Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6010

Pages:98

Published On:December 2025

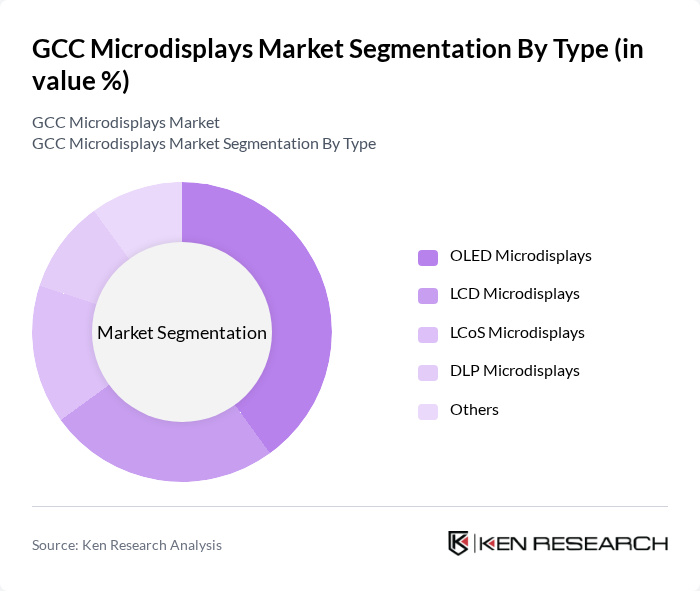

By Type:The microdisplays market can be segmented into various types, including OLED Microdisplays, LCD Microdisplays, LCoS Microdisplays, DLP Microdisplays, and Others. Each type has unique characteristics and applications, catering to different consumer needs and industry requirements.

The OLED Microdisplays segment is currently dominating the market due to their superior color accuracy, contrast ratios, and energy efficiency, which are increasingly important in near?to?eye and wearable applications. This technology is particularly favored in high?end consumer electronics, such as AR/VR headsets and smart glasses, where visual quality is paramount and compact, lightweight form factors are required. The increasing adoption of OLED technology in automotive head?up displays, digital viewfinders, and certain medical and surgical visualization systems further solidifies its leading position in advanced microdisplay applications.

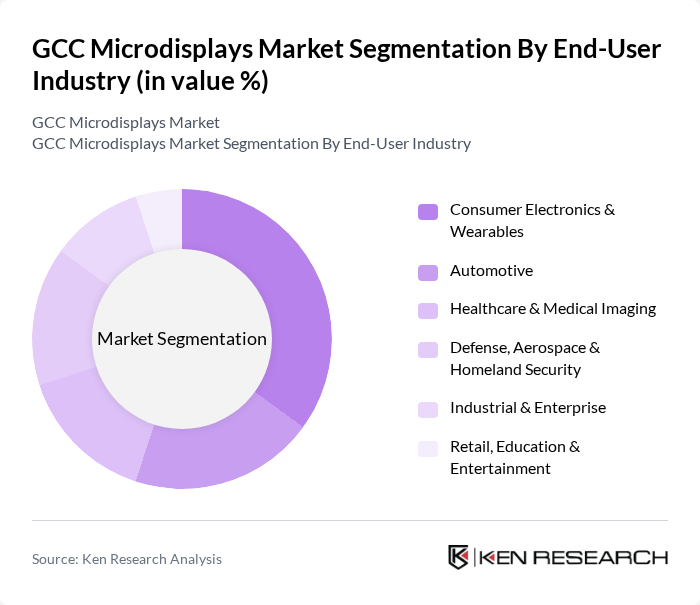

By End-User Industry:The microdisplays market is segmented by end-user industries, including Consumer Electronics & Wearables, Automotive, Healthcare & Medical Imaging, Defense, Aerospace & Homeland Security, Industrial & Enterprise, and Retail, Education & Entertainment. Each industry has distinct requirements and applications for microdisplay technologies, ranging from immersive visualization and head?mounted displays to compact projection and high?brightness information displays.

The Consumer Electronics & Wearables segment leads the market, driven by the growing popularity of AR/VR devices, smart glasses, and head?mounted displays, which are identified globally as the largest application category for microdisplays. The demand for high-quality displays in these products is increasing, as consumers seek immersive experiences with high resolution, wide color gamut, and low latency for gaming, media consumption, and remote collaboration. Additionally, the automotive sector is witnessing a rise in head?up displays, digital instrument clusters, and in?vehicle AR applications, while defense and aerospace users continue to deploy microdisplay?based solutions in night?vision systems, training simulators, and helmet?mounted displays, all of which contribute to the overall growth of the microdisplays market.

The GCC Microdisplays Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Seiko Epson Corporation, Kopin Corporation, Himax Technologies, Inc., eMagin Corporation, Jasper Display Corp. (JDC), BOE Technology Group Co., Ltd., Innolux Corporation, LG Display Co., Ltd., Samsung Display Co., Ltd., JBD (Jade Bird Display), Vuzix Corporation, Magic Leap, Inc., XpertEye (AMA Group), NReal Technology Limited (Xreal) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC microdisplays market appears promising, driven by technological innovations and increasing applications across various sectors. As manufacturers focus on enhancing display quality and reducing costs, the market is expected to witness significant growth. Additionally, the integration of AI technologies in display systems is likely to create new opportunities for product development. With government initiatives supporting technology adoption, the region is poised for a transformative shift in microdisplay applications, particularly in consumer electronics and AR/VR sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | OLED Microdisplays LCD Microdisplays LCoS Microdisplays DLP Microdisplays Others |

| By End-User Industry | Consumer Electronics & Wearables (AR/VR headsets, smart glasses) Automotive (head?up displays, in?vehicle AR displays) Healthcare & Medical Imaging (surgical displays, diagnostics) Defense, Aerospace & Homeland Security (HMDs, training & simulation) Industrial & Enterprise (maintenance, logistics, field services) Retail, Education & Entertainment |

| By Application | Near?to?Eye (AR/VR/MR headsets and smart glasses) Head?Up Displays (automotive and aviation) Projection & Viewfinders Wearable & Portable Devices Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Technology Node | OLED LCD LCoS MicroLED Others |

| By Procurement Model | OEM Supply to Device Manufacturers System Integrators & Solution Providers Direct Enterprise / Government Procurement Distribution & Channel Partners |

| By Price Band (Device?Level) | Entry?Level / Mass?Market Devices Mid?Range Devices Premium / Professional & Defense?Grade Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Microdisplay Applications | 100 | Product Managers, R&D Engineers |

| Consumer Electronics Market | 120 | Marketing Directors, Product Development Managers |

| Healthcare Display Solutions | 80 | Healthcare Technology Specialists, Procurement Officers |

| AR/VR Industry Insights | 90 | Game Developers, UX/UI Designers |

| Smart Wearables Sector | 70 | Product Designers, Market Analysts |

The GCC Microdisplays Market is valued at approximately USD 120 million, reflecting its share within the global microdisplays market, which is in the low-to-mid single-digit percentage range of worldwide revenues.