Region:Asia

Author(s):Dev

Product Code:KRAD1769

Pages:100

Published On:November 2025

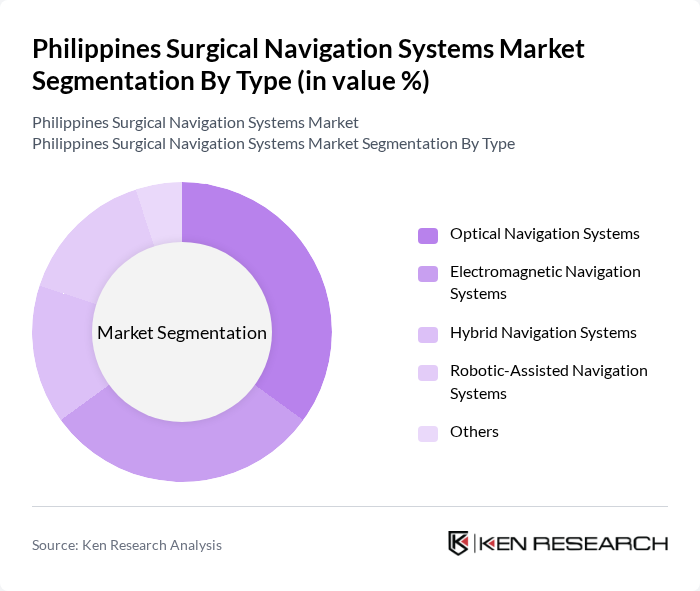

By Type:The market is segmented into various types of surgical navigation systems, including Optical Navigation Systems, Electromagnetic Navigation Systems, Hybrid Navigation Systems, Robotic-Assisted Navigation Systems, and Others. Among these,Optical Navigation Systemsare gaining traction due to their precision and ease of use in various surgical procedures.Electromagnetic Navigation Systemsare also popular, particularly in neurosurgery and orthopedic applications, due to their ability to provide real-time tracking of instruments. The demand forRobotic-Assisted Navigation Systemsis increasing as hospitals invest in advanced technologies to enhance surgical outcomes, driven by the trend toward minimally invasive and personalized surgeries.

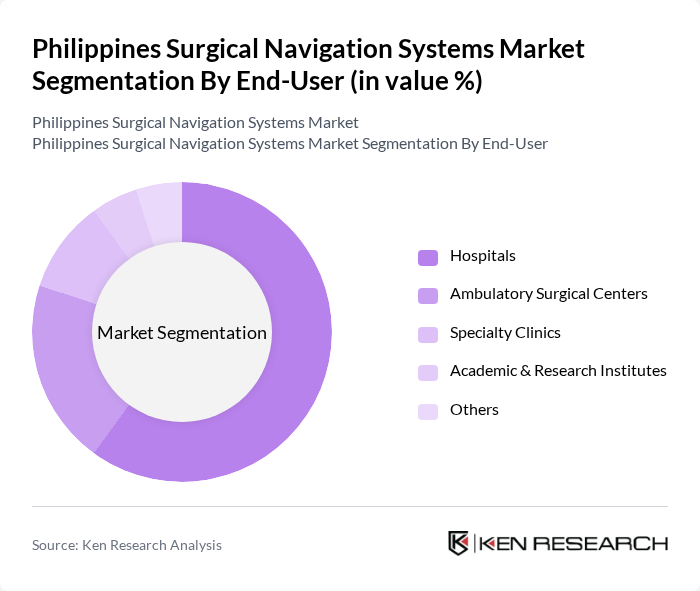

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Academic & Research Institutes, and Others.Hospitalsare the primary end-users of surgical navigation systems, driven by the need for advanced surgical techniques and improved patient outcomes.Ambulatory Surgical Centersare also increasingly adopting these technologies to enhance their service offerings, especially for minimally invasive orthopedic and neurosurgical procedures.Specialty ClinicsandAcademic & Research Institutescontribute to the market by utilizing navigation systems for specialized procedures and research purposes, reflecting the growing emphasis on precision medicine and digital operating rooms.

The Philippines Surgical Navigation Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Stryker Corporation, Brainlab AG, Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V. (Philips Healthcare), Zimmer Biomet Holdings, Inc., NuVasive, Inc., Johnson & Johnson (DePuy Synthes), Olympus Corporation, B. Braun Melsungen AG, Varian Medical Systems, Inc., Canon Medical Systems Corporation, Hitachi Medical Corporation, Accuray Incorporated contribute to innovation, geographic expansion, and service delivery in this space. These companies are driving market growth through continuous advancements in 3D imaging, intraoperative guidance, workflow automation, and integration of AI and robotics in navigation platforms.

The future of the surgical navigation systems market in the Philippines appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the government focuses on enhancing healthcare infrastructure, the integration of AI and robotics in surgical procedures is expected to gain traction. Additionally, the growing emphasis on patient-centric solutions will likely lead to more healthcare facilities adopting these systems, ultimately improving surgical outcomes and patient satisfaction across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Navigation Systems Electromagnetic Navigation Systems Hybrid Navigation Systems Robotic-Assisted Navigation Systems Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Academic & Research Institutes Others |

| By Application | Orthopedic Surgery Neurosurgery ENT Surgery Spinal Surgery Dental Surgery Cardiovascular Surgery Others |

| By Technology | D Imaging Technology Image-Guided Surgery Technology Navigation Software Solutions Intraoperative Imaging Integration Others |

| By Region | Luzon Visayas Mindanao |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgical Navigation | 100 | Orthopedic Surgeons, Hospital Procurement Officers |

| Neurosurgical Navigation Systems | 80 | Neurosurgeons, Medical Device Managers |

| General Surgical Applications | 70 | General Surgeons, Surgical Unit Heads |

| Training and Support Services | 40 | Clinical Educators, Training Coordinators |

| Market Trends and Adoption Rates | 60 | Healthcare Analysts, Market Research Professionals |

The Philippines Surgical Navigation Systems Market is valued at approximately USD 620 million, reflecting a significant growth driven by advanced surgical technologies, increased healthcare expenditure, and a rise in surgical procedures performed in the country.