Region:Middle East

Author(s):Dev

Product Code:KRAC1271

Pages:85

Published On:December 2025

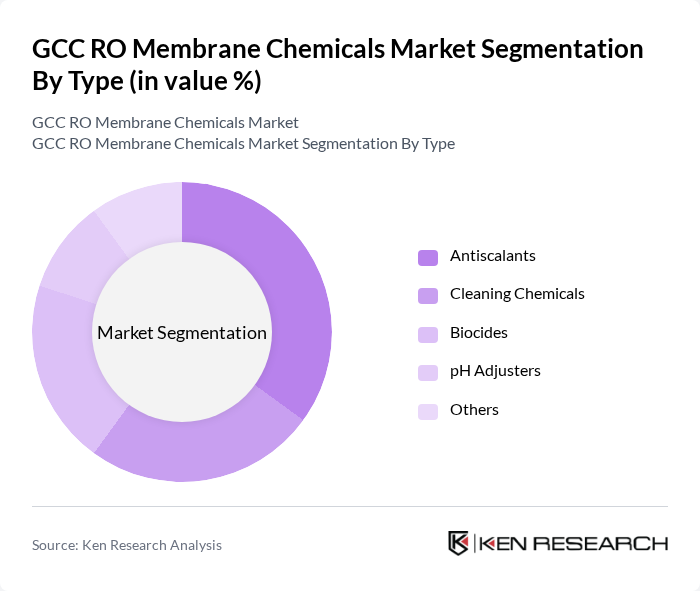

By Type:The market is segmented into various types of chemicals used in reverse osmosis membrane applications. Antiscalants are crucial for preventing scale formation, while cleaning chemicals are essential for maintaining membrane efficiency. Biocides are used to control microbial growth, and pH adjusters help in maintaining optimal operating conditions. The "Others" category includes various specialized chemicals that cater to specific needs in the industry.

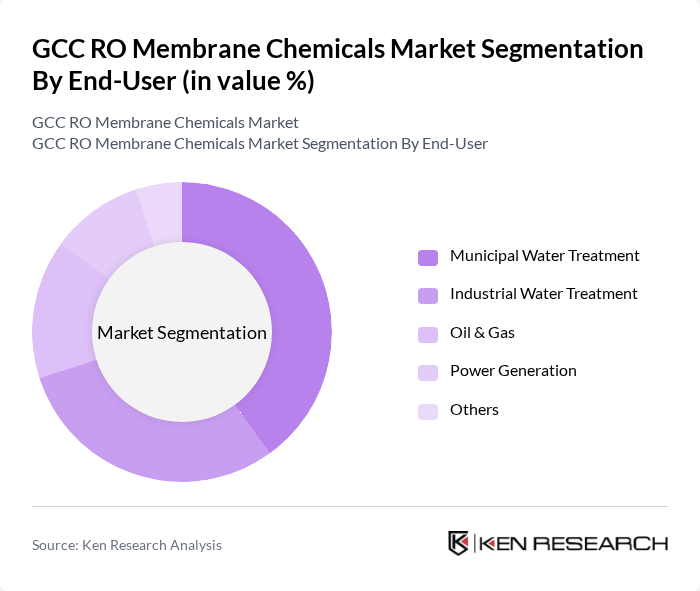

By End-User:The end-user segmentation includes municipal water treatment, industrial water treatment, oil & gas, power generation, and others. Municipal water treatment is a significant segment due to the increasing demand for clean drinking water. Industrial water treatment is also growing, driven by the need for water reuse and recycling in various industries. The oil & gas sector requires specialized chemicals for enhanced oil recovery and water management.

The GCC RO Membrane Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dow Chemical Company, BASF SE, Solvay S.A., Lanxess AG, AkzoNobel N.V., Nouryon, Hydranautics, Toray Industries, Inc., Membrane Solutions LLC, SUEZ Water Technologies & Solutions, GE Water & Process Technologies, Pentair PLC, 3M Company, Veolia Water Technologies, Ecolab Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The GCC RO membrane chemicals market is poised for significant growth, driven by increasing investments in infrastructure and the expansion of smart city initiatives. The Middle East water treatment system market is projected to reach USD 2.2 billion in future, with a substantial share attributed to RO systems. As urbanization accelerates and industrial applications expand, the demand for efficient water purification solutions will continue to rise, creating a favorable environment for membrane chemical suppliers.

| Segment | Sub-Segments |

|---|---|

| By Type | Antiscalants Cleaning Chemicals Biocides pH Adjusters Others |

| By End-User | Municipal Water Treatment Industrial Water Treatment Oil & Gas Power Generation Others |

| By Application | Desalination Wastewater Treatment Process Water Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Saudi Arabia UAE Qatar Kuwait Oman |

| By Product Formulation | Liquid Formulations Powder Formulations Others |

| By Customer Type | Large Enterprises SMEs Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Water Treatment Facilities | 100 | Plant Managers, Chemical Engineers |

| Municipal Water Authorities | 80 | Water Resource Managers, Policy Makers |

| Industrial Water Users | 70 | Procurement Managers, Operations Directors |

| Research Institutions | 50 | Research Scientists, Environmental Analysts |

| RO Membrane Manufacturers | 60 | Product Development Managers, Sales Executives |

The GCC RO Membrane Chemicals Market is valued at approximately USD 140 million, driven by investments in desalination projects and the demand for ultrapure feedwater in various industrial applications, including green hydrogen initiatives.