GCC Online Luxury Cosmetics Market Overview

- The GCC Online Luxury Cosmetics Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising trend in online shopping, and a growing demand for premium beauty products among consumers. The market has seen a significant shift towards e-commerce platforms, which have made luxury cosmetics more accessible to a broader audience.

- Key players in this market include the United Arab Emirates and Saudi Arabia, which dominate due to their affluent populations and high consumer spending on luxury goods. The UAE, particularly Dubai, serves as a major retail hub, attracting international brands and consumers alike, while Saudi Arabia's expanding e-commerce infrastructure supports the growth of online luxury cosmetics.

- In 2023, the GCC government implemented regulations to enhance consumer protection in online shopping, mandating that all e-commerce platforms must provide clear product information and secure payment options. This initiative aims to build consumer trust and encourage more online purchases in the luxury cosmetics sector.

GCC Online Luxury Cosmetics Market Segmentation

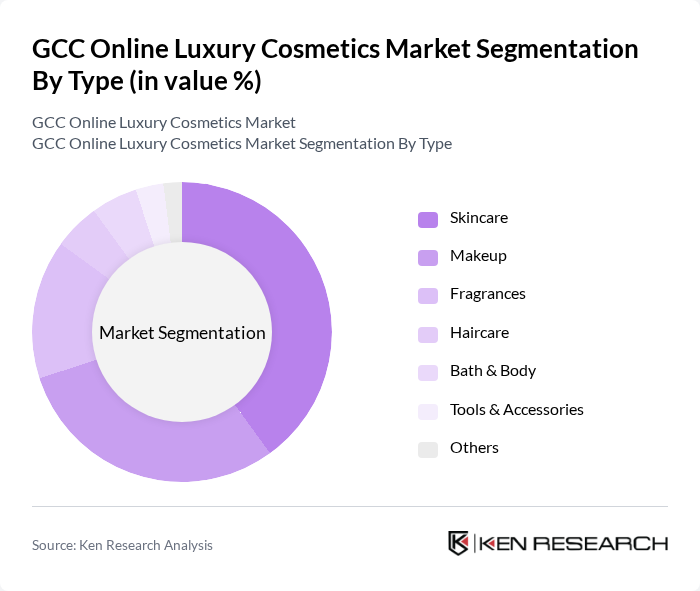

By Type:The market is segmented into various types of luxury cosmetics, including skincare, makeup, fragrances, haircare, bath & body, tools & accessories, and others. Among these, skincare products dominate the market due to the increasing consumer awareness regarding skin health and the rising popularity of natural and organic ingredients. Makeup products also hold a significant share, driven by social media trends and influencer marketing, which encourage consumers to experiment with new looks.

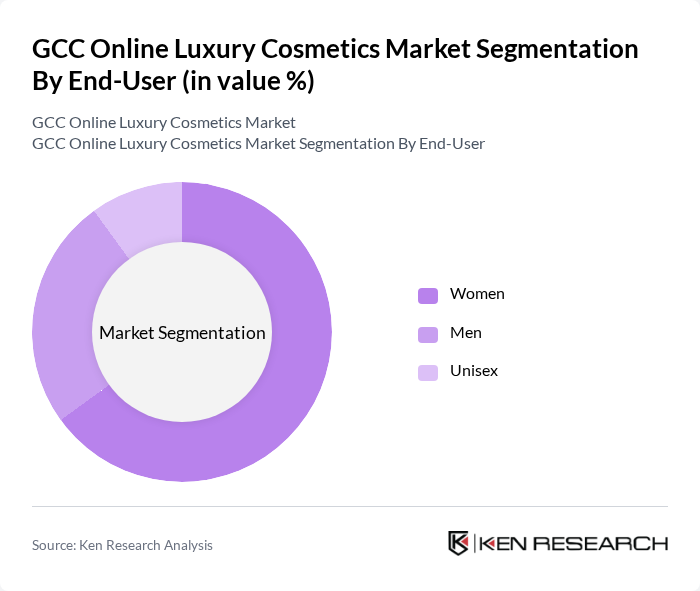

By End-User:The end-user segmentation includes women, men, and unisex products. Women represent the largest segment, driven by a strong inclination towards beauty and skincare routines. The male grooming segment is also witnessing growth, as more men are becoming conscious of their appearance and investing in luxury cosmetics. Unisex products are gaining traction, appealing to a broader audience seeking inclusive beauty solutions.

GCC Online Luxury Cosmetics Market Competitive Landscape

The GCC Online Luxury Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oreal Group, Estée Lauder Companies Inc., Shiseido Company, Limited, Coty Inc., Procter & Gamble Co., Chanel S.A., Dior (Christian Dior SE), Gucci (Kering S.A.), Givenchy (LVMH Moët Hennessy Louis Vuitton), Fenty Beauty (Kendo Holdings, Inc.), Huda Beauty, Anastasia Beverly Hills, NARS Cosmetics, Urban Decay (L'Oréal Group), Charlotte Tilbury Beauty Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

GCC Online Luxury Cosmetics Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The GCC region has witnessed a significant rise in disposable income, with average household income projected to reach $70,000 in future. This increase allows consumers to allocate more funds towards luxury cosmetics, driving demand. According to the World Bank, the GDP per capita in the GCC is expected to grow by 4.2% annually, further enhancing purchasing power and enabling consumers to invest in premium beauty products.

- Rising Demand for Premium Beauty Products:The luxury cosmetics segment in the GCC is experiencing robust growth, with sales expected to exceed $3 billion in future. This surge is attributed to changing consumer preferences, as 75% of consumers are now prioritizing quality over price. The increasing awareness of skincare and beauty trends has led to a heightened interest in premium products, further propelling market growth in the region.

- Growth of E-commerce Platforms:E-commerce in the GCC is projected to reach $35 billion in future, with online luxury cosmetics sales contributing significantly to this figure. The convenience of online shopping, coupled with the rise of digital payment solutions, has made luxury cosmetics more accessible. A report by Statista indicates that 50% of consumers in the region prefer purchasing beauty products online, highlighting the importance of e-commerce in driving market expansion.

Market Challenges

- Intense Competition Among Brands:The GCC online luxury cosmetics market is characterized by fierce competition, with over 250 brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, making it challenging for new entrants to establish themselves. According to industry reports, the top five brands account for only 28% of the market, indicating a fragmented landscape that complicates brand positioning.

- Regulatory Hurdles in Product Approvals:Navigating the regulatory landscape in the GCC can be complex, with stringent product approval processes that can take up to 10 months. Brands must comply with local regulations, including safety standards and labeling requirements, which can delay market entry. The Gulf Cooperation Council (GCC) has implemented various regulations that require thorough testing and documentation, posing a significant challenge for luxury cosmetics brands.

GCC Online Luxury Cosmetics Market Future Outlook

The GCC online luxury cosmetics market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As digital platforms become increasingly sophisticated, brands are expected to leverage data analytics to enhance customer experiences. Additionally, the integration of augmented reality (AR) in online shopping will likely transform how consumers interact with products. Sustainability will also play a crucial role, as consumers demand eco-friendly options, prompting brands to innovate and adapt to these changing dynamics.

Market Opportunities

- Expansion into Untapped Markets:There is significant potential for luxury cosmetics brands to expand into underserved markets within the GCC, such as Oman and Bahrain. With a combined population of over 5 million and increasing disposable incomes, these markets present lucrative opportunities for growth. Targeting these regions can enhance brand visibility and capture new customer segments.

- Collaborations with Local Influencers:Partnering with local influencers can significantly enhance brand reach and credibility in the GCC. With over 85% of consumers influenced by social media recommendations, brands that engage with popular local figures can effectively tap into their followers. This strategy not only boosts brand awareness but also fosters trust among potential customers, driving sales and market penetration.