Region:Asia

Author(s):Shubham

Product Code:KRAB0802

Pages:92

Published On:August 2025

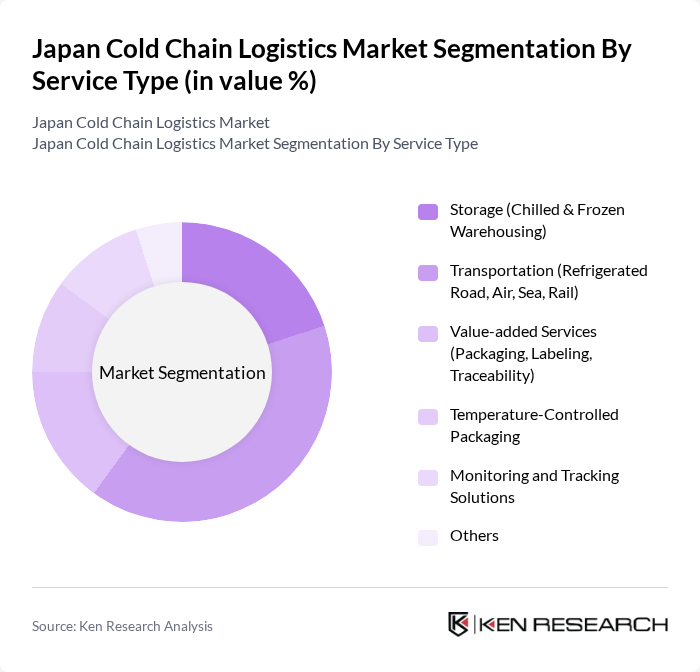

By Service Type:The service type segmentation includes Storage (Chilled & Frozen Warehousing), Transportation (Refrigerated Road, Air, Sea, Rail), Value-added Services (Packaging, Labeling, Traceability), Temperature-Controlled Packaging, Monitoring and Tracking Solutions, and Others. Among these, Transportation is the leading subsegment due to the increasing demand for efficient delivery of perishable goods across long distances. The expansion of e-commerce and the need for timely, safe delivery of fresh and frozen products have further elevated the importance of reliable transportation solutions, making it a critical component of the cold chain logistics market .

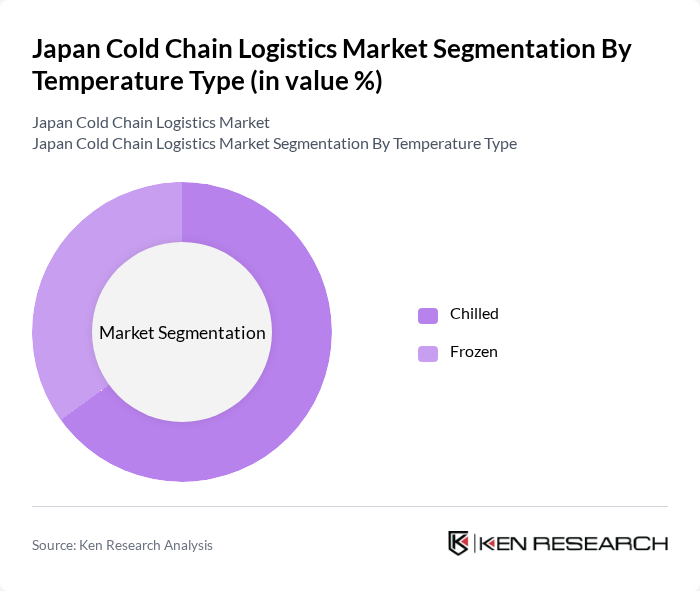

By Temperature Type:The temperature type segmentation includes Chilled and Frozen. The Chilled segment dominates the market due to the high demand for fresh produce, dairy products, and ready-to-eat meals. As consumer preferences shift towards healthier options and premium fresh foods, the need for chilled storage and transportation solutions has increased significantly, making it a vital part of the cold chain logistics landscape .

The Japan Cold Chain Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Kintetsu World Express, Inc., Marubeni Corporation, Mitsui-Soko Holdings Co., Ltd., Seino Holdings Co., Ltd., Hitachi Transport System, Ltd., K Line Logistics, Ltd., DHL Japan, Inc., DB Schenker Japan, DSV Air & Sea Co., Ltd., CEVA Logistics Japan, XPO Logistics Japan, Geodis Japan K.K., Agility Logistics Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's cold chain logistics market appears promising, driven by technological advancements and evolving consumer preferences. The integration of IoT and AI technologies is expected to enhance operational efficiency and real-time monitoring capabilities. Additionally, as sustainability becomes a priority, logistics providers are likely to adopt eco-friendly practices, such as energy-efficient refrigeration systems. These trends will not only improve service quality but also align with regulatory demands, fostering a more resilient cold chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Storage (Chilled & Frozen Warehousing) Transportation (Refrigerated Road, Air, Sea, Rail) Value-added Services (Packaging, Labeling, Traceability) Temperature-Controlled Packaging Monitoring and Tracking Solutions Others |

| By Temperature Type | Chilled Frozen |

| By Application | Horticulture (Fresh Fruits & Vegetables) Dairy Products Meats, Fish, Poultry Processed Food Products Pharmaceuticals, Life Sciences & Chemicals Others |

| By Region | Tokyo Kanto Osaka Tohoku Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain Logistics | 100 | Logistics Managers, Supply Chain Executives |

| Pharmaceutical Cold Chain Management | 60 | Quality Assurance Managers, Operations Directors |

| Temperature-Controlled Warehousing | 50 | Warehouse Managers, Facility Operations Heads |

| Retail Cold Chain Solutions | 40 | Retail Operations Managers, Supply Chain Analysts |

| Logistics Technology Providers | 40 | Product Development Managers, IT Directors |

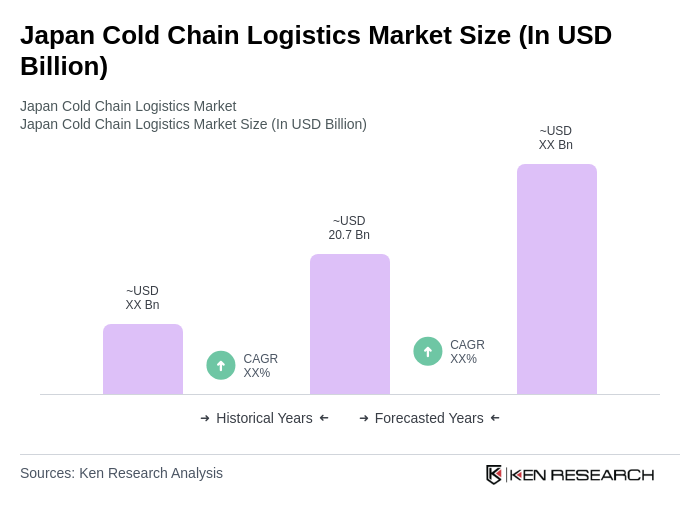

The Japan Cold Chain Logistics Market is valued at approximately USD 20.7 billion, driven by the increasing demand for temperature-sensitive products in sectors such as food, beverage, and pharmaceuticals, along with advancements in technology and e-commerce growth.