Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7328

Pages:97

Published On:October 2025

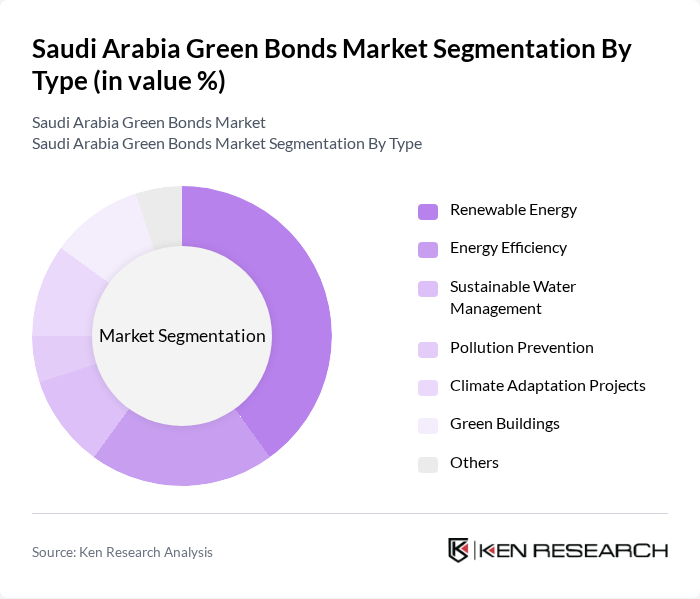

By Type:The market is segmented into various types, including Renewable Energy, Energy Efficiency, Sustainable Water Management, Pollution Prevention, Climate Adaptation Projects, Green Buildings, and Others. Among these, Renewable Energy is the leading sub-segment, driven by the government's focus on solar and wind energy projects. The increasing investments in solar power, particularly in the Neom project, highlight the growing trend towards sustainable energy solutions.

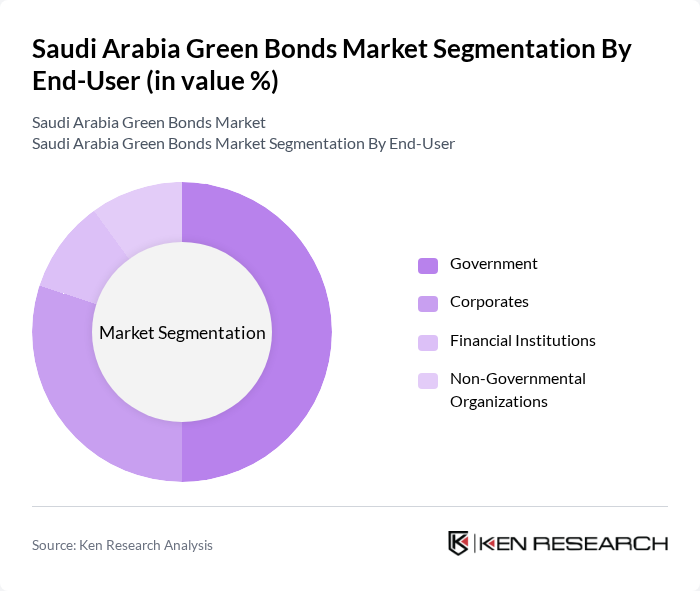

By End-User:The end-user segmentation includes Government, Corporates, Financial Institutions, and Non-Governmental Organizations. The Government sector is the dominant end-user, as it is the primary issuer of green bonds to fund large-scale infrastructure projects. The increasing collaboration between public and private sectors further enhances the market's growth, as corporates are also increasingly participating in green financing initiatives.

The Saudi Arabia Green Bonds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank, Al Rajhi Bank, Samba Financial Group, Arab National Bank, Riyad Bank, Banque Saudi Fransi, Saudi Investment Bank, National Commercial Bank, Gulf International Bank, Alinma Bank, Saudi Electricity Company, Saudi Aramco, ACWA Power, NEOM, Red Sea Global contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia green bonds market is poised for significant growth, driven by increasing government support and rising investor interest in sustainable finance. As the country continues to develop its renewable energy infrastructure, the demand for green financing will likely escalate. Furthermore, the establishment of clearer regulatory frameworks and standards will enhance investor confidence. By future, the market is expected to witness a surge in green bond issuances, reflecting a broader commitment to sustainability and climate resilience in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Renewable Energy Energy Efficiency Sustainable Water Management Pollution Prevention Climate Adaptation Projects Green Buildings Others |

| By End-User | Government Corporates Financial Institutions Non-Governmental Organizations |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Infrastructure Development Urban Development Transportation Projects Renewable Energy Projects |

| By Policy Support | Subsidies Tax Exemptions Regulatory Frameworks Green Certifications |

| By Risk Profile | Low Risk Medium Risk High Risk |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Green Bond Issuers | 100 | CFOs, Treasury Managers, Sustainability Officers |

| Institutional Investors in Green Bonds | 80 | Portfolio Managers, Investment Analysts, ESG Specialists |

| Regulatory Bodies and Policy Makers | 50 | Government Officials, Policy Advisors, Economic Analysts |

| Environmental NGOs and Advocacy Groups | 40 | Program Directors, Research Analysts, Campaign Managers |

| Financial Institutions and Banks | 60 | Investment Bankers, Risk Managers, Compliance Officers |

The Saudi Arabia Green Bonds Market is valued at approximately USD 10 billion, reflecting significant growth driven by the country's commitment to sustainable financing and environmental initiatives as part of its Vision 2030 strategy.