Region:Middle East

Author(s):Rebecca

Product Code:KRAC2580

Pages:92

Published On:October 2025

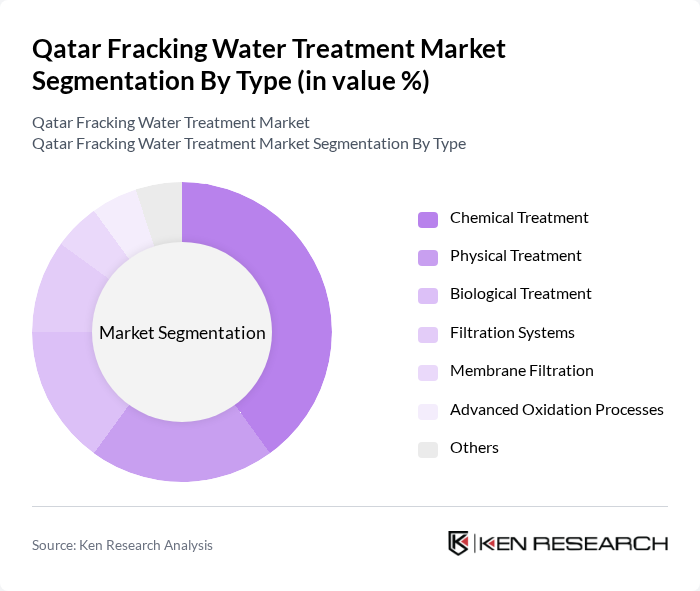

By Type:The market is segmented into Chemical Treatment, Physical Treatment, Biological Treatment, Filtration Systems, Membrane Filtration, Advanced Oxidation Processes, and Others. Chemical Treatment remains the most widely adopted due to its proven effectiveness in removing a broad spectrum of contaminants, including heavy metals and organic compounds. The adoption of membrane filtration is accelerating, driven by its ability to produce high-quality reusable water and meet tightening discharge standards. Physical and biological treatments are increasingly integrated as part of multi-stage systems to enhance overall efficiency and sustainability.

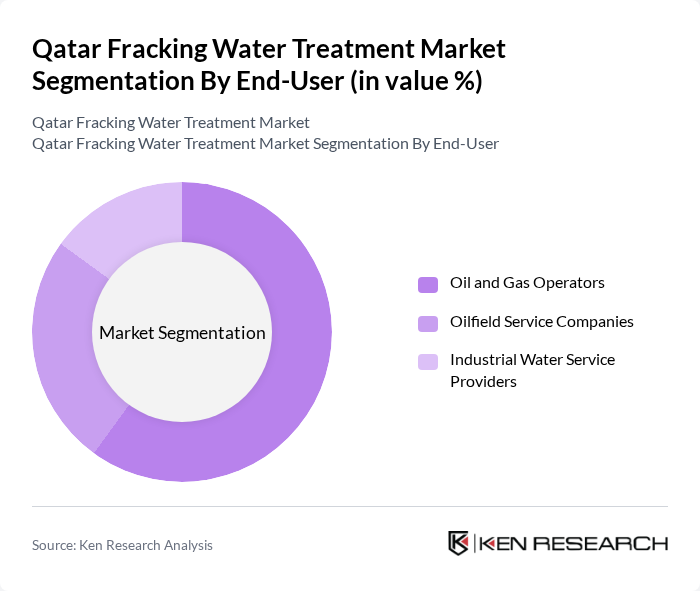

By End-User:The end-user segmentation includes Oil and Gas Operators, Oilfield Service Companies, and Industrial Water Service Providers. Oil and Gas Operators account for the largest share, reflecting their responsibility for managing produced water volumes and ensuring compliance with environmental standards. Oilfield Service Companies provide specialized treatment solutions and project execution, while Industrial Water Service Providers support broader water management initiatives across the sector.

The Qatar Fracking Water Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Water Technologies, SUEZ Water Technologies & Solutions, Xylem Inc., Aquatech International LLC, Schlumberger Water Services, Baker Hughes (Water Solutions), Pentair plc, Kurita Water Industries Ltd., IDE Technologies, DuPont Water Solutions, Ecolab Inc. (Nalco Water), Biwater, Tetra Tech, Inc., Qatar Engineering & Construction Company (Qcon), Gulf Water Treatment Co. W.L.L. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar fracking water treatment market appears promising, driven by increasing investments in sustainable practices and technological innovations. As the industry adapts to stringent regulations and environmental concerns, companies are likely to focus on integrated water management solutions. Furthermore, the rise of public-private partnerships will facilitate knowledge sharing and resource allocation, enhancing operational efficiencies and promoting sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Treatment Physical Treatment Biological Treatment Filtration Systems Membrane Filtration Advanced Oxidation Processes Others |

| By End-User | Oil and Gas Operators Oilfield Service Companies Industrial Water Service Providers |

| By Application | Produced Water Treatment Flowback Water Treatment Water Recycling & Reuse Brine Management Others |

| By Distribution Channel | Direct Contracts with Operators EPC Contractors Equipment Distributors |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Regulatory Compliance | Local Regulations International Standards Environmental Compliance |

| By Technology | Membrane Technologies (RO, UF, NF) Chemical Precipitation Electrocoagulation Biological Treatment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fracking Water Treatment Providers | 75 | Operations Managers, Technical Directors |

| Environmental Regulatory Bodies | 45 | Policy Makers, Environmental Analysts |

| Oil and Gas Industry Stakeholders | 65 | Project Managers, Sustainability Officers |

| Water Treatment Technology Suppliers | 55 | Sales Managers, Product Development Engineers |

| Consultants in Water Management | 50 | Consultants, Industry Experts |

The Qatar Fracking Water Treatment Market is valued at approximately USD 490 million, reflecting a significant growth driven by the increasing demand for advanced water treatment solutions in the oil and gas sector.