Region:Middle East

Author(s):Shubham

Product Code:KRAA8706

Pages:95

Published On:November 2025

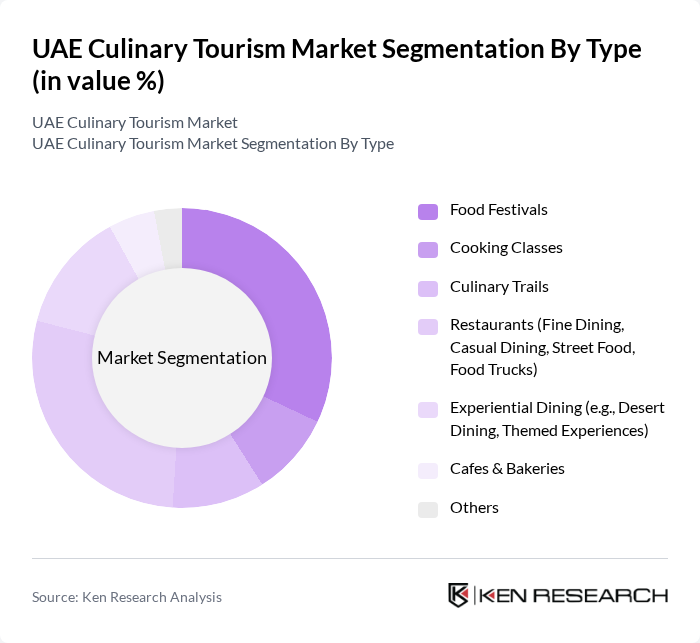

By Type:The culinary tourism market can be segmented into various types, including food festivals, cooking classes, culinary trails, restaurants, experiential dining, cafes & bakeries, and others. Among these, food festivals represent the largest segment by revenue, driven by the popularity of large-scale events and the increasing number of international visitors seeking immersive culinary experiences. Restaurants, including fine dining and casual dining, also hold a significant share due to high demand from both tourists and locals. The trend towards unique dining experiences, such as themed restaurants and food trucks, continues to gain traction .

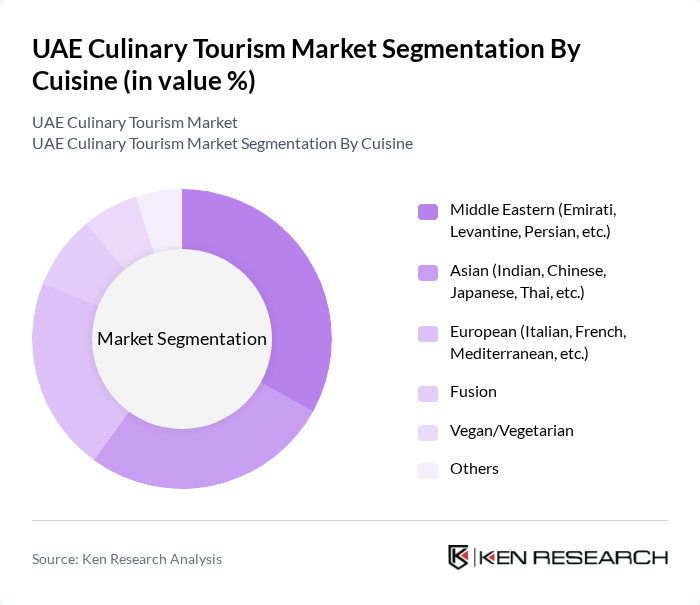

By Cuisine:The culinary tourism market is also segmented by cuisine types, including Middle Eastern, Asian, European, fusion, vegan/vegetarian, and others. Middle Eastern cuisine, particularly Emirati and Levantine dishes, is highly popular among tourists, reflecting the UAE’s cultural heritage and authenticity. Asian cuisine, especially Indian and Chinese, also commands significant demand due to the large expatriate population and their culinary influence. European cuisine, including Italian and French, appeals to high-income consumers and international travelers. Fusion and vegan/vegetarian options are gaining ground as consumer preferences diversify .

The UAE Culinary Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Culinary Guild, Dubai Food Festival (Dubai Festivals and Retail Establishment), Abu Dhabi Culinary (Department of Culture and Tourism – Abu Dhabi), Al Ain Food Festival, Taste of Dubai (Turret Media), Platinum Heritage, Sonara Camp, The Dubai Mall (Emaar Malls Management LLC), Jumeirah Group, Atlantis, The Palm, Emaar Hospitality Group, Hilton Worldwide, Marriott International, Accor Hotels, Radisson Hotel Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE culinary tourism market appears promising, driven by increasing global interest in authentic food experiences and the government's commitment to enhancing tourism infrastructure. As culinary events and festivals continue to grow, the integration of technology in food experiences will likely attract a younger demographic. Additionally, the focus on sustainability and local sourcing will resonate with eco-conscious travelers, further solidifying the UAE's position as a premier culinary destination in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Festivals Cooking Classes Culinary Trails Restaurants (Fine Dining, Casual Dining, Street Food, Food Trucks) Experiential Dining (e.g., Desert Dining, Themed Experiences) Cafes & Bakeries Others |

| By Cuisine | Middle Eastern (Emirati, Levantine, Persian, etc.) Asian (Indian, Chinese, Japanese, Thai, etc.) European (Italian, French, Mediterranean, etc.) Fusion Vegan/Vegetarian Others |

| By Demographics | Age Group Income Level Family Size Travel Purpose (Leisure, Business, MICE, etc.) Nationality/Origin Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Seasonality | Peak Season Off-Peak Season Holiday Seasons (Ramadan, Eid, Christmas, etc.) Others |

| By Marketing Channel | Online Marketing Social Media Influencer Collaborations Traditional Advertising Food Delivery Platforms Others |

| By Customer Type | International Tourists Domestic Tourists Locals/Residents Corporate Clients Event Organizers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Culinary Tour Participants | 100 | International Tourists, Food Enthusiasts |

| Local Restaurant Owners | 60 | Chefs, Restaurant Managers |

| Culinary Event Organizers | 50 | Event Planners, Marketing Managers |

| Food Bloggers and Influencers | 40 | Content Creators, Social Media Influencers |

| Tourism Board Representatives | 40 | Policy Makers, Tourism Development Officers |

The UAE Culinary Tourism Market is valued at approximately USD 510 million, reflecting a significant growth driven by the influx of international tourists and a rising interest in diverse culinary experiences.