Region:Middle East

Author(s):Rebecca

Product Code:KRAD6240

Pages:82

Published On:December 2025

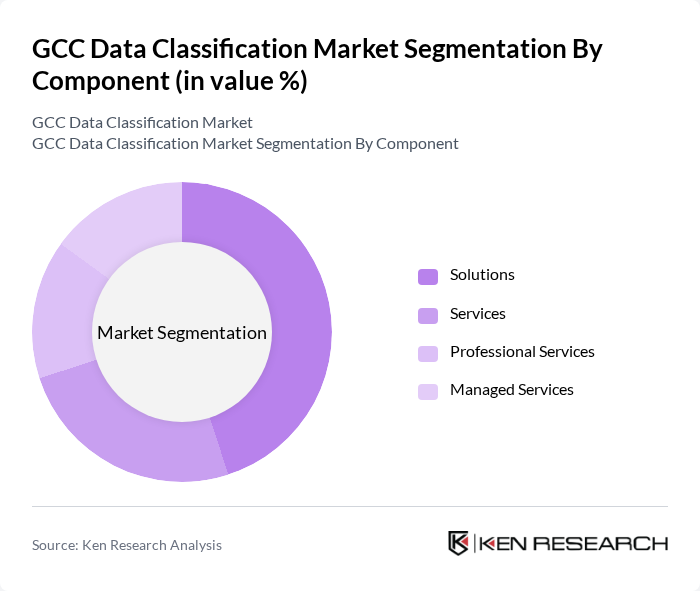

By Component:The segmentation by component includes Solutions, Services, Professional Services, and Managed Services. Each of these subsegments plays a crucial role in the overall market dynamics, with varying degrees of demand based on organizational needs and technological advancements. In line with global patterns, solutions typically account for the largest share as enterprises prioritize platforms that automate discovery, labeling, and protection of sensitive data, while services support implementation, customization, and ongoing management.

The Solutions subsegment is currently dominating the market due to the increasing adoption of advanced data classification technologies that help organizations automate their data management processes, consistent with global trends where solutions represent well over half of market revenues. Companies are increasingly investing in software solutions that provide real-time data classification, policy?based labeling, and integration with data loss prevention and access management tools, enabling them to comply with regulatory requirements and enhance data security. The demand for integrated solutions that combine data classification with analytics, reporting, and governance dashboards is also on the rise, further solidifying the position of this subsegment as a market leader in the GCC.

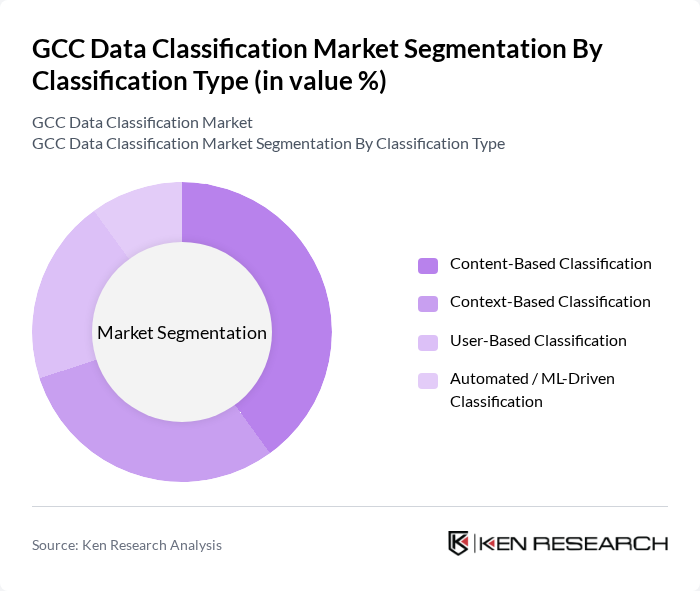

By Classification Type:The classification type segmentation includes Content-Based Classification, Context-Based Classification, User-Based Classification, and Automated / ML-Driven Classification. Each type serves different organizational needs and is influenced by the evolving landscape of data management and security, with enterprises increasingly combining multiple methods within unified platforms.

Content-Based Classification is leading the market as organizations prioritize the classification of data based on its content to ensure compliance and security, reflecting widespread use of pattern?, keyword?, and dictionary?based inspection to detect personal, financial, and health information. This method allows for a more granular approach to data management, enabling organizations to identify sensitive information effectively across documents, emails, and databases and to apply appropriate protection policies. The growing emphasis on data privacy and protection regulations, as well as the need to demonstrate robust governance during audits, has further propelled the demand for content-based solutions, while interest in automated and ML?driven classification is rising as GCC organizations scale cloud adoption and unstructured data volumes.

The GCC Data Classification Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc., Google LLC (Google Cloud), Oracle Corporation, SAP SE, Informatica Inc., Varonis Systems, Inc., Netwrix Corporation, Digital Guardian (HelpSystems LLC), Forcepoint LLC, Proofpoint, Inc., McAfee, LLC, Broadcom Inc. (Symantec Enterprise Division), Thales Group (Thales CPL) contribute to innovation, geographic expansion, and service delivery in this space, aligning with the global landscape of data classification vendors.

The GCC data classification market is poised for significant growth as organizations increasingly recognize the importance of data governance and compliance. With the rise of hybrid cloud solutions and a focus on data ethics, businesses are expected to invest more in advanced data classification technologies. Additionally, the integration of AI and machine learning will enhance data management capabilities, allowing for more efficient classification processes. As the region continues to embrace digital transformation, the demand for innovative data solutions will likely accelerate, shaping the future landscape of the market.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions Services Professional Services Managed Services |

| By Classification Type | Content-Based Classification Context-Based Classification User-Based Classification Automated / ML-Driven Classification |

| By Application | Governance, Risk and Compliance (GRC) Access Control & Policy Enforcement Web, Mobile, and Email Protection Data Discovery & Cataloging Centralized Management & Reporting |

| By Deployment Model | On-Premises Cloud Hybrid |

| By Data Sensitivity Level | Public Data Internal Data Confidential / Restricted Data Secret / Highly Confidential Data |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-User Industry | Banking, Financial Services and Insurance (BFSI) Government and Public Sector Healthcare and Life Sciences IT and Telecom Energy and Utilities Retail and E-commerce Manufacturing Others |

| By Compliance Requirement | National Data Protection Laws (e.g., PDPL, NDMO, UAE Data Law) Sector-Specific Regulations (e.g., Central Bank, Healthcare Regulators) International Standards (e.g., ISO/IEC 27001, ISO/IEC 27701) Cross-Border Data Transfer Requirements |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Classification | 120 | Data Protection Officers, IT Security Managers |

| Healthcare Data Management | 90 | Compliance Officers, Health IT Directors |

| Government Data Governance | 80 | Policy Makers, IT Administrators |

| Retail Sector Data Security | 70 | Data Analysts, E-commerce Managers |

| Telecommunications Data Handling | 100 | Network Security Engineers, Compliance Managers |

The GCC Data Classification Market is valued at approximately USD 1.0 billion, reflecting a significant growth trajectory driven by increasing data security needs, compliance with regulations, and the rising volume of data generated across various sectors.