Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1065

Pages:84

Published On:October 2025

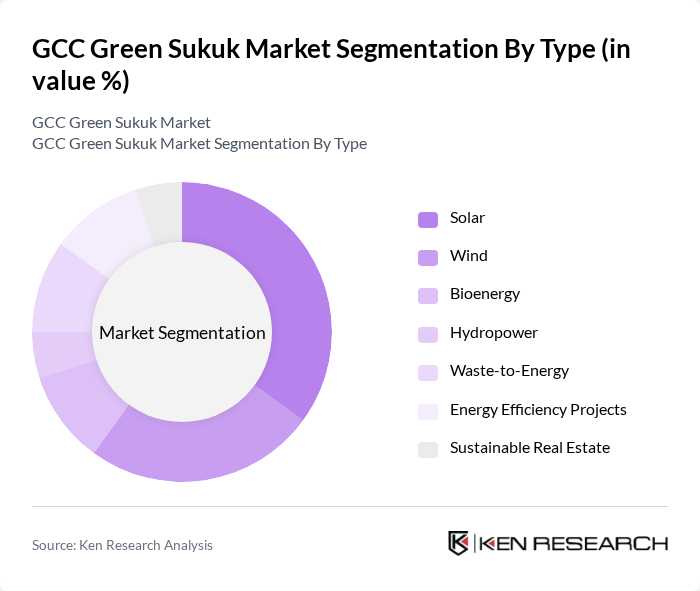

By Type:The market is segmented into Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Energy Efficiency Projects, and Sustainable Real Estate. Solar and Wind projects are particularly prominent, reflecting the region’s abundant solar irradiance and favorable wind corridors. The GCC’s focus on renewable energy diversification—exemplified by large-scale solar parks and wind farms—has driven significant investment into these segments, positioning them as leading contributors to the green sukuk market .

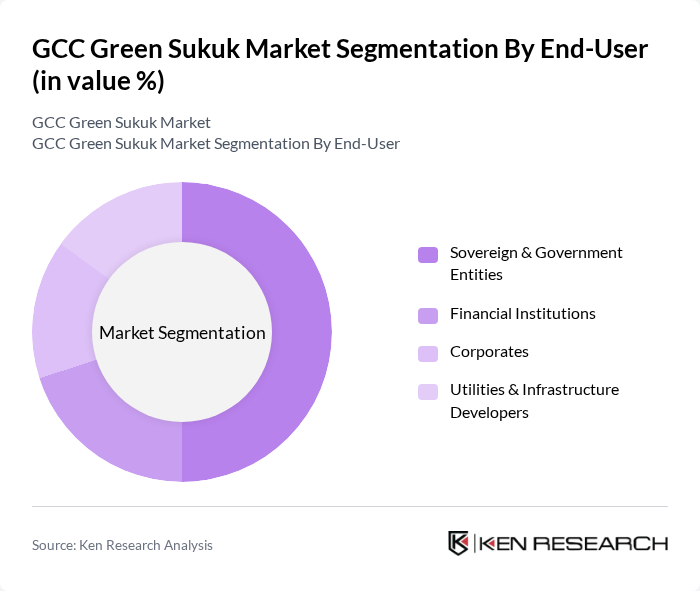

By End-User:The end-user segmentation includes Sovereign & Government Entities, Financial Institutions, Corporates, and Utilities & Infrastructure Developers. Sovereign and government entities are the dominant end-users, frequently acting as primary issuers of green sukuk to finance national sustainability and infrastructure projects. Their leadership is critical for establishing regulatory frameworks and catalyzing private sector participation in green finance .

The GCC Green Sukuk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Islamic Bank, Dubai Islamic Bank, Qatar Islamic Bank, Al Baraka Banking Group, Bank Aljazira, Emirates NBD, Kuwait Finance House, Saudi National Bank, Al Rajhi Bank, Abu Dhabi Investment Authority, Qatar Investment Authority, Bahrain Mumtalakat Holding Company, Oman Investment Authority, Islamic Development Bank, and Majid Al Futtaim contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC green sukuk market appears promising, driven by increasing governmental support and a growing emphasis on sustainable development. As countries in the region align their economic strategies with global sustainability goals, the issuance of green sukuk is expected to rise significantly. Furthermore, the integration of technology in financing processes will enhance transparency and efficiency, attracting more investors. The collaboration between local entities and international green funds will also play a crucial role in expanding the market and fostering innovative financial solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Energy Efficiency Projects Sustainable Real Estate |

| By End-User | Sovereign & Government Entities Financial Institutions Corporates Utilities & Infrastructure Developers |

| By Investment Source | Domestic Institutional Investors Foreign Institutional Investors Multilateral Development Banks Public-Private Partnerships (PPP) |

| By Application | Renewable Energy Infrastructure Green Building Projects Sustainable Transportation Water and Waste Management |

| By Policy Support | Green Finance Guidelines Tax Incentives Subsidies & Grants |

| By Market Maturity | Emerging Markets Established Markets Developing Markets |

| By Risk Profile | Low Risk Medium Risk High Risk |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Sukuk Issuers | 60 | Corporate Finance Managers, Sustainability Officers |

| Institutional Investors | 50 | Portfolio Managers, Investment Analysts |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| Environmental NGOs | 40 | Program Directors, Research Analysts |

| Financial Analysts | 40 | Equity Analysts, Credit Analysts |

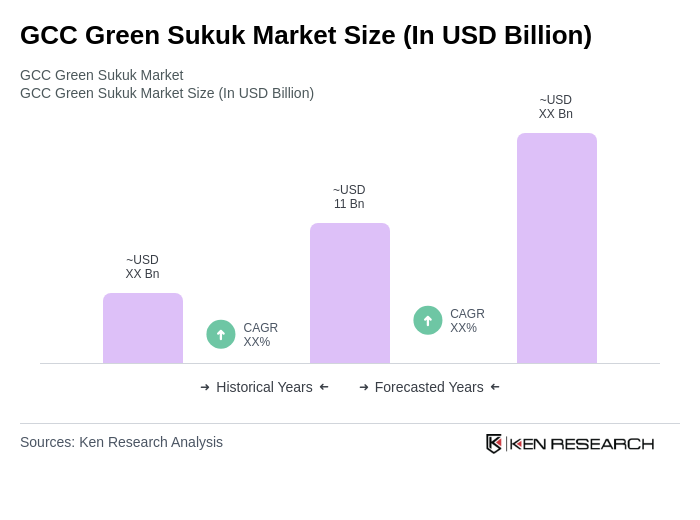

The GCC Green Sukuk Market is valued at approximately USD 11 billion, driven by investments in sustainable infrastructure and government-led green finance initiatives. This growth reflects the region's commitment to economic diversification and international climate commitments.