Region:Middle East

Author(s):Rebecca

Product Code:KRAD2778

Pages:100

Published On:November 2025

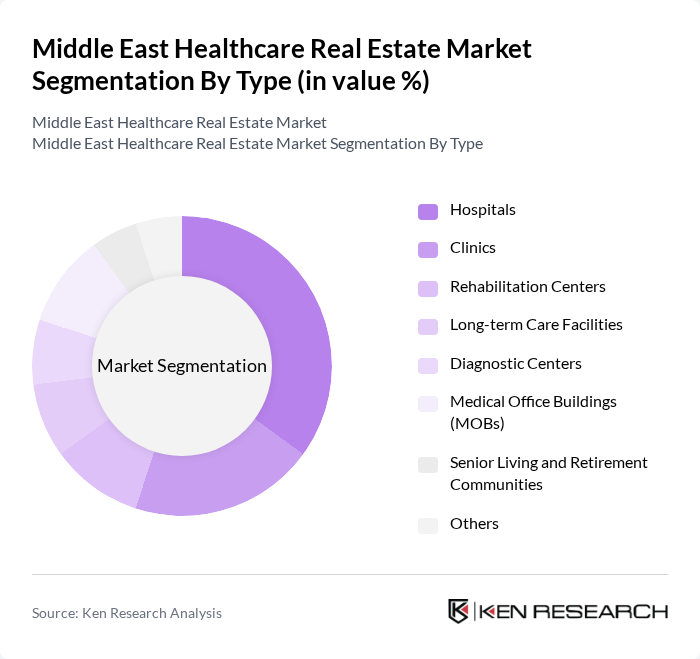

By Type:The market is segmented into various types of healthcare facilities, including hospitals, clinics, rehabilitation centers, long-term care facilities, diagnostic centers, medical office buildings (MOBs), senior living and retirement communities, and others. Each of these segments plays a crucial role in meeting the diverse healthcare needs of the population. Hospitals and clinics represent the largest share, driven by ongoing investments in acute and outpatient care infrastructure. Rehabilitation centers and long-term care facilities are gaining prominence due to the region's aging population and rising prevalence of chronic diseases. Diagnostic centers and medical office buildings are expanding as healthcare delivery models shift toward outpatient and preventive care .

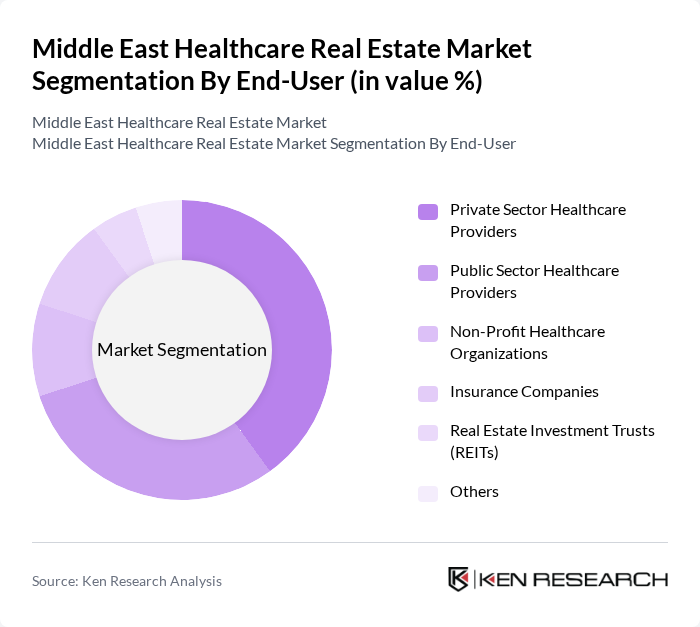

By End-User:The end-user segmentation includes private sector healthcare providers, public sector healthcare providers, non-profit healthcare organizations, insurance companies, real estate investment trusts (REITs), and others. Each of these end-users plays a vital role in the healthcare ecosystem, influencing the demand for healthcare real estate. Private sector providers lead in investment and development of new facilities, while public sector entities focus on expanding access and upgrading existing infrastructure. REITs are increasingly active, attracted by stable returns and long-term lease structures prevalent in healthcare real estate .

The Middle East Healthcare Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mediclinic International, NMC Health, Al Noor Hospitals Group, Saudi German Health, Emirates Healthcare Group, Aster DM Healthcare, Cleveland Clinic Abu Dhabi, Abu Dhabi Health Services Company (SEHA), Hamad Medical Corporation, King Faisal Specialist Hospital & Research Centre, Al Habtoor Group, Life Healthcare Group, Mediclinic Middle East, HealthPlus Network of Specialty Centers, Dallah Healthcare Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East healthcare real estate market appears promising, driven by ongoing government initiatives and a growing emphasis on innovative healthcare solutions. As the region continues to invest in advanced healthcare infrastructure, the integration of technology and patient-centric designs will become increasingly prevalent. Furthermore, the expansion of telemedicine services is expected to reshape healthcare delivery, enhancing accessibility and efficiency. These trends will likely create a dynamic environment for real estate development, fostering growth and attracting international partnerships.

| Segment | Sub-Segments |

|---|---|

| By Type | Hospitals Clinics Rehabilitation Centers Long-term Care Facilities Diagnostic Centers Medical Office Buildings (MOBs) Senior Living and Retirement Communities Others |

| By End-User | Private Sector Healthcare Providers Public Sector Healthcare Providers Non-Profit Healthcare Organizations Insurance Companies Real Estate Investment Trusts (REITs) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, etc.) North Africa (Egypt, Morocco, etc.) Others |

| By Facility Size | Small Facilities (<50 beds or <2,000 sqm) Medium Facilities (50-200 beds or 2,000-10,000 sqm) Large Facilities (>200 beds or >10,000 sqm) Others |

| By Ownership Type | Publicly Owned Privately Owned Joint Ventures REIT-Owned Others |

| By Service Type | Inpatient Services Outpatient Services Emergency Services Specialty Services Wellness and Preventive Care Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Institutional Investors (including REITs, Private Equity) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Development Projects | 100 | Healthcare Facility Managers, Real Estate Developers |

| Outpatient Clinic Expansion | 60 | Clinic Administrators, Healthcare Investors |

| Long-term Care Facilities | 50 | Facility Operators, Policy Makers |

| Healthcare Technology Integration | 40 | IT Managers, Healthcare Consultants |

| Real Estate Investment Trusts (REITs) in Healthcare | 70 | Investment Analysts, Portfolio Managers |

The Middle East Healthcare Real Estate Market is valued at approximately USD 50 billion, driven by increasing healthcare expenditure, a growing population, and the expansion of healthcare facilities across the region.