Region:Middle East

Author(s):Shubham

Product Code:KRAB7589

Pages:89

Published On:October 2025

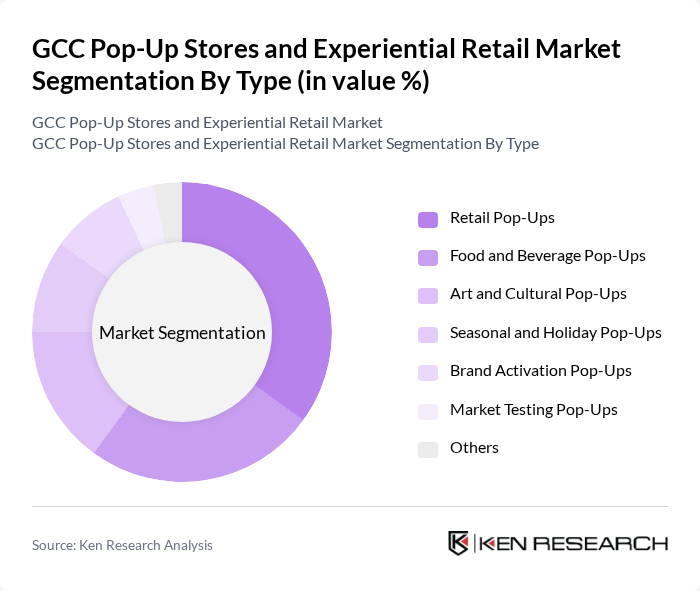

By Type:The market is segmented into various types of pop-up stores, including Retail Pop-Ups, Food and Beverage Pop-Ups, Art and Cultural Pop-Ups, Seasonal and Holiday Pop-Ups, Brand Activation Pop-Ups, Market Testing Pop-Ups, and Others. Among these, Retail Pop-Ups are currently dominating the market due to their ability to create immersive shopping experiences that attract consumers looking for novelty and exclusivity. Food and Beverage Pop-Ups are also gaining traction, driven by the growing trend of food tourism and the desire for unique culinary experiences.

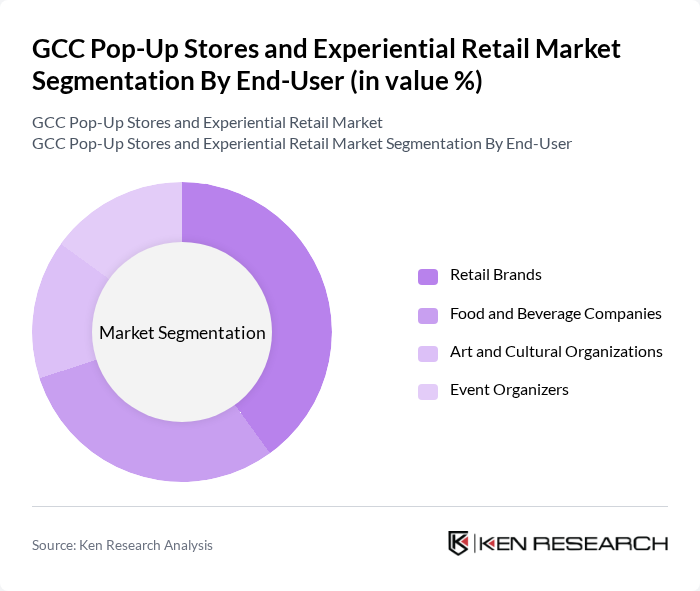

By End-User:The end-user segmentation includes Retail Brands, Food and Beverage Companies, Art and Cultural Organizations, and Event Organizers. Retail Brands are the leading end-users, leveraging pop-up stores to enhance brand visibility and engage directly with consumers. Food and Beverage Companies are also significant players, utilizing pop-up formats to introduce new products and create buzz around their offerings. Art and Cultural Organizations are increasingly adopting pop-up strategies to promote events and exhibitions, while Event Organizers use these spaces to enhance attendee experiences.

The GCC Pop-Up Stores and Experiential Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Majid Al Futtaim, Landmark Group, Chalhoub Group, Al Tayer Group, Emaar Properties, Al Habtoor Group, Dubai Holding, Al Ghurair Group, Jashanmal Group, Al Shaya Group, Azadea Group, M.H. Alshaya Co., Gulf Marketing Group, Al Jaber Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC pop-up stores and experiential retail market appears promising, driven by evolving consumer preferences and technological advancements. As brands increasingly leverage digital platforms for marketing, the integration of augmented reality and virtual experiences is expected to enhance customer engagement. Furthermore, the growing emphasis on sustainability will likely lead to innovative retail practices, fostering a more responsible consumer culture. This dynamic environment presents opportunities for brands to differentiate themselves and capture market share effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Pop-Ups Food and Beverage Pop-Ups Art and Cultural Pop-Ups Seasonal and Holiday Pop-Ups Brand Activation Pop-Ups Market Testing Pop-Ups Others |

| By End-User | Retail Brands Food and Beverage Companies Art and Cultural Organizations Event Organizers |

| By Sales Channel | Direct Sales Online Sales Third-Party Retailers Event Partnerships |

| By Location | Urban Centers Shopping Malls Festivals and Events Temporary Venues |

| By Duration | Short-Term (Less than 3 months) Medium-Term (3 to 6 months) Long-Term (More than 6 months) |

| By Consumer Demographics | Age Groups Income Levels Lifestyle Segments |

| By Marketing Strategy | Social Media Campaigns Influencer Collaborations Experiential Marketing Traditional Advertising |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pop-Up Store Executives | 100 | Brand Managers, Retail Directors |

| Consumer Engagement in Experiential Retail | 150 | Frequent Shoppers, Event Attendees |

| Marketing Professionals in Retail | 80 | Marketing Managers, Digital Strategists |

| Real Estate Developers for Retail Spaces | 60 | Property Managers, Leasing Agents |

| Tourism Impact on Retail | 70 | Tourism Operators, Travel Agency Managers |

The GCC Pop-Up Stores and Experiential Retail Market is valued at approximately USD 1.2 billion, reflecting a growing demand for unique shopping experiences and innovative consumer engagement strategies across the region.