Region:Middle East

Author(s):Shubham

Product Code:KRAB8243

Pages:85

Published On:October 2025

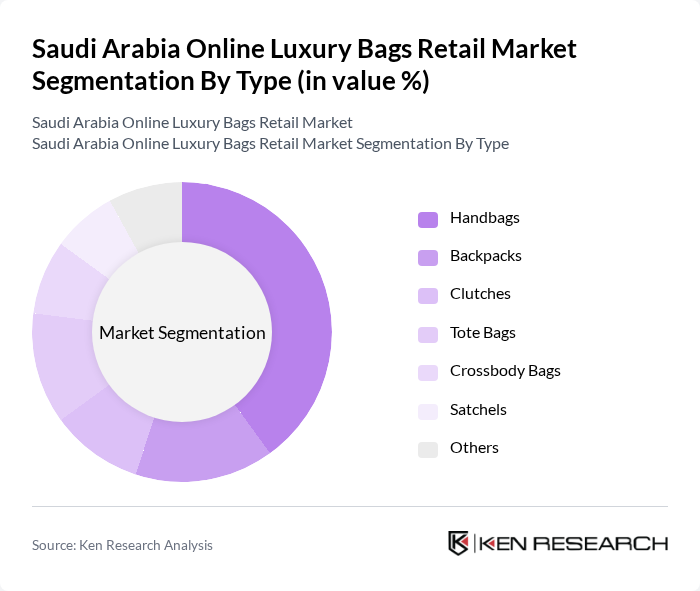

By Type:The market is segmented into various types of luxury bags, including handbags, backpacks, clutches, tote bags, crossbody bags, satchels, and others. Among these, handbags are the most popular choice among consumers, driven by their versatility and status as a fashion statement. The increasing trend of personalization and customization in handbags has further fueled their demand, making them a dominant segment in the market.

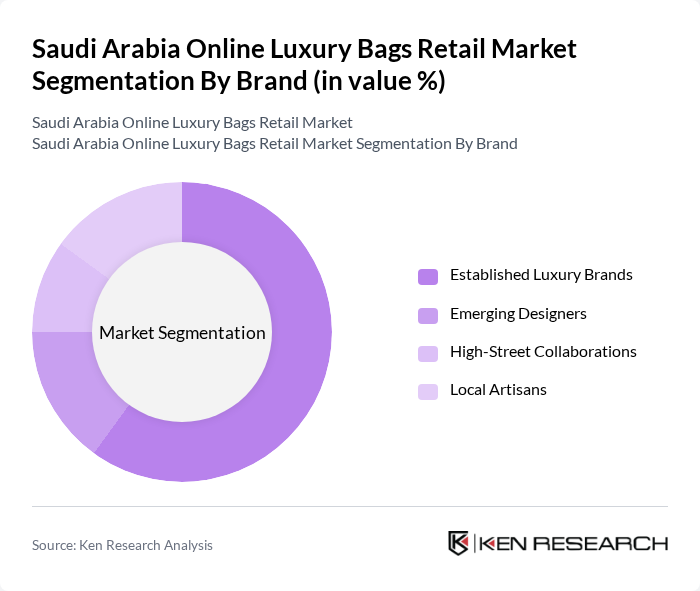

By Brand:The market is also segmented by brand, including established luxury brands, emerging designers, high-street collaborations, and local artisans. Established luxury brands dominate the market due to their strong brand equity and consumer loyalty. These brands are often associated with high quality and exclusivity, which appeals to affluent consumers looking for status symbols.

The Saudi Arabia Online Luxury Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain, Ounass, Namshi, Farfetch, Bloomingdale's, Saks Fifth Avenue, Harvey Nichols, LuisaViaRoma, The Luxury Closet, Moda Operandi, 6thStreet, Elabelz, Shopbop, Net-a-Porter, Mytheresa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online luxury bags retail market in Saudi Arabia appears promising, driven by increasing digital penetration and evolving consumer preferences. As more consumers embrace online shopping, brands are likely to invest in enhancing their digital presence and customer engagement strategies. Additionally, the integration of advanced technologies, such as artificial intelligence and virtual reality, will further enrich the shopping experience, making it more personalized and immersive for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Handbags Backpacks Clutches Tote Bags Crossbody Bags Satchels Others |

| By Brand | Established Luxury Brands Emerging Designers High-Street Collaborations Local Artisans |

| By Price Range | Below SAR 1,000 SAR 1,000 - SAR 3,000 SAR 3,000 - SAR 5,000 Above SAR 5,000 |

| By Sales Channel | Brand Websites E-commerce Marketplaces Social Media Platforms Mobile Apps |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender (Male, Female) Income Level (Low, Middle, High) |

| By Occasion | Everyday Use Special Occasions Gifting |

| By Material | Leather Synthetic Fabric Eco-friendly Materials |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Bag Retail Insights | 150 | Brand Managers, E-commerce Directors |

| Consumer Preferences in Luxury Bags | 200 | Affluent Consumers, Luxury Shoppers |

| Market Trends and Growth Drivers | 100 | Industry Analysts, Market Researchers |

| Online Shopping Behavior | 120 | Frequent Online Shoppers, E-commerce Users |

| Brand Perception Studies | 80 | Luxury Bag Enthusiasts, Fashion Influencers |

The Saudi Arabia Online Luxury Bags Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing disposable incomes and a rising preference for luxury goods among consumers.