Region:Middle East

Author(s):Shubham

Product Code:KRAC4344

Pages:88

Published On:October 2025

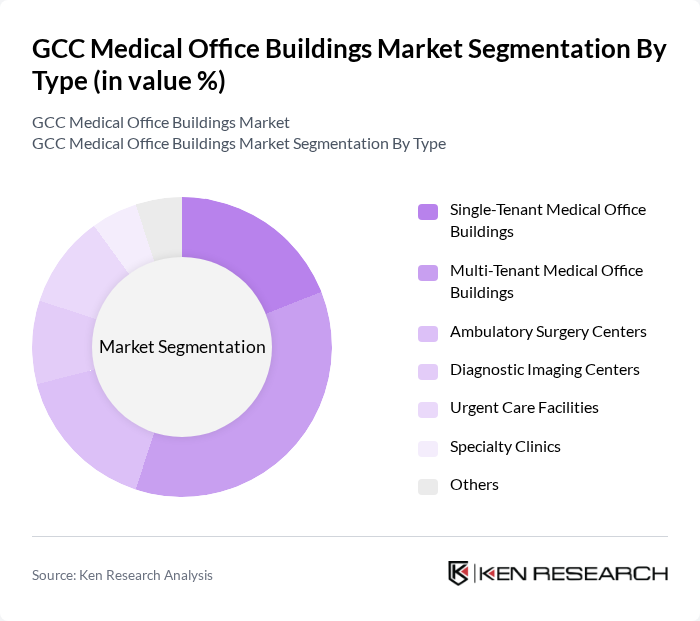

By Type:The market is segmented into various types of medical office buildings, including Single-Tenant Medical Office Buildings, Multi-Tenant Medical Office Buildings, Ambulatory Surgery Centers, Diagnostic Imaging Centers, Urgent Care Facilities, Specialty Clinics, and Others. Among these, Multi-Tenant Medical Office Buildings are currently dominating the market due to their ability to accommodate various healthcare providers under one roof, enhancing patient convenience and operational efficiency. The trend towards integrated healthcare services, telehealth-enabled facilities, and collaborative care models is driving the demand for these buildings, as they allow for shared resources, flexible space utilization, and technology integration .

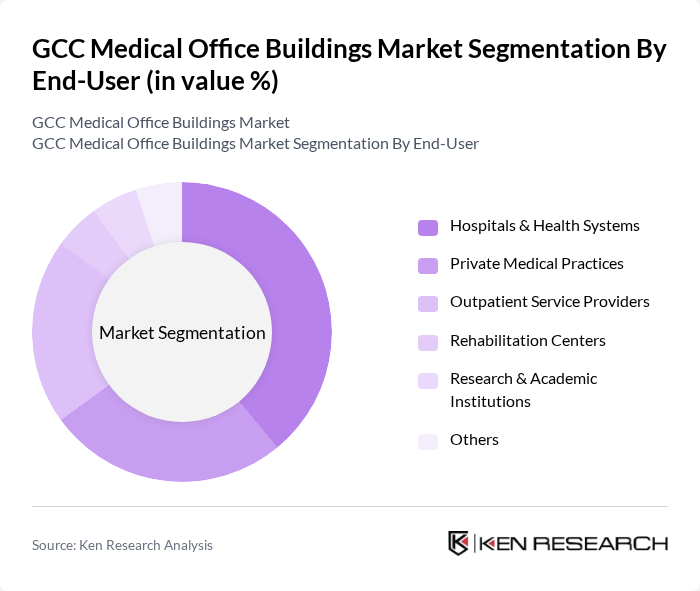

By End-User:The end-user segmentation includes Hospitals & Health Systems, Private Medical Practices, Outpatient Service Providers, Rehabilitation Centers, Research & Academic Institutions, and Others. Hospitals & Health Systems are the leading end-users, as they require extensive medical office space to provide comprehensive healthcare services. The increasing trend of outpatient care, the shift toward value-based care, and the expansion of telemedicine and digital health services are also driving the demand for outpatient service providers, which are becoming increasingly important in the healthcare landscape .

The GCC Medical Office Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mediclinic International, NMC Health, Al Noor Hospitals Group, Saudi German Health, Aster DM Healthcare, Emirates Healthcare Group, Dallah Healthcare Company, Al Habtoor Group, United Eastern Medical Services (UEMedical), Qatar Medical Center, Gulf Medical Projects Company, Al-Futtaim Health, HealthPlus Network of Specialty Centers, Abu Dhabi Health Services Company (SEHA), Mediclinic Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC medical office buildings market appears promising, driven by ongoing government initiatives to enhance healthcare infrastructure and the increasing adoption of innovative technologies. As the region continues to prioritize health services, the demand for modern medical facilities is expected to rise. Furthermore, the shift towards integrated healthcare models and patient-centric care will likely influence the design and functionality of new medical office buildings, ensuring they meet evolving healthcare needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Tenant Medical Office Buildings Multi-Tenant Medical Office Buildings Ambulatory Surgery Centers Diagnostic Imaging Centers Urgent Care Facilities Specialty Clinics Others |

| By End-User | Hospitals & Health Systems Private Medical Practices Outpatient Service Providers Rehabilitation Centers Research & Academic Institutions Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Size | Small (Less than 5,000 sq ft) Medium (5,000 - 15,000 sq ft) Large (More than 15,000 sq ft) |

| By Ownership Model | Owned Leased Joint Ventures Others |

| By Service Type | Primary Care Services Specialty Care Services Diagnostic Services Rehabilitation Services Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Outpatient Medical Facilities | 100 | Facility Managers, Healthcare Administrators |

| Multi-specialty Clinics | 80 | Clinic Owners, Operations Directors |

| Healthcare Real Estate Investment Trusts (REITs) | 50 | Investment Analysts, Portfolio Managers |

| Healthcare Service Providers | 90 | Chief Medical Officers, Practice Managers |

| Construction Firms Specializing in Healthcare | 60 | Project Managers, Business Development Executives |

The GCC Medical Office Buildings Market is valued at approximately USD 13 billion, reflecting a significant growth driven by increasing demand for outpatient healthcare services, chronic disease prevalence, and expanding healthcare infrastructure in the region.