Region:Middle East

Author(s):Dev

Product Code:KRAD5285

Pages:83

Published On:December 2025

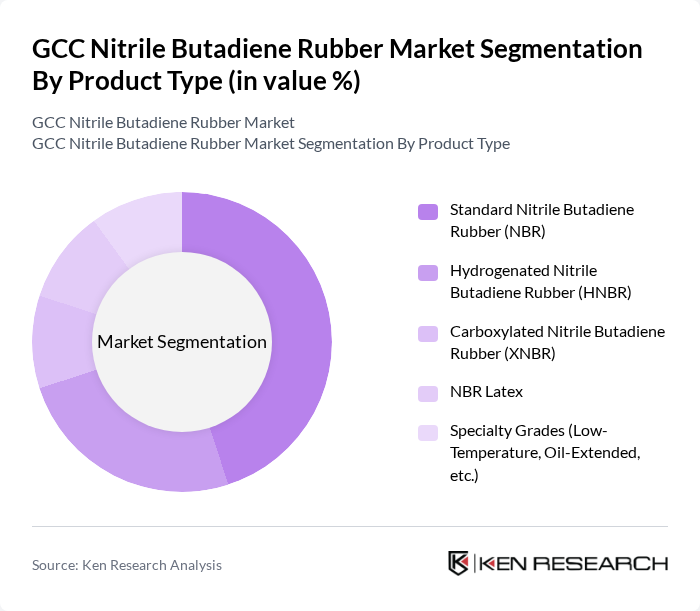

By Product Type:The product type segmentation includes various forms of Nitrile Butadiene Rubber, each catering to specific industrial needs. The subsegments are Standard Nitrile Butadiene Rubber (NBR), Hydrogenated Nitrile Butadiene Rubber (HNBR), Carboxylated Nitrile Butadiene Rubber (XNBR), NBR Latex, and Specialty Grades (Low-Temperature, Oil-Extended, etc.). This structure reflects common industry segmentation, where base NBR, HNBR, XNBR, and NBR latex are distinguished by acrylonitrile content, hydrogenation, and carboxylation level for different performance requirements in oil, fuel, temperature, and abrasion resistance. Among these, Standard Nitrile Butadiene Rubber (NBR) is the most widely used due to its versatility, cost-effectiveness, and broad applicability in automotive seals, hoses, belts, gaskets, and industrial rubber goods.

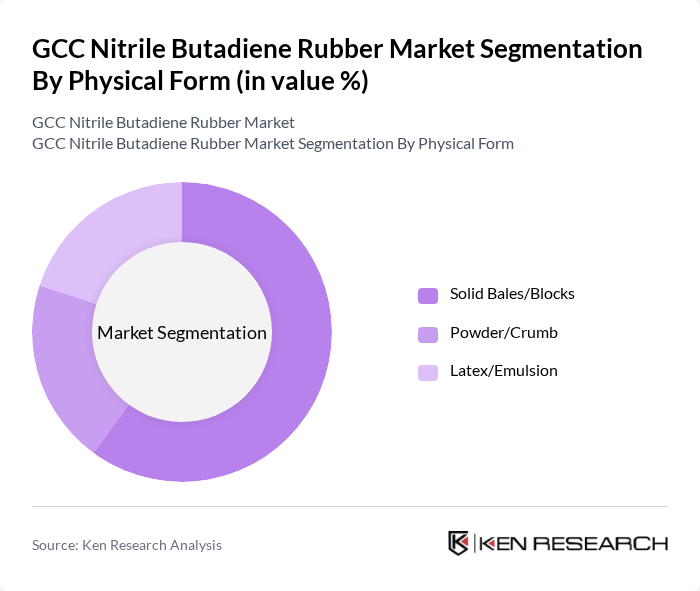

By Physical Form:The physical form segmentation includes Solid Bales/Blocks, Powder/Crumb, and Latex/Emulsion. Solid Bales/Blocks are predominantly used in manufacturing processes for molded, extruded, and calendared rubber parts due to their ease of handling, storage, and suitability for conventional compounding and mixing operations. Powder/Crumb is gaining traction in specialized applications such as friction materials, rubber modification, and blending where improved dispersion and processing are required. Latex/Emulsion is preferred in industries requiring flexibility, film-forming capability, and dip-coating, such as gloves, textiles, foam, and coatings, and has seen steady growth driven by medical and industrial glove demand. Solid Bales/Blocks dominate the market due to their widespread use in diverse industrial and automotive rubber applications and their established processing routes in GCC-based converters.

The GCC Nitrile Butadiene Rubber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Aramco (Including Aramco Performance Materials), Petro Rabigh, Tasnee (National Industrialization Company), Qatar Petroleum (QatarEnergy), Borouge, ADNOC Group (Abu Dhabi National Oil Company), Kuwait Petroleum Corporation (KPC), Oman Oil Company / OQ, Saudi Arabian Amiantit Company, JSR Corporation, Kumho Petrochemical, Lanxess AG, Zeon Corporation, China Petroleum & Chemical Corporation (Sinopec) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC nitrile butadiene rubber market is poised for significant growth, driven by increasing demand from key sectors such as automotive and healthcare. As technological advancements continue to enhance production efficiency, manufacturers are likely to benefit from reduced costs and improved product quality. Additionally, the focus on sustainable practices will shape the market landscape, encouraging innovation and collaboration among industry players. Overall, the market is expected to adapt to evolving consumer needs and regulatory requirements, ensuring a robust growth trajectory.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Standard Nitrile Butadiene Rubber (NBR) Hydrogenated Nitrile Butadiene Rubber (HNBR) Carboxylated Nitrile Butadiene Rubber (XNBR) NBR Latex Specialty Grades (Low-Temperature, Oil-Extended, etc.) |

| By Physical Form | Solid Bales/Blocks Powder/Crumb Latex/Emulsion |

| By Application | Seals, Gaskets, and O-Rings Hoses and Tubing Gloves (Industrial and Medical) Belts, Cables, and Conveyor Components Adhesives, Sealants, and Coatings Foams, Sponge, and Molded Components Others |

| By End-Use Industry | Automotive and Transportation Oil & Gas and Petrochemicals Industrial Machinery & Equipment Construction & Infrastructure Medical & Healthcare Gloves and PPE Manufacturing Consumer Goods and Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Managers, Quality Assurance Engineers |

| Healthcare Sector Usage | 90 | Procurement Managers, Regulatory Affairs Specialists |

| Industrial Applications | 80 | Operations Managers, Supply Chain Analysts |

| Consumer Goods Manufacturing | 70 | Product Development Managers, Marketing Directors |

| Research & Development Insights | 60 | R&D Scientists, Innovation Managers |

The GCC Nitrile Butadiene Rubber market is valued at approximately USD 25 million, based on a five-year historical analysis. This valuation reflects the growing demand from various sectors, including automotive, oil and gas, and healthcare.