Region:Middle East

Author(s):Rebecca

Product Code:KRAB7028

Pages:80

Published On:October 2025

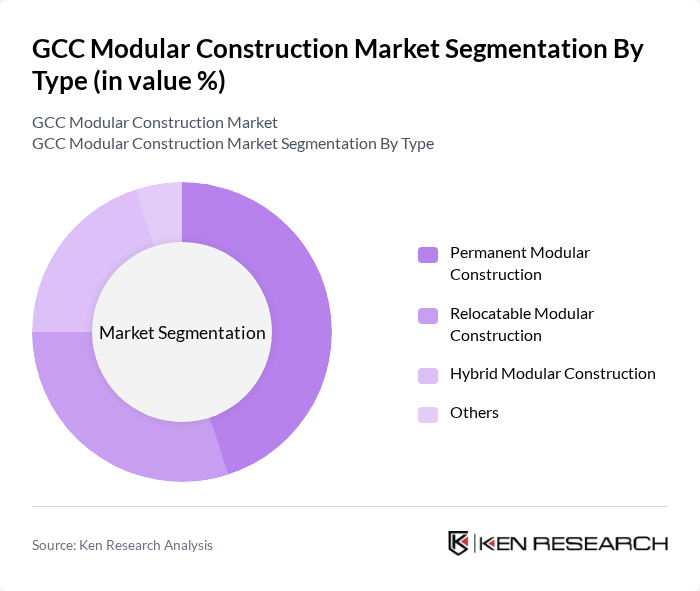

By Type:The market is segmented into Permanent Modular Construction, Relocatable Modular Construction, Hybrid Modular Construction, and Others. Among these, Permanent Modular Construction is gaining traction due to its durability and suitability for permanent structures, while Relocatable Modular Construction is favored for temporary setups and quick relocations. Hybrid Modular Construction combines elements of both, appealing to a diverse range of projects.

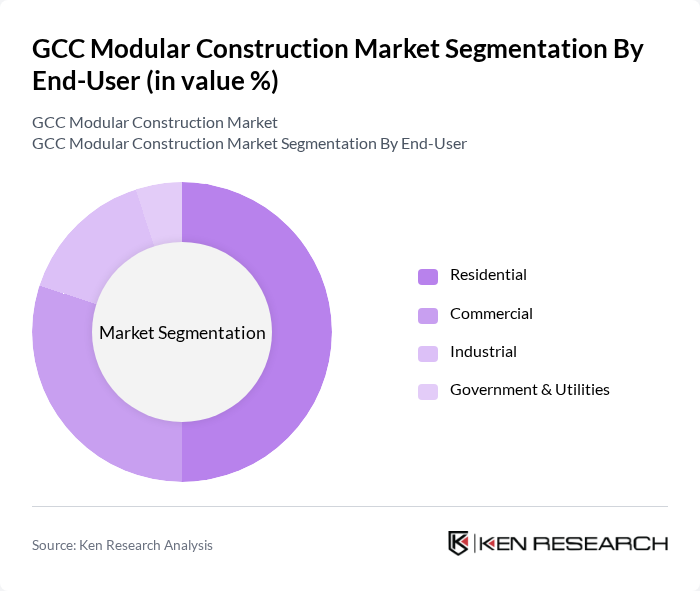

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the largest, driven by the increasing demand for affordable housing solutions. The Commercial segment is also significant, as businesses seek efficient construction methods to reduce costs and time. Industrial applications are growing, particularly in sectors like manufacturing and logistics.

The GCC Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Habtoor Group, Al-Futtaim Group, Al Jaber Group, Katerra, Red Sea International, Al Mufeed Group, Al Shafar General Contracting, Al Nabil Group, Al Maktoum Group, Al Mufeed Construction, Al Meraikhi Group, Al Mufeed Modular, Al Mufeed Engineering, Al Mufeed Development, Al Mufeed Holdings contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC modular construction market appears promising, driven by increasing urbanization and a shift towards sustainable building practices. As governments continue to prioritize infrastructure development, the demand for innovative construction methods will likely rise. Additionally, advancements in technology, such as the integration of IoT and smart building solutions, will enhance operational efficiency and attract further investment. The market is poised for growth as stakeholders recognize the long-term benefits of modular construction in addressing housing shortages and environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Permanent Modular Construction Relocatable Modular Construction Hybrid Modular Construction Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Healthcare Facilities Educational Institutions Hospitality Retail Spaces |

| By Construction Method | Off-site Construction On-site Construction |

| By Material Used | Steel Wood Concrete |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Construction | 100 | Architects, Project Managers |

| Commercial Modular Projects | 80 | Construction Firm Executives, Developers |

| Infrastructure Modular Solutions | 60 | Government Officials, Urban Planners |

| Modular Building Materials Supply | 70 | Suppliers, Procurement Managers |

| Modular Construction Technology | 90 | Technology Providers, R&D Managers |

The GCC Modular Construction Market is valued at approximately USD 15 billion, driven by rapid urbanization, government initiatives for sustainable building practices, and the demand for cost-effective construction solutions.