Region:Middle East

Author(s):Rebecca

Product Code:KRAC3299

Pages:81

Published On:October 2025

By Type:The market is segmented into various types of legal technology solutions, including Document Management Systems, E-Billing Solutions, Case Management Software, Contract Lifecycle Management (CLM) Tools, Legal Research Platforms, Compliance & Regulatory Technology Solutions, eDiscovery Solutions, AI-Powered Legal Analytics, and Others. Among these, Document Management Systems and AI-Powered Legal Analytics are gaining significant traction due to their ability to enhance operational efficiency and provide data-driven insights. The adoption of eDiscovery and contract lifecycle management tools is also rising, driven by increasing regulatory scrutiny and the need for faster, more accurate legal processes .

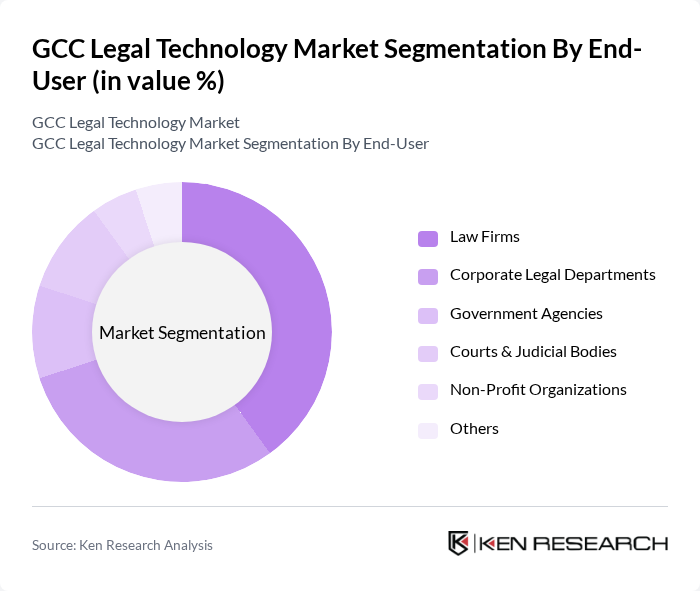

By End-User:The end-user segmentation includes Law Firms, Corporate Legal Departments, Government Agencies, Courts & Judicial Bodies, Non-Profit Organizations, and Others. Law Firms and Corporate Legal Departments are the leading segments, driven by their need for efficient case management and compliance with regulatory standards. Government agencies and courts are increasingly adopting digital case management and e-filing systems, while non-profits and others are leveraging legal tech for document automation and compliance tracking .

The GCC Legal Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thomson Reuters, LexisNexis, iManage, LawGeex, Everlaw, CaseGuard, Fenergo, DocuSign, Quantexa, Refinitiv, Chainalysis, ComplyAdvantage, Trulioo, Amlify, Oracle, IBM, Riskified, Smokeball, PracticePanther, Zola Suite, Rocket Lawyer, MyCase, TimeSolv, ROSS Intelligence, LegalTech Solutions (UAE), Cognitiv+ (regional AI contract analytics), App4Legal (Dubai-based legal tech), Legal Advice Middle East, SmartWay2 (regional workflow automation) contribute to innovation, geographic expansion, and service delivery in this space .

The GCC legal technology market is poised for transformative growth, driven by increasing digitalization and the integration of advanced technologies. As firms adapt to remote legal services and prioritize user experience, the demand for innovative solutions will rise. Additionally, the ongoing support from governments for digital initiatives will further accelerate the adoption of legal tech. This evolving landscape presents opportunities for startups and established firms to collaborate, enhancing service delivery and operational efficiency in the legal sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Document Management Systems E-Billing Solutions Case Management Software Contract Lifecycle Management (CLM) Tools Legal Research Platforms Compliance & Regulatory Technology Solutions eDiscovery Solutions AI-Powered Legal Analytics Others |

| By End-User | Law Firms Corporate Legal Departments Government Agencies Courts & Judicial Bodies Non-Profit Organizations Others |

| By Application | Litigation Support Contract Management Compliance Tracking Legal Research Risk Management Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Law Firm Technology Adoption | 80 | Managing Partners, IT Directors |

| In-house Legal Department Tools | 100 | General Counsel, Legal Operations Managers |

| Legal Tech Startups Insights | 60 | Founders, Product Managers |

| Corporate Legal Technology Usage | 90 | Legal Operations Managers, Procurement Specialists |

| Regulatory Impact on Legal Tech | 70 | Policy Advisors, Legal Consultants |

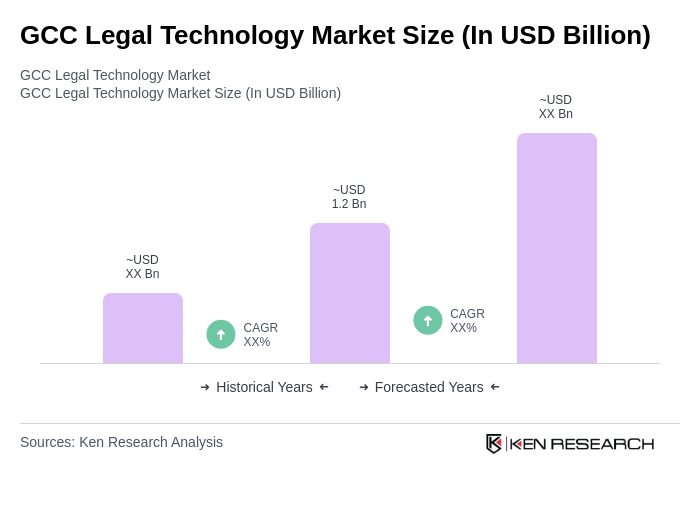

The GCC Legal Technology Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital solutions, efficiency demands, and regulatory compliance across the region, particularly in the UAE and Saudi Arabia.