Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2407

Pages:99

Published On:October 2025

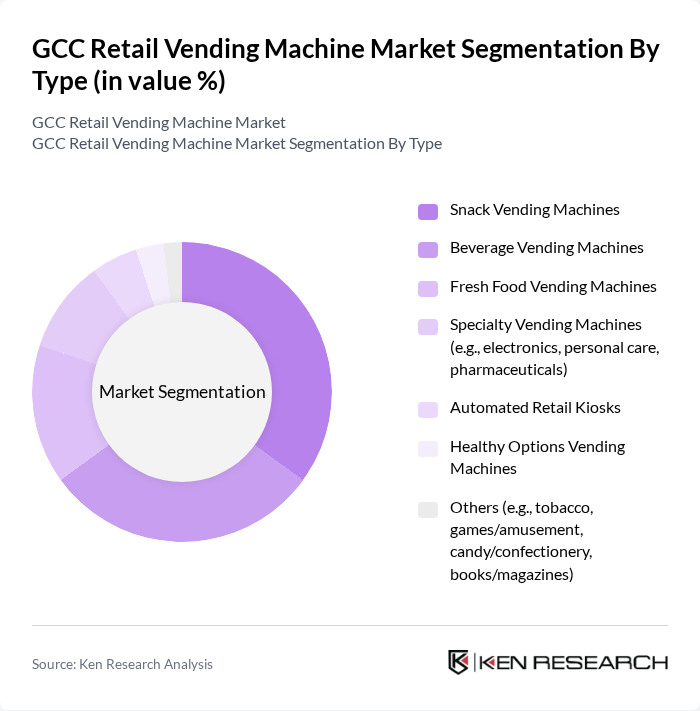

By Type:The market is segmented into various types of vending machines, including snack vending machines, beverage vending machines, fresh food vending machines, specialty vending machines, automated retail kiosks, healthy options vending machines, and others. Among these, snack vending machines and beverage vending machines remain the most popular due to their convenience, wide acceptance in high-traffic locations, and the growing trend of ready-to-eat and functional food consumption .

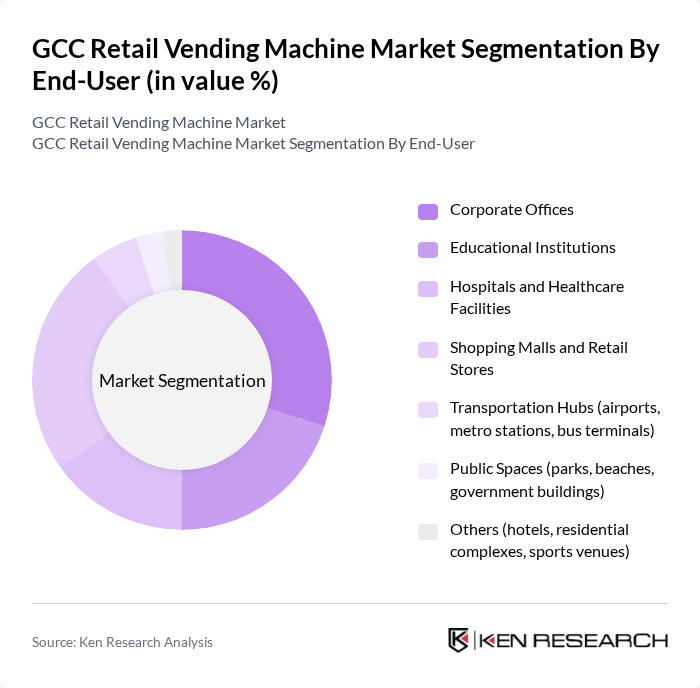

By End-User:The end-user segmentation includes corporate offices, educational institutions, hospitals and healthcare facilities, shopping malls and retail stores, transportation hubs, public spaces, and others. Corporate offices and shopping malls are leading segments, attributed to high foot traffic and the increasing demand for quick snack and beverage options among working professionals and shoppers .

The GCC Retail Vending Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crane Merchandising Systems, N&W Global Vending, Azkoyen Group, Jofemar Corporation, Seaga Manufacturing Inc., Vendon, Bianchi Vending Group, Royal Vendors, Fuji Electric Co., Ltd., SandenVendo, Selecta Group, Express Vending (UK) Ltd., Glory Global Solutions, Cantaloupe Inc., Westomatic Vending Services Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC retail vending machine market appears promising, driven by technological advancements and changing consumer preferences. As smart vending solutions become more prevalent, operators will likely enhance customer engagement through personalized experiences. Additionally, the increasing focus on sustainability will push companies to adopt eco-friendly practices, such as using biodegradable packaging. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Snack Vending Machines Beverage Vending Machines Fresh Food Vending Machines Specialty Vending Machines (e.g., electronics, personal care, pharmaceuticals) Automated Retail Kiosks Healthy Options Vending Machines Others (e.g., tobacco, games/amusement, candy/confectionery, books/magazines) |

| By End-User | Corporate Offices Educational Institutions Hospitals and Healthcare Facilities Shopping Malls and Retail Stores Transportation Hubs (airports, metro stations, bus terminals) Public Spaces (parks, beaches, government buildings) Others (hotels, residential complexes, sports venues) |

| By Sales Channel | Direct Sales (OEMs to end-users) Distributors (local and regional partners) Online Sales (e-commerce platforms, company websites) Retail Partnerships (supermarkets, convenience stores) Others (franchise models, leasing) |

| By Product Offering | Healthy Snacks Beverages (hot, cold, soft drinks, juices) Frozen Foods Personal Care Products Others (electronics, pharmaceuticals, books/magazines) |

| By Payment Method | Cash Credit/Debit Cards Mobile Payments (Apple Pay, Google Pay, local apps) Contactless Payments (NFC, QR codes) Others (loyalty cards, prepaid cards) |

| By Location | Urban Areas (city centers, business districts) Suburban Areas (residential neighborhoods, outskirts) Rural Areas (villages, remote locations) High Traffic Locations (airports, malls, stadiums) Others (industrial zones, free zones) |

| By Brand | National Brands (multinationals with GCC presence) Private Labels (retailer-owned vending solutions) Local Brands (GCC-based vending operators) Others (niche, emerging brands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vending Machine Operators | 60 | Business Owners, Operations Managers |

| Retail Managers in Malls | 50 | Store Managers, Retail Directors |

| Consumer Insights on Vending | 120 | Frequent Users, Occasional Users |

| Product Suppliers for Vending Machines | 50 | Sales Representatives, Product Managers |

| Market Analysts and Consultants | 40 | Industry Analysts, Market Researchers |

The GCC Retail Vending Machine Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by consumer demand for convenience and advancements in vending technology.