Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4542

Pages:93

Published On:October 2025

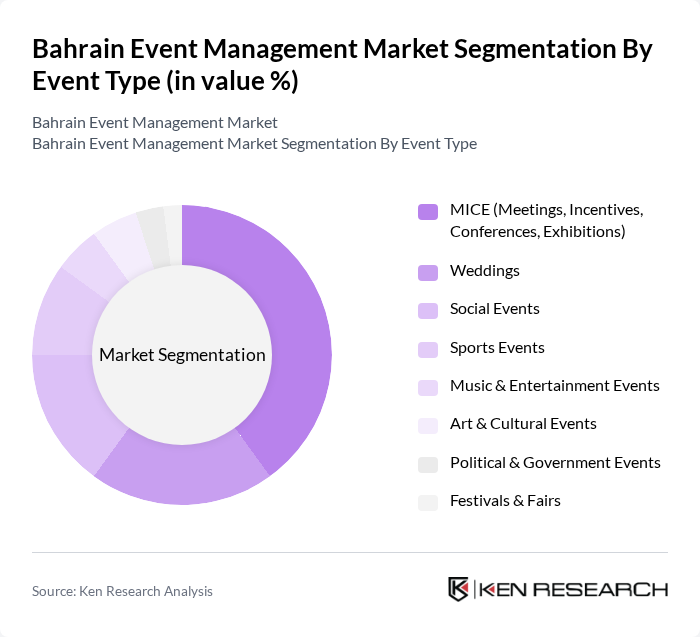

By Event Type:The event management market in Bahrain is segmented into various types, includingMICE (Meetings, Incentives, Conferences, Exhibitions), Weddings, Social Events, Sports Events, Music & Entertainment Events, Art & Cultural Events, Political & Government Events, and Festivals & Fairs. Among these,MICE events dominate the marketdue to Bahrain's strategic location and its growing reputation as a business hub in the Gulf region. Demand for corporate meetings and exhibitions has surged, driven by the influx of international businesses and organizations seeking to establish a presence in the region. The rise of hybrid and virtual event formats is also notable, catering to both local and international audiences and expanding the reach of traditional event types.

By Service Type:The service types in the Bahrain event management market includeEvent Planning & Coordination, Event Production & Technical Services, Event Marketing & Promotion, Venue Sourcing & Logistic Management, Registration, Ticketing, & Attendee Management, Catering Services, and Audio-Visual Services.Event Planning & Coordinationis the leading service type, as it encompasses the comprehensive management of events from inception to execution, ensuring that all aspects are seamlessly integrated to meet client expectations. The adoption of event management software, digital ticketing, and data-driven attendee engagement tools is rising, reflecting the market’s focus on efficiency and personalized experiences.

The Bahrain Event Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain International Exhibition & Convention Centre (BIECC), Bahrain Tourism and Exhibitions Authority (BTEA), ART Rotana Amwaj Islands Bahrain, The Ritz-Carlton, Bahrain, Four Seasons Hotel Bahrain Bay, The Diplomat Radisson Blu Hotel, Residence & Spa, Gulf Conventions, Bahrain International Circuit, Coral Bay Resort, Downtown Rotana Manama, Al Areen Palace & Spa by Accor, Swiss-Belhotel Seef Bahrain, Crowne Plaza Bahrain, InterContinental Regency Bahrain, Sofitel Bahrain Zallaq Thalassa Sea & Spa contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain event management market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As virtual and hybrid events gain traction, planners are expected to adopt innovative solutions to enhance engagement and reach broader audiences. Additionally, the emphasis on sustainability will shape event planning strategies, with a focus on eco-friendly practices. These trends indicate a dynamic future, where adaptability and creativity will be crucial for success in the competitive landscape of event management.

| Segment | Sub-Segments |

|---|---|

| By Event Type | MICE (Meetings, Incentives, Conferences, Exhibitions) Weddings Social Events Sports Events Music & Entertainment Events Art & Cultural Events Political & Government Events Festivals & Fairs |

| By Service Type | Event Planning & Coordination Event Production & Technical Services Event Marketing & Promotion Venue Sourcing & Logistic Management Registration, Ticketing, & Attendee Management Catering Services Audio-Visual Services |

| By Delivery Mode | In-Person Events Virtual Events Hybrid Events |

| By End-User | Corporate Individual Public/Government Non-Profit Organizations Educational Institutions |

| By Venue Type | Hotels & Conference Centers Exhibition Halls & Convention Centers Outdoor Venues Sports & Entertainment Venues Virtual Platforms |

| By Revenue Source | Ticket Sales Sponsorship Service Fees Other Revenue Sources |

| By Audience Size | Small Events (1-50 attendees) Medium Events (51-200 attendees) Large Events (201-500 attendees) Mega Events (500+ attendees) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Management | 65 | Event Managers, Corporate Executives |

| Wedding and Social Events | 50 | Wedding Planners, Venue Owners |

| Cultural and Festival Events | 45 | Event Coordinators, Cultural Affairs Officers |

| Exhibitions and Trade Shows | 60 | Exhibition Managers, Marketing Directors |

| Virtual and Hybrid Events | 40 | Technology Providers, Event Technicians |

The Bahrain Event Management Market is valued at approximately USD 650 million, reflecting a robust growth trajectory driven by an increase in corporate events, exhibitions, and social gatherings, alongside a thriving tourism sector.