Region:Middle East

Author(s):Rebecca

Product Code:KRAB8360

Pages:86

Published On:October 2025

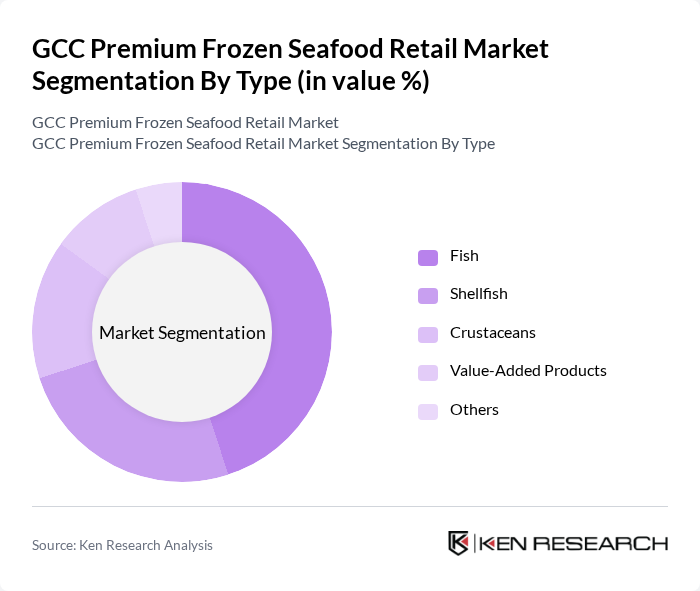

By Type:The segmentation by type includes various categories such as Fish, Shellfish, Crustaceans, Value-Added Products, and Others. Among these, Fish is the leading sub-segment, driven by its popularity and versatility in culinary applications. Shellfish and Crustaceans also hold significant market shares due to their premium positioning and consumer preference for gourmet seafood options. Value-Added Products are gaining traction as consumers seek convenience without compromising on quality.

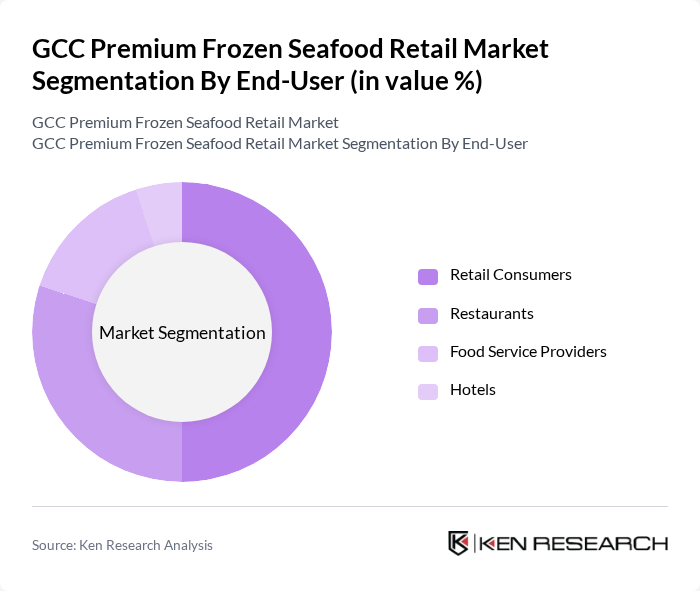

By End-User:The end-user segmentation includes Retail Consumers, Restaurants, Food Service Providers, and Hotels. Retail Consumers dominate the market, driven by the increasing trend of home cooking and the demand for high-quality frozen seafood. Restaurants and Food Service Providers are also significant contributors, as they seek premium seafood to enhance their menus. Hotels are increasingly focusing on offering gourmet dining experiences, further driving the demand for premium frozen seafood.

The GCC Premium Frozen Seafood Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Marai Company, Gulf Seafood Company, Al Kabeer Group, Emirates Fish Company, Al Ain Farms, Al Jazeera Fish Company, Al Watania Poultry, Al Falah Fisheries, Al Bait Al Mandi, Al Khor Fish Market, Al Quds Fish Company, Al Mufeed Fish Company, Al Sadiq Fish Company, Al Noor Fish Company, Al Maktoum Fish Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC premium frozen seafood market appears promising, driven by evolving consumer preferences and technological advancements. As health and wellness trends continue to shape purchasing decisions, companies are likely to invest in product innovation and sustainable sourcing practices. Additionally, the integration of e-commerce platforms will facilitate broader market reach, enabling brands to cater to the growing demand for convenient shopping experiences. Overall, the market is poised for dynamic growth, reflecting changing consumer behaviors and economic conditions.

| Segment | Sub-Segments |

|---|---|

| By Type | Fish Shellfish Crustaceans Value-Added Products Others |

| By End-User | Retail Consumers Restaurants Food Service Providers Hotels |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales |

| By Packaging Type | Vacuum Sealed Bulk Packaging Retail Packs |

| By Price Range | Premium Mid-Range Economy |

| By Region | UAE Saudi Arabia Qatar Kuwait |

| By Product Origin | Locally Sourced Imported Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Category Buyers |

| Consumer Preferences | 200 | Household Decision Makers, Seafood Consumers |

| Distribution Channel Analysis | 100 | Logistics Coordinators, Supply Chain Managers |

| Quality Perception Studies | 80 | Culinary Experts, Chefs |

| Market Trend Evaluation | 120 | Market Analysts, Industry Experts |

The GCC Premium Frozen Seafood Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality seafood products and a shift towards healthier eating habits.