Region:Middle East

Author(s):Dev

Product Code:KRAC3354

Pages:80

Published On:October 2025

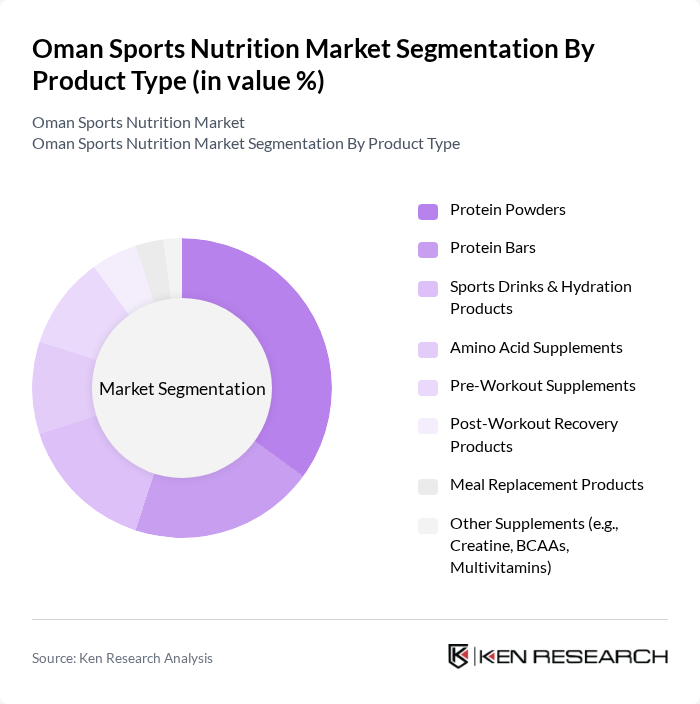

By Product Type:The product type segmentation includes various categories such as protein powders, protein bars, sports drinks, amino acid supplements, pre-workout supplements, post-workout recovery products, meal replacement products, and other supplements. Among these,protein powdersare the most popular due to their versatility and effectiveness in muscle recovery and growth. The increasing trend of fitness and bodybuilding, along with a growing consumer focus on protein-rich diets, has led to a significant rise in the consumption of protein powders, making them a dominant segment in the market .

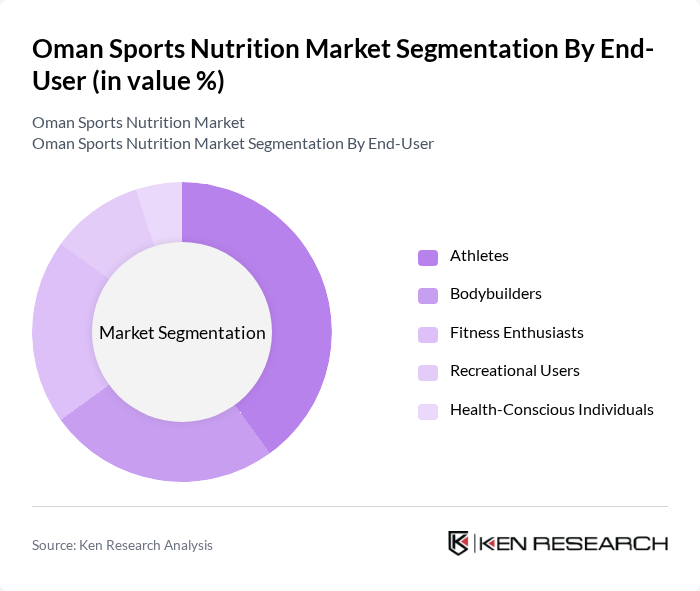

By End-User:The end-user segmentation includes athletes, bodybuilders, fitness enthusiasts, recreational users, and health-conscious individuals.Athletes and bodybuildersrepresent the largest consumer base, driven by their need for enhanced performance and recovery. The growing trend of fitness among the general population, supported by social media and digital fitness platforms, has also led to an increase in demand from fitness enthusiasts and health-conscious individuals, who seek nutritional products to support their active lifestyles .

The Oman Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition (Glanbia Performance Nutrition), BSN (Bio-Engineered Supplements and Nutrition, Inc.), MusclePharm Corporation, Myprotein (The Hut Group), GNC Holdings, LLC, Quest Nutrition (Simply Good Foods Co.), Dymatize Enterprises, LLC, Isagenix International LLC, EAS (Energy Athletic Supplements), Scivation (Xtend), ProMix Nutrition, Vega (Danone S.A.), Kaged Muscle, NutraBio Labs, Inc., Al Manahil Sports (Oman), Muscat Sports (Oman), The Wellness Center Oman, Sun & Sand Sports Oman, Decathlon Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman sports nutrition market is poised for significant growth, driven by increasing health awareness and a shift towards fitness-oriented lifestyles. As more consumers prioritize nutrition, the demand for innovative products will rise. Additionally, the expansion of e-commerce will facilitate easier access to a wider range of sports nutrition products. Companies that adapt to these trends and focus on quality, natural ingredients, and personalized offerings are likely to thrive in this evolving landscape, enhancing their market presence and consumer loyalty.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Protein Powders Protein Bars Sports Drinks & Hydration Products Amino Acid Supplements Pre-Workout Supplements Post-Workout Recovery Products Meal Replacement Products Other Supplements (e.g., Creatine, BCAAs, Multivitamins) |

| By End-User | Athletes Bodybuilders Fitness Enthusiasts Recreational Users Health-Conscious Individuals |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Specialty Nutrition Stores Pharmacies Gyms and Fitness Centers Small Grocery Stores |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bottles Sachets Tubs Cans |

| By Brand Origin | International Brands Regional/Middle East Brands Local Omani Brands |

| By Product Form | Powder Liquid Bars Capsules/Tablets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Professional Athletes | 75 | Elite athletes across various sports disciplines |

| Fitness Enthusiasts | 120 | Regular gym-goers and fitness program participants |

| Nutrition Experts | 45 | Registered dietitians and sports nutritionists |

| Coaches and Trainers | 65 | Fitness trainers and coaches from local sports clubs |

| Health and Wellness Influencers | 50 | Social media influencers focused on health and fitness |

The Oman Sports Nutrition Market is valued at approximately USD 135 million, reflecting a significant growth trend driven by increased health consciousness, fitness activities, and the popularity of sports among the youth.