Region:Middle East

Author(s):Shubham

Product Code:KRAD5488

Pages:90

Published On:December 2025

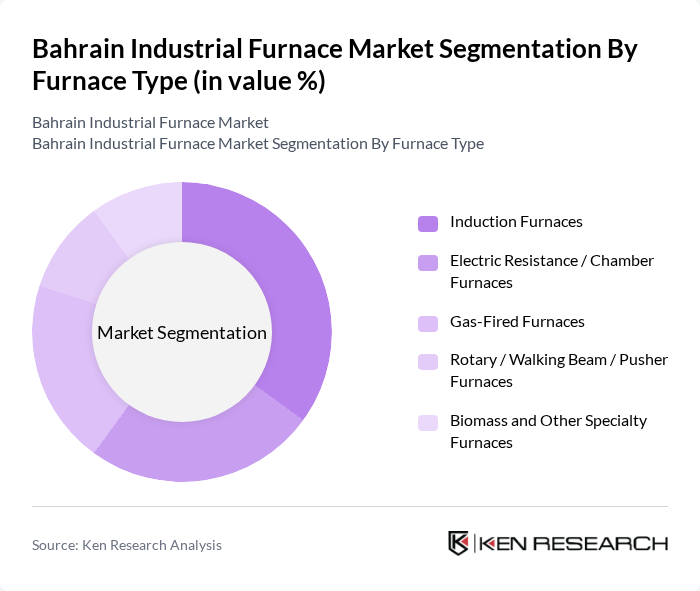

By Furnace Type:The Bahrain Industrial Furnace Market can be segmented into various types of furnaces, each serving specific industrial needs. The primary types include Induction Furnaces, Electric Resistance / Chamber Furnaces, Gas-Fired Furnaces, Rotary / Walking Beam / Pusher Furnaces, and Biomass and Other Specialty Furnaces. Among these, Induction Furnaces are gaining traction due to their energy efficiency and ability to handle various materials, making them a preferred choice in metal processing industries.

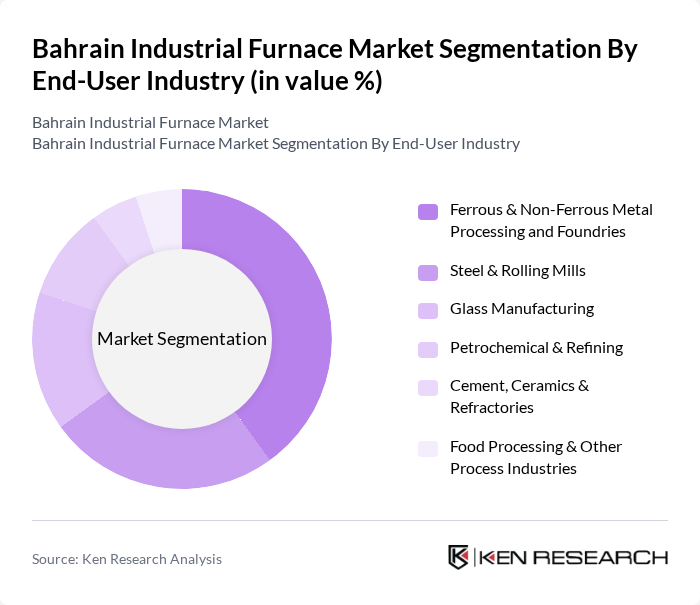

By End-User Industry:The market is also segmented by end-user industries, which include Ferrous & Non-Ferrous Metal Processing and Foundries, Steel & Rolling Mills, Glass Manufacturing, Petrochemical & Refining, Cement, Ceramics & Refractories, and Food Processing & Other Process Industries. The Ferrous & Non-Ferrous Metal Processing segment is the largest due to the high demand for metal products in construction and manufacturing sectors, driving the need for efficient furnace solutions.

The Bahrain Industrial Furnace Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Steel B.S.C. (c), Gulf Industrial Investment Company (GIIC), Aluminium Bahrain B.S.C. (Alba), Arab Shipbuilding & Repair Yard Company (ASRY), Bahrain Petroleum Company (Bapco Energies), Tatweer Petroleum W.L.L., Fives Group, Tenova S.p.A., Inductotherm Group, Aichelin Group, Danieli & C. Officine Meccaniche S.p.A., SMS group GmbH, Primetals Technologies Ltd., Andritz AG, Metso Outotec Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain industrial furnace market is poised for significant transformation, driven by technological advancements and a strong push towards sustainability. As industries increasingly adopt automation and renewable energy sources, the demand for smart furnace technologies is expected to rise. Furthermore, partnerships between local industries and international manufacturers will likely enhance innovation and efficiency. The government's commitment to industrial growth will continue to create a conducive environment for investment, fostering a competitive landscape that prioritizes energy efficiency and environmental compliance.

| Segment | Sub-Segments |

|---|---|

| By Furnace Type | Induction Furnaces Electric Resistance / Chamber Furnaces Gas-Fired Furnaces Rotary / Walking Beam / Pusher Furnaces Biomass and Other Specialty Furnaces |

| By End-User Industry | Ferrous & Non-Ferrous Metal Processing and Foundries Steel & Rolling Mills Glass Manufacturing Petrochemical & Refining Cement, Ceramics & Refractories Food Processing & Other Process Industries |

| By Process/Application | Heat Treatment (Annealing, Normalizing, Tempering) Melting & Holding Casting & Foundry Operations Reheating & Forging Drying, Preheating & Other Thermal Processes |

| By Fuel / Energy Source | Natural Gas / LPG Electricity Fuel Oil Biomass & Alternative Fuels Hybrid & Other Sources |

| By Furnace Configuration | Batch / Periodic Furnaces Continuous Furnaces Modular / Skid-Mounted Systems |

| By Governorate | Capital Governorate Muharraq Governorate Northern Governorate Southern Governorate Industrial Zones & Free Zones (Hidd, Sitra, Others) |

| By Policy & Compliance Driver | Energy Efficiency & Emission Compliance-Driven Installations Capacity Expansion & New Project-Driven Installations Replacement / Retrofit & Modernization Projects R&D, Pilot and Specialty Installations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Metal Processing Industry | 120 | Production Managers, Plant Engineers |

| Ceramics Manufacturing | 90 | Operations Supervisors, Quality Control Managers |

| Glass Production Sector | 80 | Technical Directors, Process Engineers |

| Research & Development in Materials | 60 | R&D Managers, Innovation Leads |

| Energy Efficiency Initiatives | 50 | Sustainability Officers, Energy Managers |

The Bahrain Industrial Furnace Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for energy-efficient and high-performance furnaces across various industries.