Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8137

Pages:97

Published On:November 2025

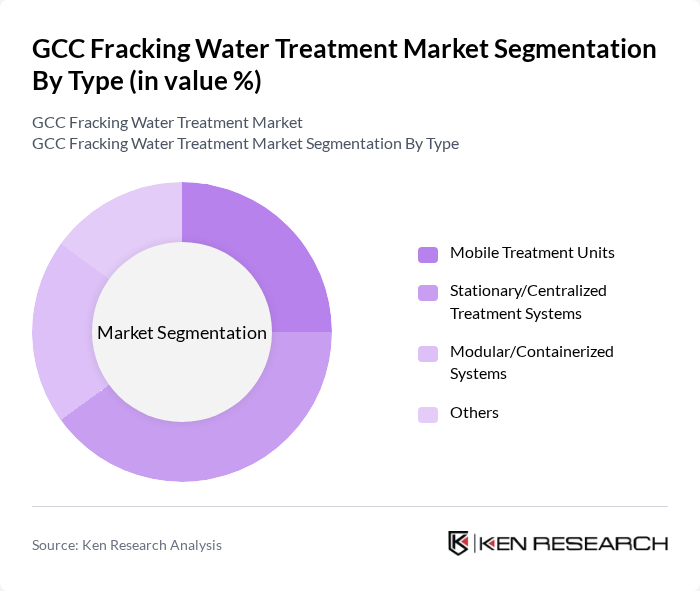

By Type:The market is segmented into various types of treatment systems, including Mobile Treatment Units, Stationary/Centralized Treatment Systems, Modular/Containerized Systems, and Others. Among these, Stationary/Centralized Treatment Systems are leading due to their efficiency and capacity to handle large volumes of wastewater generated from fracking operations. The demand for these systems is driven by the need for reliable and consistent treatment solutions that can be integrated into existing oil and gas infrastructure. Advanced membrane filtration and physical separation technologies are increasingly being adopted in these systems to meet regulatory and operational requirements.

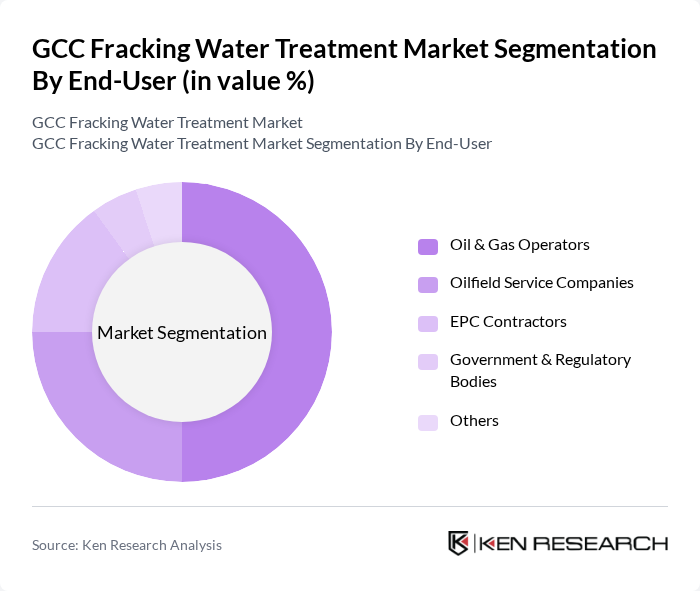

By End-User:The end-user segmentation includes Oil & Gas Operators, Oilfield Service Companies, EPC Contractors, Government & Regulatory Bodies, and Others. Oil & Gas Operators are the dominant segment, as they are the primary consumers of fracking water treatment services. The increasing focus on environmental compliance, operational efficiency, and the need for effective water management in oil extraction processes are driving this segment's growth.

The GCC Fracking Water Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Water Technologies, SUEZ Water Technologies & Solutions, Aquatech International LLC, Xylem Inc., Schlumberger Water Services, Halliburton, Baker Hughes, Ecolab (Nalco Water), Pentair, AECOM, Golder Associates, Clean Harbors, Almar Water Solutions, Metito, Wetico (Water & Environment Technologies Co. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC fracking water treatment market appears promising, driven by increasing investments in sustainable practices and technological innovations. As water scarcity intensifies, companies are likely to prioritize efficient water management solutions, leading to a surge in demand for advanced treatment technologies. Additionally, the integration of smart water management systems and AI-driven processes is expected to enhance operational efficiency, further propelling market growth. The focus on sustainability will also encourage partnerships between private firms and governments, fostering a collaborative approach to water resource management.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Treatment Units Stationary/Centralized Treatment Systems Modular/Containerized Systems Others |

| By End-User | Oil & Gas Operators Oilfield Service Companies EPC Contractors Government & Regulatory Bodies Others |

| By Source of Water | Produced Water Flowback Water Brackish Water Surface Water Others |

| By Treatment Method | Membrane Filtration (e.g., Reverse Osmosis, Nanofiltration) Chemical Treatment (e.g., Coagulation, Oxidation) Biological Treatment Electrocoagulation Thermal Treatment (e.g., Distillation, Evaporation) Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman |

| By Application | Water Recycling & Reuse Environmental Compliance Resource Recovery Wastewater Disposal Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships International Aid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fracking Water Treatment Facilities | 60 | Facility Managers, Operations Directors |

| Environmental Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Water Treatment Technology Providers | 50 | Product Managers, Technical Sales Representatives |

| Oil & Gas Exploration Companies | 45 | Environmental Engineers, Project Managers |

| Consultants in Water Management | 40 | Environmental Consultants, Industry Analysts |

The GCC Fracking Water Treatment Market is valued at approximately USD 470 million, driven by the increasing demand for effective water treatment solutions in the oil and gas sector and the adoption of advanced treatment technologies.