Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7489

Pages:86

Published On:October 2025

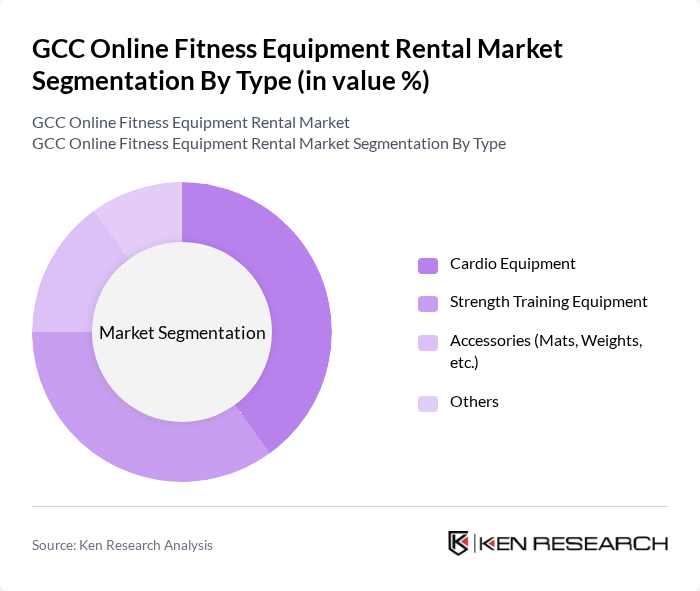

By Type:The market is segmented into various types of fitness equipment, including cardio equipment, strength training equipment, accessories, and others. Cardio equipment, such as treadmills and stationary bikes, is particularly popular due to its effectiveness in promoting cardiovascular health. Strength training equipment, including weights and resistance machines, is also in high demand as consumers increasingly focus on building muscle and overall fitness. Accessories like mats and weights complement these primary categories, catering to diverse fitness needs.

By End-User:The end-user segmentation includes residential users, commercial gyms, corporate offices, and others. Residential users are increasingly opting for rental services to equip their home gyms, driven by the convenience of having fitness equipment at home. Commercial gyms are also significant users, as they often require a variety of equipment to cater to their clientele. Corporate offices are beginning to recognize the importance of employee wellness, leading to a rise in demand for fitness equipment rentals in workplace settings.

The GCC Online Fitness Equipment Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as FitRent, RentMyGym, Gym Equipment Rental Co., Fitness on Demand, HomeFit Rentals, Active Lifestyle Rentals, FlexiFit Rentals, FitBox Rentals, GymShare, Rent-A-Gym, FitFlex, GymBuddy Rentals, HomeGym Solutions, FitRental Hub, Fitness Gear Rentals contribute to innovation, geographic expansion, and service delivery in this space.

The GCC online fitness equipment rental market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As more individuals prioritize health and wellness, the demand for flexible rental options is expected to rise. Additionally, the integration of smart technology into fitness equipment will enhance user experience, making rentals more appealing. Companies that adapt to these trends and focus on customer-centric solutions will likely thrive in this dynamic market landscape, fostering innovation and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | Cardio Equipment Strength Training Equipment Accessories (Mats, Weights, etc.) Others |

| By End-User | Residential Commercial Gyms Corporate Offices Others |

| By Rental Duration | Short-Term Rentals Long-Term Rentals Subscription Models |

| By Pricing Model | Pay-Per-Use Monthly Subscription Annual Subscription |

| By Distribution Channel | Online Platforms Physical Stores Direct Sales |

| By Customer Segment | Fitness Enthusiasts Casual Users Corporate Clients |

| By Region | UAE Saudi Arabia Qatar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Equipment Rental Users | 150 | Fitness Enthusiasts, Casual Users |

| Rental Service Providers | 100 | Business Owners, Operations Managers |

| Fitness Trainers and Coaches | 80 | Personal Trainers, Group Fitness Instructors |

| Health and Fitness Influencers | 60 | Social Media Influencers, Bloggers |

| Market Analysts and Experts | 50 | Industry Analysts, Market Researchers |

The GCC Online Fitness Equipment Rental Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased health consciousness and the rise of home fitness trends, particularly during and after the pandemic.