Region:Middle East

Author(s):Dev

Product Code:KRAD3263

Pages:99

Published On:November 2025

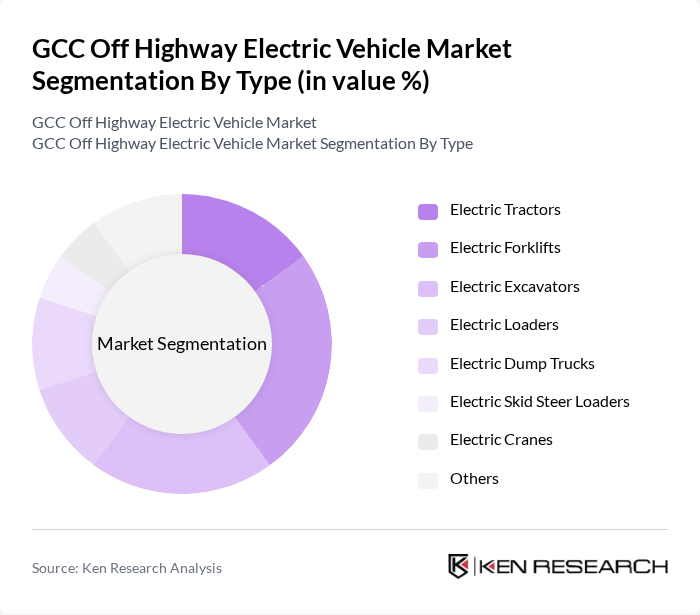

By Type:The market is segmented into various types of electric vehicles, including Electric Tractors, Electric Forklifts, Electric Excavators, Electric Loaders, Electric Dump Trucks, Electric Skid Steer Loaders, Electric Cranes, and Others. Among these, Electric Forklifts and Electric Excavators are leading the market due to their widespread use in logistics and construction, respectively. The demand for these vehicles is driven by the need for efficient material handling and earth-moving operations, which are critical in urban development projects .

By End-User:The end-user segmentation includes Agriculture, Construction, Mining, Logistics and Warehousing, Oil & Gas, and Others. The Construction sector is the dominant end-user, driven by rapid urbanization and infrastructure projects across the GCC region. The increasing focus on sustainability and efficiency in construction operations is propelling the demand for electric vehicles in this sector .

The GCC Off Highway Electric Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Volvo Group, Hitachi Construction Machinery, JCB, Doosan Bobcat Inc., Liebherr Group, Wacker Neuson SE, XCMG Group, SANY Group, CASE Construction Equipment, New Holland Agriculture, Mahindra & Mahindra Ltd., Al-Futtaim Auto & Machinery Company (FAMCO), Al Shirawi Enterprises LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC off-highway electric vehicle market appears promising, driven by increasing government support and technological advancements. By future, the region is expected to see a substantial rise in electric vehicle adoption, with a projected 40% of new vehicle sales being electric. This shift will be bolstered by enhanced charging infrastructure and innovative financing models, making electric vehicles more accessible to a broader audience. The integration of smart technologies will further enhance vehicle efficiency and user experience, paving the way for a sustainable transportation future.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Tractors Electric Forklifts Electric Excavators Electric Loaders Electric Dump Trucks Electric Skid Steer Loaders Electric Cranes Others |

| By End-User | Agriculture Construction Mining Logistics and Warehousing Oil & Gas Others |

| By Application | Material Handling Land Development Waste Management Road Construction Quarrying Others |

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Nickel-metal Hydride Batteries Solid-State Batteries Others |

| By Charging Infrastructure | Fast Charging Stations Standard Charging Stations On-site Charging Solutions Home Charging Solutions Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Local Content Requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Fleet Operators | 60 | Fleet Managers, Operations Directors |

| Agricultural Machinery Users | 50 | Agronomists, Farm Managers |

| Mining Equipment Suppliers | 40 | Procurement Managers, Site Supervisors |

| Logistics and Transportation Companies | 55 | Logistics Coordinators, Fleet Operations Managers |

| Government and Regulatory Bodies | 45 | Policy Makers, Environmental Analysts |

The GCC Off Highway Electric Vehicle Market is valued at approximately USD 260 million, driven by investments in sustainable technologies and government initiatives promoting electric vehicles, particularly in construction and agriculture sectors.