Region:Middle East

Author(s):Dev

Product Code:KRAA9517

Pages:84

Published On:November 2025

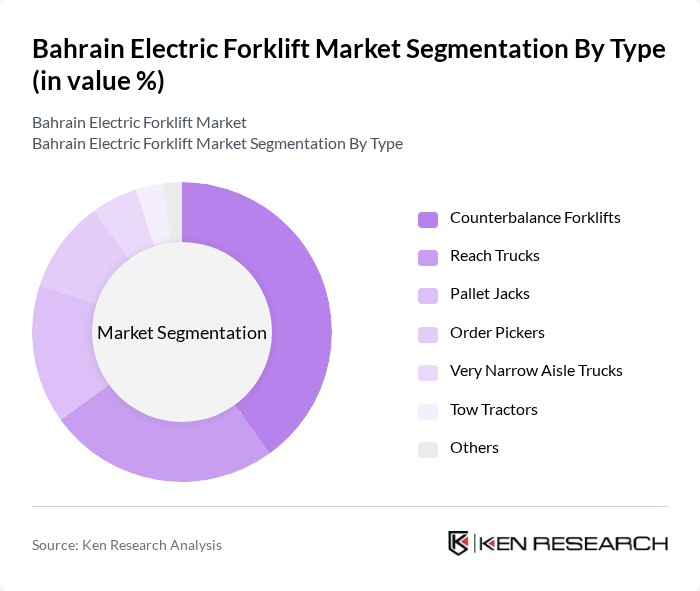

By Type:The electric forklift market is segmented into Counterbalance Forklifts, Reach Trucks, Pallet Jacks, Order Pickers, Very Narrow Aisle Trucks, Tow Tractors, and Others. Each type serves specific operational needs, withCounterbalance Forkliftsremaining the most widely used due to their versatility and ability to handle diverse load requirements. The adoption of lithium-ion powered models is particularly strong in the counterbalance and reach truck categories, driven by the need for longer operational cycles and reduced maintenance .

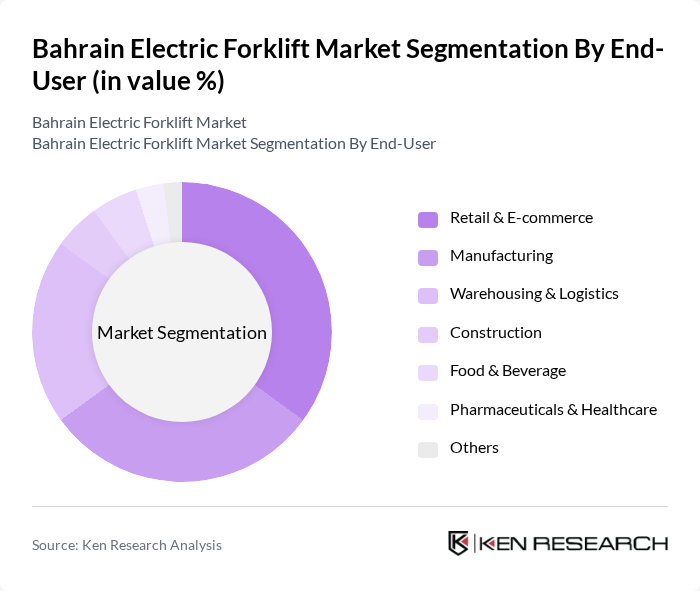

By End-User:The market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing, Warehousing & Logistics, Construction, Food & Beverage, Pharmaceuticals & Healthcare, and Others. TheRetail & E-commercesector is currently the largest end-user, propelled by the rapid expansion of online shopping and the need for efficient inventory management. Manufacturing and warehousing sectors are also experiencing robust demand due to ongoing industrialization and supply chain modernization .

The Bahrain Electric Forklift Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Material Handling, Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Crown Equipment Corporation, Mitsubishi Logisnext Co., Ltd., KION Group AG, Doosan Industrial Vehicle, Clark Material Handling Company, Yale Materials Handling Corporation, Komatsu Ltd., Manitou Group, Hangcha Group Co., Ltd., EP Equipment Co., Ltd., Combilift, Noblelift Intelligent Equipment Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Bahrain electric forklift market appears promising, driven by increasing investments in green technologies and government support for electric vehicle adoption. As businesses prioritize sustainability, the demand for electric forklifts is expected to rise significantly. Additionally, advancements in battery technology and charging infrastructure will likely enhance operational efficiency, making electric forklifts a more attractive option for logistics and warehousing operations in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Counterbalance Forklifts Reach Trucks Pallet Jacks Order Pickers Very Narrow Aisle Trucks Tow Tractors Others |

| By End-User | Retail & E-commerce Manufacturing Warehousing & Logistics Construction Food & Beverage Pharmaceuticals & Healthcare Others |

| By Application | Indoor Operations Outdoor Operations Heavy Lifting Narrow Aisle Operations Cold Storage Others |

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Nickel-metal Hydride Batteries Others |

| By Load Capacity | Below 2,000 kg ,000 kg - 4,000 kg Above 4,000 kg Others |

| By Charging Method | Standard Charging Fast Charging Opportunity Charging Battery Swapping Others |

| By Region | Capital Governorate (Manama) Northern Governorate Southern Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Warehousing Sector | 85 | Logistics Managers, Warehouse Supervisors |

| Manufacturing Industry | 65 | Production Managers, Operations Directors |

| Retail Sector | 55 | Supply Chain Managers, Inventory Control Specialists |

| Construction and Infrastructure | 45 | Site Managers, Equipment Procurement Officers |

| Government and Regulatory Bodies | 40 | Policy Makers, Urban Planning Officials |

The Bahrain Electric Forklift Market is valued at approximately USD 120 million, reflecting a robust growth trajectory driven by increased demand for efficient material handling solutions across various sectors, including manufacturing and logistics.