Region:Middle East

Author(s):Dev

Product Code:KRAB7236

Pages:100

Published On:October 2025

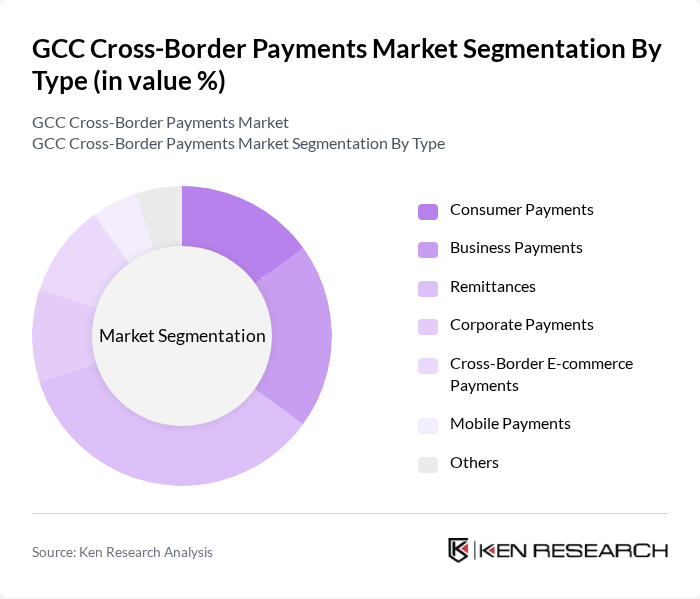

By Type:The segmentation by type includes various sub-segments such as Consumer Payments, Business Payments, Remittances, Corporate Payments, Cross-Border E-commerce Payments, Mobile Payments, and Others. Among these, Remittances are currently the leading sub-segment, driven by the high number of expatriates in the GCC region who regularly send money back to their home countries. The ease of use and lower transaction costs associated with digital remittance services have further fueled this growth.

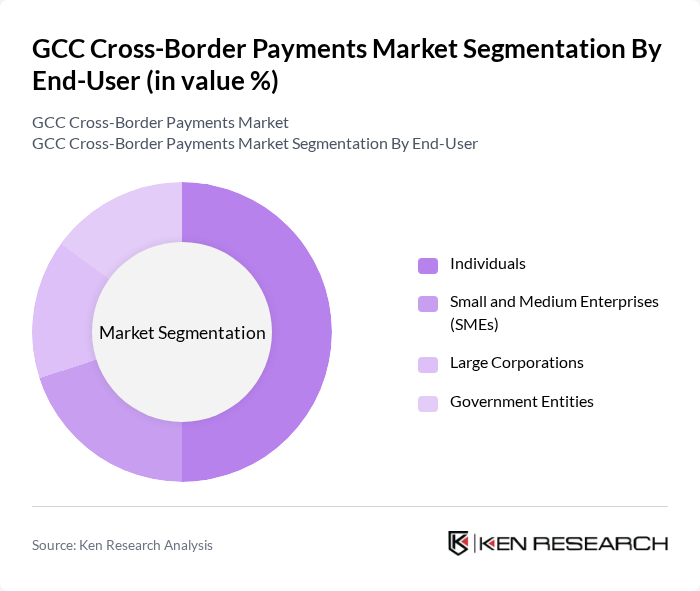

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individuals represent the largest segment, primarily due to the high volume of remittances sent by expatriates. The increasing reliance on digital payment platforms for personal transactions has also contributed to the growth of this segment, as more individuals seek convenient and cost-effective ways to send money across borders.

The GCC Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Western Union Company, TransferWise Ltd., MoneyGram International, Inc., Visa Inc., Mastercard Incorporated, Stripe, Inc., Alipay (Ant Group), Payoneer Inc., Revolut Ltd., Remitly, Inc., WorldRemit Ltd., Xoom Corporation, Skrill Limited, OFX Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The GCC cross-border payments market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As digital payment platforms expand, the integration of artificial intelligence and blockchain technology will enhance transaction security and efficiency. Additionally, the increasing collaboration between traditional banks and fintech companies is expected to streamline payment processes, making them more accessible. This dynamic environment will likely foster innovation, positioning the GCC as a leader in cross-border payment solutions by future.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer Payments Business Payments Remittances Corporate Payments Cross-Border E-commerce Payments Mobile Payments Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | Bank Transfers Credit/Debit Cards E-wallets Cryptocurrencies |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Geographic Focus | Intra-GCC Payments GCC to Asia Payments GCC to Europe Payments GCC to Africa Payments |

| By Industry | Retail Travel and Tourism Financial Services Telecommunications |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cross-Border Transactions | 150 | Transaction Managers, Compliance Officers |

| Fintech Payment Solutions | 100 | Product Managers, Business Development Executives |

| SME Cross-Border Payment Users | 80 | Business Owners, Financial Controllers |

| Consumer Payment Preferences | 120 | End-users, Digital Payment Adopters |

| Regulatory Impact Assessment | 60 | Regulatory Affairs Specialists, Legal Advisors |

The GCC Cross-Border Payments Market is valued at approximately USD 30 billion, driven by increasing international trade, remittances from expatriates, and the adoption of digital payment solutions, alongside advancements in technology enhancing transaction speed and security.