Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9056

Pages:93

Published On:November 2025

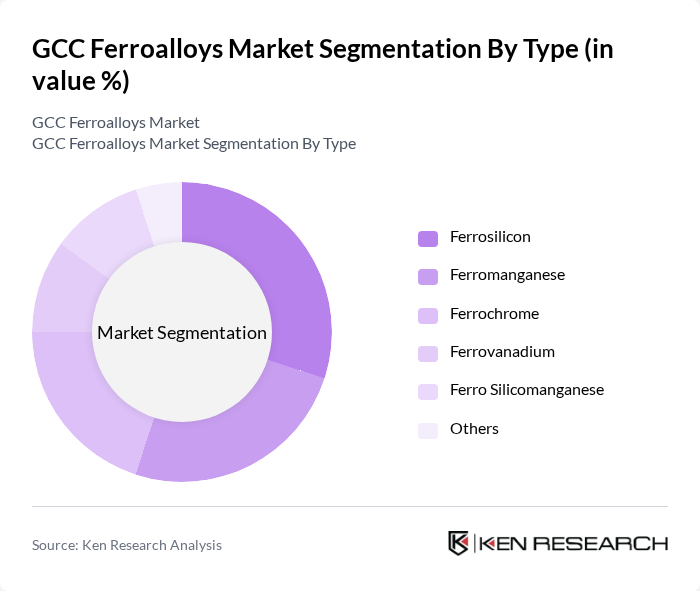

By Type:The market is segmented into various types of ferroalloys, including Ferrosilicon, Ferromanganese, Ferrochrome, Ferrovanadium, Ferro Silicomanganese, and Others. Each type serves distinct purposes in metallurgical processes, with specific applications in steelmaking and alloy production. Ferrosilicon is widely used as a deoxidizer and alloying element in steel production, while ferromanganese and ferrochrome are essential for imparting strength and corrosion resistance to steel. Ferrovanadium and ferro silicomanganese are used for specialized alloy steels and high-strength applications.

The Ferrosilicon segment is currently the leading sub-segment in the market, primarily due to its essential role in steel production and its ability to improve the strength and quality of steel. The increasing demand for high-quality steel in construction and automotive applications has further propelled the growth of this segment. Additionally, the versatility of Ferrosilicon in various metallurgical processes makes it a preferred choice among manufacturers.

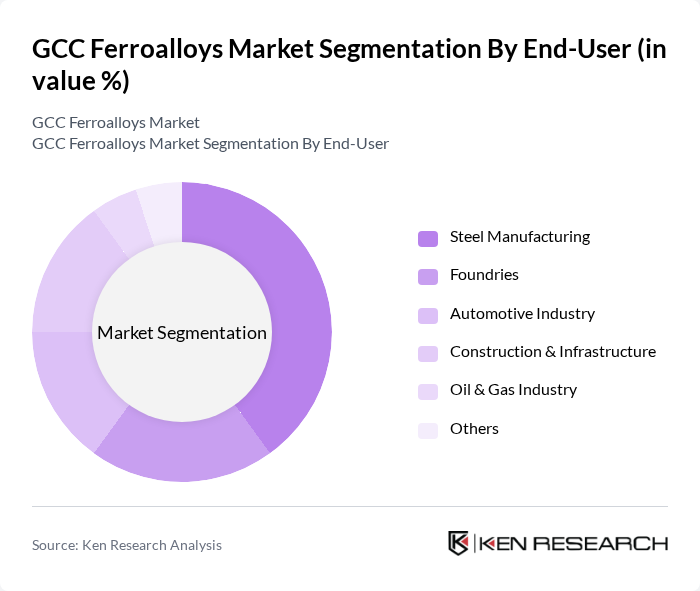

By End-User:The market is segmented based on end-users, including Steel Manufacturing, Foundries, Automotive Industry, Construction & Infrastructure, Oil & Gas Industry, and Others. Each end-user category has unique requirements and applications for ferroalloys, influencing their demand in the market. Steel manufacturing remains the largest consumer, followed by foundries and construction, reflecting the region's focus on infrastructure and industrialization.

The Steel Manufacturing sector is the dominant end-user of ferroalloys, accounting for a significant portion of the market. This is largely due to the essential role that ferroalloys play in enhancing the properties of steel, such as strength, ductility, and resistance to corrosion. The ongoing expansion of the construction and infrastructure sectors in the GCC region further drives the demand for steel, thereby boosting the ferroalloys market.

The GCC Ferroalloys Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Ferro Alloys Company (SABAYEK), Oman Ferroalloy Company (OFAC), Qatar Steel Company, Emirates Steel, Al Ghurair Iron & Steel LLC, Saudi Ferroalloys Company, Ferroalloy Industries LLC (UAE), Middle East Ferroalloys LLC, National Ferroalloys Company (Saudi Arabia), United Ferroalloys LLC (Oman), Al Jazeera Steel Products Co. SAOG, Qatar Mining Company, Arabian Ferroalloys Company, Al-Futtaim Group, and Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The GCC ferroalloys market is poised for significant transformation, driven by a shift towards sustainable production methods and increased digitalization in manufacturing processes. As the region focuses on reducing carbon footprints, investments in green technologies are expected to rise. Additionally, the growing emphasis on recycling and waste management will likely create new avenues for growth. The demand for high-performance alloys will also increase, particularly in sectors like automotive and aerospace, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ferrosilicon Ferromanganese Ferrochrome Ferrovanadium Ferro Silicomanganese Others |

| By End-User | Steel Manufacturing Foundries Automotive Industry Construction & Infrastructure Oil & Gas Industry Others |

| By Application | Alloy Production Steelmaking Casting Welding Others |

| By Geography | Saudi Arabia UAE Qatar Oman Kuwait |

| By Production Method | Electric Arc Furnace Blast Furnace Others |

| By Quality Grade | High-Grade Ferroalloys Low-Grade Ferroalloys Others |

| By Supply Chain Model | Direct Supply Distributor Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ferroalloy Producers | 60 | Production Managers, Operations Directors |

| Steel Manufacturers | 50 | Procurement Managers, Quality Control Officers |

| Alloy Distributors | 40 | Sales Managers, Supply Chain Coordinators |

| Research Institutions | 40 | Industry Analysts, Market Researchers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

The GCC Ferroalloys Market is valued at approximately USD 1.2 billion, driven by increasing demand for steel and alloys across various industries, including construction, automotive, and manufacturing, as well as ongoing infrastructure projects in the region.