Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7479

Pages:85

Published On:October 2025

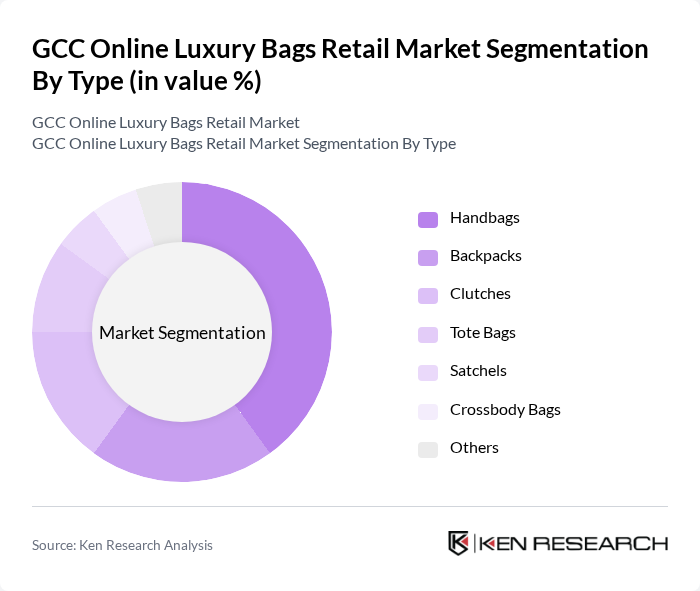

By Type:The market is segmented into various types of luxury bags, including handbags, backpacks, clutches, tote bags, satchels, crossbody bags, and others. Among these, handbags are the most popular choice among consumers, driven by their versatility and status as a fashion statement. Backpacks and tote bags are also gaining traction, particularly among younger consumers who prioritize functionality alongside style.

By Brand:The market is also segmented by brand, including established luxury brands, emerging designers, high-street collaborations, and niche luxury brands. Established luxury brands dominate the market due to their strong brand equity and loyal customer base. Emerging designers are gaining popularity, particularly among younger consumers seeking unique and innovative designs.

The GCC Online Luxury Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Chanel, Prada, Hermès, Burberry, Fendi, Balenciaga, Valentino, Bottega Veneta, Celine, Salvatore Ferragamo, Givenchy, Dolce & Gabbana, Michael Kors contribute to innovation, geographic expansion, and service delivery in this space.

The GCC online luxury bags market is poised for substantial growth, driven by evolving consumer preferences and technological advancements. As digital shopping becomes increasingly prevalent, brands are expected to enhance their online presence and customer engagement strategies. Additionally, the integration of augmented reality and virtual try-ons will likely reshape the shopping experience, making it more interactive. Sustainability will also play a crucial role, as consumers demand eco-friendly luxury options, prompting brands to innovate and adapt to these changing dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Handbags Backpacks Clutches Tote Bags Satchels Crossbody Bags Others |

| By Brand | Established Luxury Brands Emerging Designers High-Street Collaborations Niche Luxury Brands |

| By Price Range | Under $500 $500 - $1000 $1000 - $2000 Above $2000 |

| By Sales Channel | Brand Websites E-commerce Marketplaces Social Media Platforms Luxury Retailers |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level |

| By Occasion | Everyday Use Special Events Gifting |

| By Material | Leather Synthetic Fabric Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Bag Retailers | 100 | Retail Managers, Brand Executives |

| Affluent Consumers | 150 | High-Income Individuals, Luxury Shoppers |

| Fashion Influencers | 50 | Social Media Influencers, Fashion Bloggers |

| E-commerce Platforms | 80 | eCommerce Managers, Digital Marketing Heads |

| Market Analysts | 30 | Industry Analysts, Research Consultants |

The GCC Online Luxury Bags Retail Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increasing disposable incomes and a shift towards online shopping among consumers, particularly millennials and Gen Z.