Region:Middle East

Author(s):Rebecca

Product Code:KRAB8351

Pages:97

Published On:October 2025

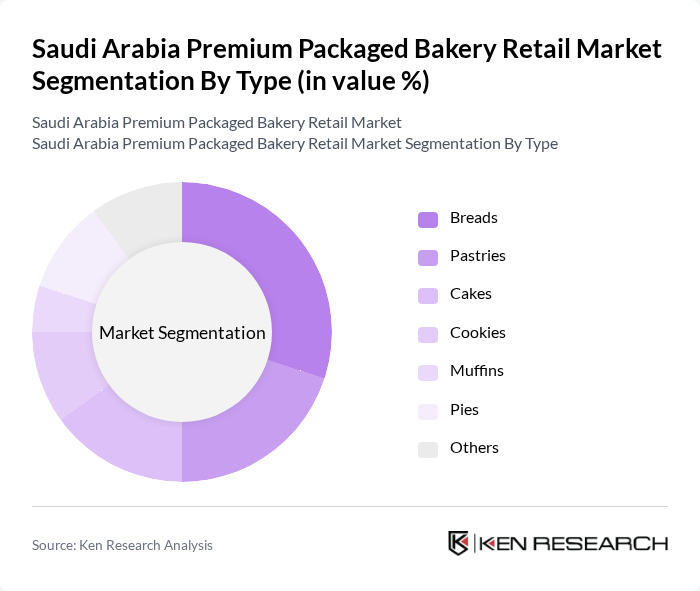

By Type:The market is segmented into various types of bakery products, including breads, pastries, cakes, cookies, muffins, pies, and others. Each of these subsegments caters to different consumer preferences and occasions, contributing to the overall market dynamics.

The breads subsegment is currently dominating the market due to their essential role in daily diets and the increasing preference for artisanal and specialty breads among consumers. The trend towards healthier options has also led to a rise in demand for whole grain and organic breads. Pastries and cakes follow closely, driven by their popularity in celebrations and special occasions. The growing trend of online shopping has further boosted the sales of these products, making them easily accessible to consumers.

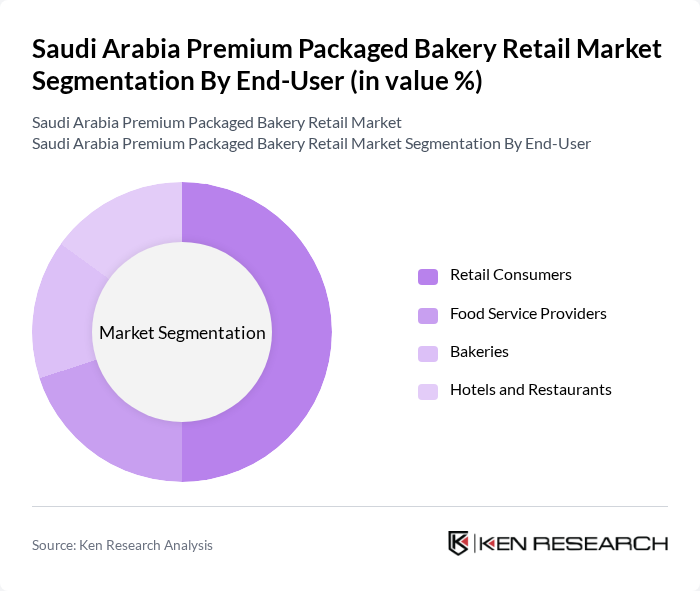

By End-User:The market is segmented based on end-users, including retail consumers, food service providers, bakeries, and hotels and restaurants. Each segment has unique requirements and purchasing behaviors that influence market trends.

Retail consumers represent the largest segment, driven by the increasing trend of purchasing packaged bakery products for convenience and variety. The food service providers segment is also significant, as restaurants and cafes increasingly incorporate premium bakery items into their menus. The demand from bakeries and hotels and restaurants is growing, reflecting a shift towards high-quality, ready-to-use bakery products that enhance their offerings.

The Saudi Arabia Premium Packaged Bakery Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Saudi Bakery and Confectionery Company, Al-Faisal Bakery, United Food Industries Corporation, Al-Othaim Markets, Al-Jazira Foods, Al-Muhaidib Group, Al-Baik Food Systems, Al-Safi Danone, Al-Hokair Group, Al-Mansour Group, Al-Muhaidib Foods, Al-Rajhi Group, Al-Salam Bakery, Al-Mahmal Bakery contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia premium packaged bakery market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious trends continue to rise, brands are likely to innovate with healthier options, including organic and gluten-free products. Additionally, the expansion of e-commerce will facilitate greater market penetration, particularly in rural areas. Companies that leverage digital marketing and sustainable practices will likely gain a competitive edge, positioning themselves favorably in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Breads Pastries Cakes Cookies Muffins Pies Others |

| By End-User | Retail Consumers Food Service Providers Bakeries Hotels and Restaurants |

| By Sales Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores |

| By Distribution Mode | Direct Sales Wholesalers Distributors |

| By Price Range | Premium Mid-range Economy |

| By Packaging Type | Plastic Packaging Paper Packaging Eco-friendly Packaging |

| By Occasion | Everyday Consumption Festive Occasions Special Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Bakery Retailers | 100 | Store Managers, Franchise Owners |

| Consumer Preferences | 150 | Frequent Bakery Shoppers, Health-Conscious Consumers |

| Distribution Channel Insights | 80 | Supply Chain Managers, Retail Buyers |

| Market Trends Analysis | 70 | Industry Analysts, Market Researchers |

| Product Development Feedback | 60 | Product Managers, R&D Specialists |

The Saudi Arabia Premium Packaged Bakery Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by consumer demand for convenience foods and premium bakery products.