Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4105

Pages:87

Published On:December 2025

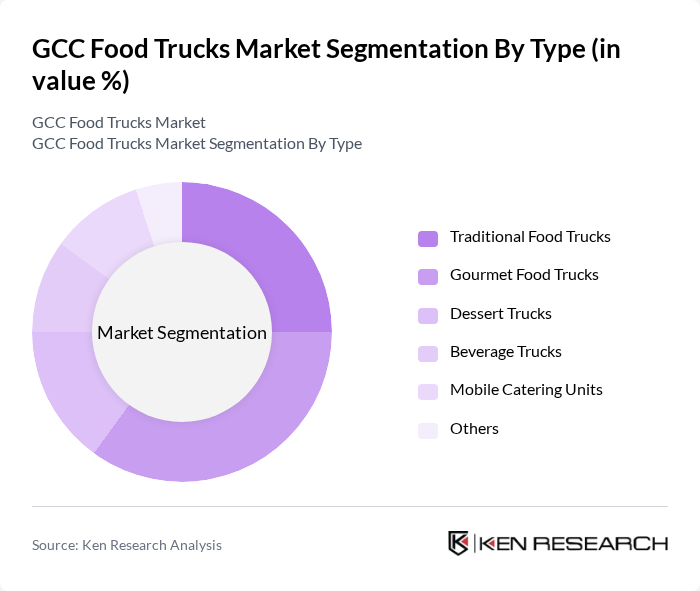

By Type:The food truck market can be segmented into various types, including Traditional Food Trucks, Gourmet Food Trucks, Dessert Trucks, Beverage Trucks, Mobile Catering Units, and Others. Each type caters to different consumer preferences and occasions, with gourmet and dessert trucks gaining popularity for their unique offerings and high-quality ingredients. Traditional food trucks continue to serve classic dishes, while beverage trucks provide refreshing options, especially in hot climates.

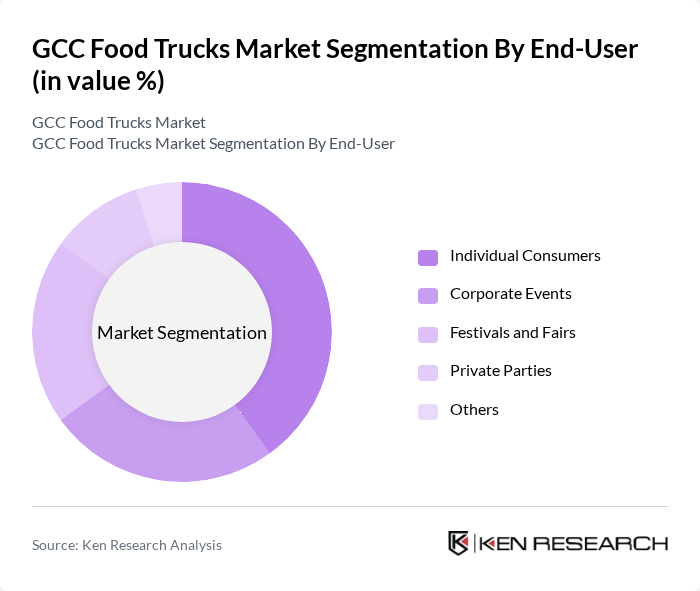

By End-User:The end-user segmentation includes Individual Consumers, Corporate Events, Festivals and Fairs, Private Parties, and Others. Individual consumers represent a significant portion of the market, driven by the growing trend of casual dining and the desire for unique food experiences. Corporate events and festivals also contribute to the demand, as food trucks provide convenient catering solutions for large gatherings.

The GCC Food Trucks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Food Truck Company A, Food Truck Company B, Food Truck Company C, Food Truck Company D, Food Truck Company E, Food Truck Company F, Food Truck Company G, Food Truck Company H, Food Truck Company I, Food Truck Company J, Food Truck Company K, Food Truck Company L, Food Truck Company M, Food Truck Company N, Food Truck Company O contribute to innovation, geographic expansion, and service delivery in this space.

The GCC food truck market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As urbanization accelerates, food trucks are likely to expand into underserved areas, enhancing accessibility. Additionally, the integration of mobile payment solutions and online ordering systems will streamline operations, catering to the growing demand for convenience. Sustainability practices will also gain traction, as consumers increasingly favor eco-friendly options, shaping the future landscape of the food truck industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Food Trucks Gourmet Food Trucks Dessert Trucks Beverage Trucks Mobile Catering Units Others |

| By End-User | Individual Consumers Corporate Events Festivals and Fairs Private Parties Others |

| By Location | Urban Areas Suburban Areas Tourist Attractions Event Venues Others |

| By Cuisine Type | Middle Eastern Cuisine Asian Cuisine American Cuisine European Cuisine Others |

| By Service Type | On-Site Service Pre-Order and Delivery Catering Services Others |

| By Payment Method | Cash Payments Card Payments Mobile Payments Others |

| By Customer Demographics | Age Groups Income Levels Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Truck Operators | 45 | Owners, Managers, and Operators |

| Consumer Preferences | 120 | Regular Food Truck Customers, Event Attendees |

| Regulatory Insights | 30 | Local Government Officials, Regulatory Bodies |

| Market Trends | 50 | Culinary Experts, Food Critics, Industry Analysts |

| Event-Driven Demand | 55 | Event Organizers, Festival Coordinators |

The GCC Food Trucks Market is valued at approximately USD 1.2 billion, driven by increasing demand for diverse culinary experiences, urbanization, and the popularity of food festivals and events across the region.