Region:Middle East

Author(s):Shubham

Product Code:KRAC4254

Pages:86

Published On:October 2025

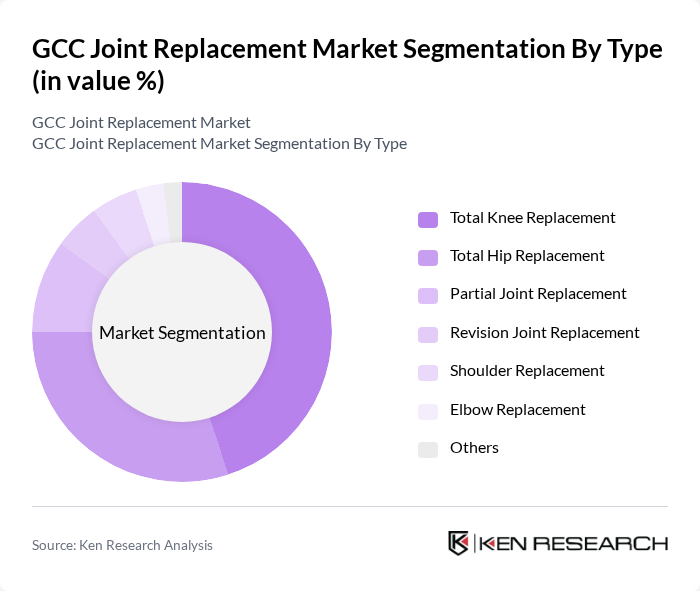

By Type:The market is segmented into various types of joint replacements, including Total Knee Replacement, Total Hip Replacement, Partial Joint Replacement, Revision Joint Replacement, Shoulder Replacement, Elbow Replacement, and Others. Among these, Total Knee Replacement is the most dominant segment due to the high incidence of knee-related disorders and the effectiveness of the procedure in alleviating pain and restoring mobility. The growing awareness of the benefits of knee replacement surgeries has led to increased patient acceptance and demand .

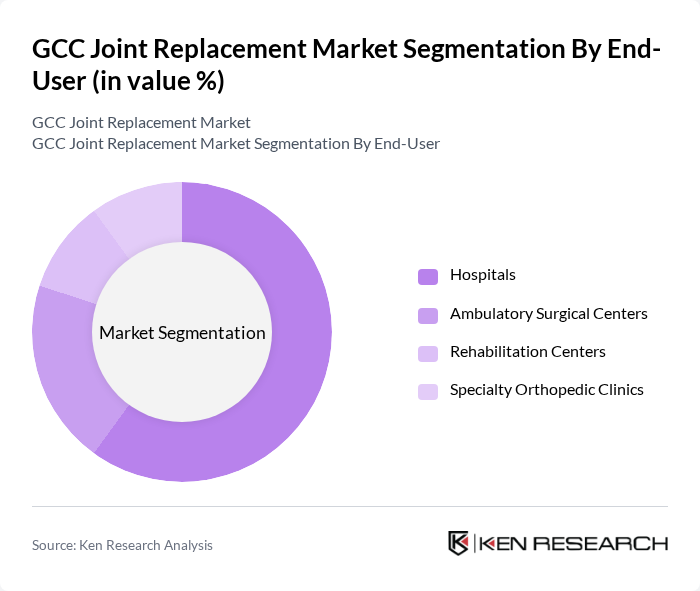

By End-User:The market is categorized by end-users, including Hospitals, Ambulatory Surgical Centers, Rehabilitation Centers, and Specialty Orthopedic Clinics. Hospitals are the leading end-user segment, primarily due to their comprehensive facilities and resources for performing complex joint replacement surgeries. The increasing number of surgical procedures performed in hospitals, coupled with the availability of advanced medical technologies, drives this segment's growth .

The GCC Joint Replacement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet, Smith & Nephew plc, B. Braun Melsungen AG, Arthrex, Inc., Exactech, Inc., Medacta International, LimaCorporate S.p.A., Conformis, Inc., MicroPort Orthopedics, Corin Group, DJO, LLC (Enovis), United Orthopedic Corporation, Aesculap Implant Systems, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC joint replacement market is poised for significant transformation, driven by technological advancements and demographic shifts. As the population ages and orthopedic disorders become more prevalent, healthcare providers are expected to adopt innovative surgical techniques and improve patient care. The integration of telemedicine and digital health solutions will enhance access to orthopedic services, particularly in underserved areas. Furthermore, the focus on personalized medicine will lead to tailored treatment plans, improving patient outcomes and satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Total Knee Replacement Total Hip Replacement Partial Joint Replacement Revision Joint Replacement Shoulder Replacement Elbow Replacement Others |

| By End-User | Hospitals Ambulatory Surgical Centers Rehabilitation Centers Specialty Orthopedic Clinics |

| By Material | Metal-on-Metal Ceramic-on-Ceramic Polyethylene Metal-on-Polyethylene |

| By Age Group | 30 Years 50 Years 70 Years Above 70 Years |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 100 | Surgeons specializing in joint replacement procedures |

| Hospital Administrators | 60 | Decision-makers in hospital procurement and management |

| Patients with Joint Replacements | 120 | Individuals who have undergone joint replacement surgeries |

| Health Insurance Providers | 40 | Executives involved in policy and coverage decisions |

| Medical Device Manufacturers | 50 | Product managers and sales representatives in orthopedic devices |

The GCC Joint Replacement Market is valued at approximately USD 230 million, driven by the rising prevalence of orthopedic disorders, an aging population, and advancements in surgical techniques and technologies.