (Johnson & Johnson subsidiary), KLS Martin Group, Aesculap AG (B. Braun subsidiary), Conmed Corporation, NuVasive, Inc., Medline Industries, Inc., Baxter International Inc., Surgical Specialties Corporation, Globus Medical, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC cranial clamps market appears promising, driven by ongoing advancements in medical technology and increasing healthcare investments. As the region's healthcare infrastructure expands, the demand for innovative surgical solutions will likely rise. Additionally, the integration of smart technologies and 3D printing in cranial clamp production is expected to enhance customization and efficiency, catering to the specific needs of patients and surgeons alike, thus fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Three-Pin Clamps Four-Pin Clamps Specialized Clamps for Niche Applications Pediatric Cranial Clamps |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Research Institutions |

| By Application | Neurosurgery (Craniotomies, Tumor Resections, Aneurysm Clipping) Trauma Surgery Spine Surgery Others |

| By Material | Stainless Steel Titanium Composite Materials Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Distribution Channel | Direct Sales to Healthcare Facilities Medical Device Distributors Online Sales Platforms Hospital Group Contracts |

| By Price Range | Economy Segment Mid-Range Segment Premium Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurosurgery Departments in Hospitals | 100 | Neurosurgeons, Surgical Coordinators |

| Orthopedic Surgery Clinics | 80 | Orthopedic Surgeons, Clinic Managers |

| Medical Device Distributors | 60 | Sales Representatives, Distribution Managers |

| Healthcare Procurement Departments | 90 | Procurement Officers, Supply Chain Managers |

| Regulatory Bodies and Associations | 50 | Regulatory Affairs Specialists, Policy Makers |

The GCC Cranial Clamps Market is valued at approximately USD 12 million, driven by factors such as the rising prevalence of neurological disorders and advancements in surgical techniques, alongside an increase in neurosurgeries performed in the region.