Region:Global

Author(s):Dev

Product Code:KRAB0356

Pages:92

Published On:August 2025

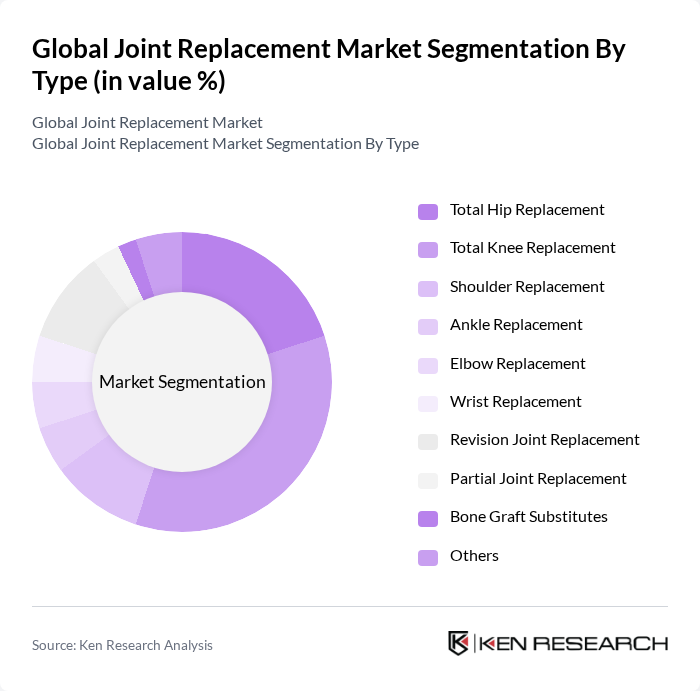

By Type:The market is segmented into various types of joint replacements, including Total Hip Replacement, Total Knee Replacement, Shoulder Replacement, Ankle Replacement, Elbow Replacement, Wrist Replacement, Revision Joint Replacement, Partial Joint Replacement, Bone Graft Substitutes, and Others. Among these, Total Knee Replacement is the most dominant segment due to the high incidence of knee osteoarthritis and the effectiveness of the procedure in alleviating pain and restoring mobility .

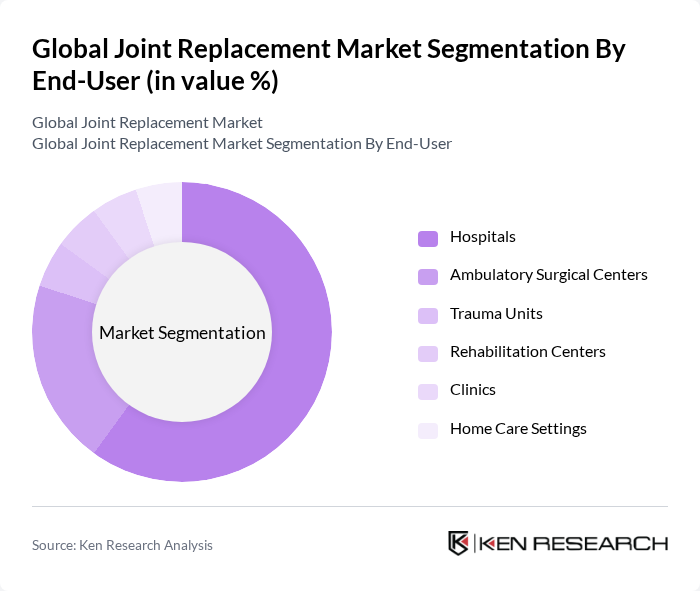

By End-User:The market is segmented by end-users, including Hospitals, Ambulatory Surgical Centers, Trauma Units, Rehabilitation Centers, Clinics, and Home Care Settings. Hospitals are the leading end-user segment, primarily due to their capacity to provide comprehensive surgical services and post-operative care, which are essential for successful joint replacement surgeries .

The Global Joint Replacement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson MedTech (DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, DJO, LLC (Colfax Corporation), Arthrex, Inc., Exactech, Inc., Conformis, Inc., MicroPort Orthopedics Inc., Corin Group, B. Braun Melsungen AG (Aesculap), NuVasive, Inc., Orthofix Medical Inc., LimaCorporate S.p.A., RTI Surgical Holdings, Inc., Conmed Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the joint replacement market appears promising, driven by technological advancements and an increasing focus on patient-centered care. As outpatient surgical models gain traction, more patients will have access to joint replacement procedures, reducing hospital stays and associated costs. Additionally, the integration of telemedicine for post-operative care is expected to enhance patient monitoring and recovery, further supporting market growth. The emphasis on personalized solutions will also cater to diverse patient needs, ensuring better outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Total Hip Replacement Total Knee Replacement Shoulder Replacement Ankle Replacement Elbow Replacement Wrist Replacement Revision Joint Replacement Partial Joint Replacement Bone Graft Substitutes Others |

| By End-User | Hospitals Ambulatory Surgical Centers Trauma Units Rehabilitation Centers Clinics Home Care Settings |

| By Material | Metal Alloys Ceramics Polymers Composite Materials |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Surgical Approach | Open Surgery Minimally Invasive Surgery Robotic-Assisted Surgery |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Premium Mid-Range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 100 | Surgeons specializing in hip and knee replacements |

| Hospital Administrators | 60 | Healthcare executives managing orthopedic departments |

| Patients with Joint Replacements | 80 | Individuals who have undergone joint replacement surgeries |

| Medical Device Manufacturers | 50 | Product managers and R&D leads in orthopedic device companies |

| Health Insurance Providers | 40 | Policy analysts and claims managers in health insurance firms |

The Global Joint Replacement Market is valued at approximately USD 23 billion, driven by factors such as the increasing prevalence of orthopedic disorders, an aging population, and advancements in surgical techniques and implant technologies.