Region:Middle East

Author(s):Rebecca

Product Code:KRAB9766

Pages:88

Published On:October 2025

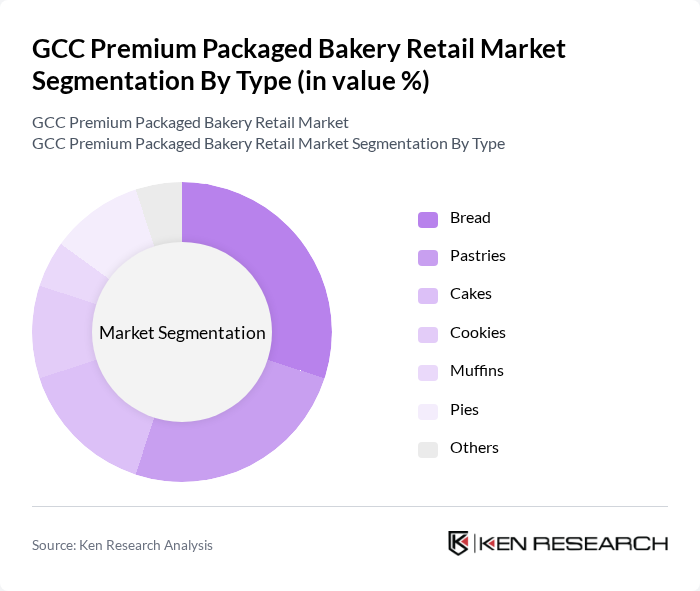

By Type:The market is segmented into various types of baked goods, including bread, pastries, cakes, cookies, muffins, pies, and others. Each sub-segment caters to different consumer preferences and occasions, with bread and pastries being the most popular choices due to their versatility and convenience. The increasing trend of snacking and on-the-go consumption has further fueled the demand for these products.

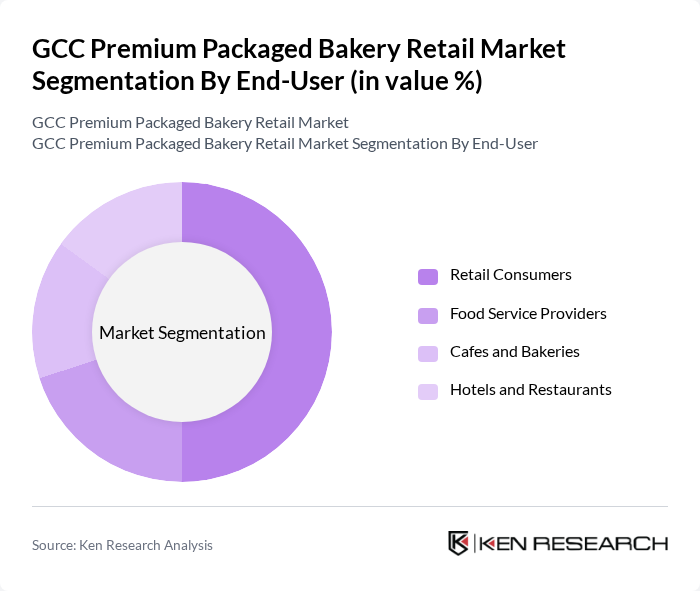

By End-User:The end-user segmentation includes retail consumers, food service providers, cafes and bakeries, and hotels and restaurants. Retail consumers dominate the market as they seek convenient and ready-to-eat options. Food service providers and cafes are also significant contributors, driven by the growing trend of dining out and the demand for premium baked goods in various culinary settings.

The GCC Premium Packaged Bakery Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Britannia Industries Limited, Bimbo Bakeries USA, General Mills, Inc., Mondelez International, Inc., Nestlé S.A., Flowers Foods, Inc., Aryzta AG, Grupo Bimbo S.A.B. de C.V., CSM Bakery Solutions, Rich Products Corporation, Dawn Foods Products, Inc., Associated British Foods plc, Premier Foods plc, Hostess Brands, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC premium packaged bakery market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek nutritious options, manufacturers are likely to innovate with gluten-free and organic products. Additionally, the rise of e-commerce platforms will facilitate broader market access, allowing brands to reach untapped demographics. Sustainability will also play a crucial role, with companies focusing on eco-friendly packaging solutions to attract environmentally aware consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Muffins Pies Others |

| By End-User | Retail Consumers Food Service Providers Cafes and Bakeries Hotels and Restaurants |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Specialty Stores |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| By Price Range | Premium Mid-range Economy |

| By Packaging Type | Plastic Packaging Paper Packaging Eco-friendly Packaging |

| By Flavor Profile | Sweet Savory Mixed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Bakery Retailers | 150 | Store Managers, Franchise Owners |

| Consumer Preferences in Bakery Products | 200 | Frequent Bakery Shoppers, Food Enthusiasts |

| Distribution Channel Insights | 100 | Supply Chain Managers, Retail Analysts |

| Market Trends and Innovations | 80 | Culinary Experts, Food Trend Analysts |

| Regulatory Impact on Bakery Products | 60 | Food Safety Officers, Regulatory Compliance Managers |

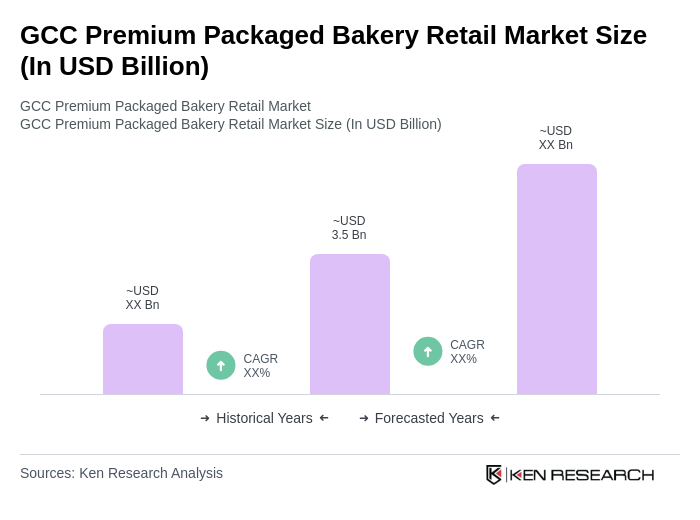

The GCC Premium Packaged Bakery Retail Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by consumer demand for high-quality and convenient baked goods.