Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7495

Pages:92

Published On:October 2025

By Type:The market is segmented into various types of baby diapers, including Disposable Diapers, Cloth Diapers, Biodegradable Diapers, Training Pants, Swim Diapers, Overnight Diapers, and Others. Among these, Disposable Diapers are the most popular due to their convenience and ease of use, making them the preferred choice for busy parents. Cloth Diapers, while eco-friendly, have a smaller market share as they require more maintenance. Biodegradable Diapers are gaining traction among environmentally conscious consumers, while Training Pants and Swim Diapers cater to specific needs as children grow.

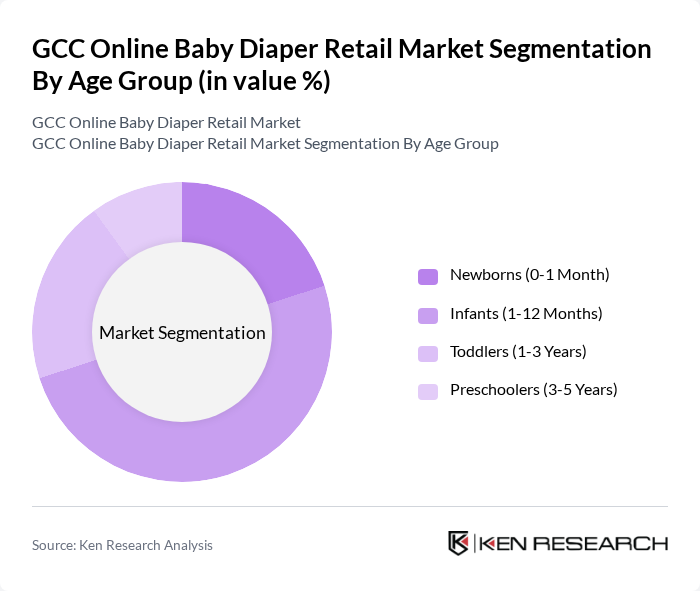

By Age Group:The market is segmented by age group into Newborns (0-1 Month), Infants (1-12 Months), Toddlers (1-3 Years), and Preschoolers (3-5 Years). The Infants segment holds the largest share, driven by the high demand for diapers during the first year of life when babies require frequent changes. The Newborn segment also contributes significantly, as parents tend to purchase specialized diapers for their newborns. The Toddlers and Preschoolers segments are growing as parents seek training pants and swim diapers for their older children.

The GCC Online Baby Diaper Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Kimberly-Clark Corporation, Unicharm Corporation, Huggies (Kimberly-Clark), Pampers (Procter & Gamble), Bambo Nature, Babyganics, Seventh Generation, Molfix, Little Angel, Merries (Kao Corporation), Luvs (Procter & Gamble), Earth + Eden, Naty, Honest Company contribute to innovation, geographic expansion, and service delivery in this space.

The GCC online baby diaper retail market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As parents increasingly seek convenience and quality, the demand for innovative and eco-friendly products is expected to rise. Additionally, the integration of advanced logistics and delivery systems will enhance customer experience, further propelling market expansion. Retailers that adapt to these trends will likely capture a larger share of the market, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Diapers Cloth Diapers Biodegradable Diapers Training Pants Swim Diapers Overnight Diapers Others |

| By Age Group | Newborns (0-1 Month) Infants (1-12 Months) Toddlers (1-3 Years) Preschoolers (3-5 Years) |

| By Sales Channel | E-commerce Websites Mobile Apps Social Media Platforms Direct Sales |

| By Brand | Premium Brands Mid-range Brands Budget Brands |

| By Packaging Type | Single Packs Bulk Packs Subscription Packs |

| By Distribution Mode | Home Delivery Click and Collect In-store Pickup |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Baby Diaper Retailers | 150 | eCommerce Managers, Marketing Directors |

| Parents of Infants and Toddlers | 200 | New Parents, Caregivers |

| Retail Store Managers | 100 | Store Managers, Category Buyers |

| Manufacturers of Baby Products | 80 | Product Development Managers, Sales Executives |

| Market Analysts and Consultants | 50 | Market Analysts, Industry Experts |

The GCC Online Baby Diaper Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing birth rates and the rising popularity of online shopping among parents in the region.