Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5968

Pages:85

Published On:December 2025

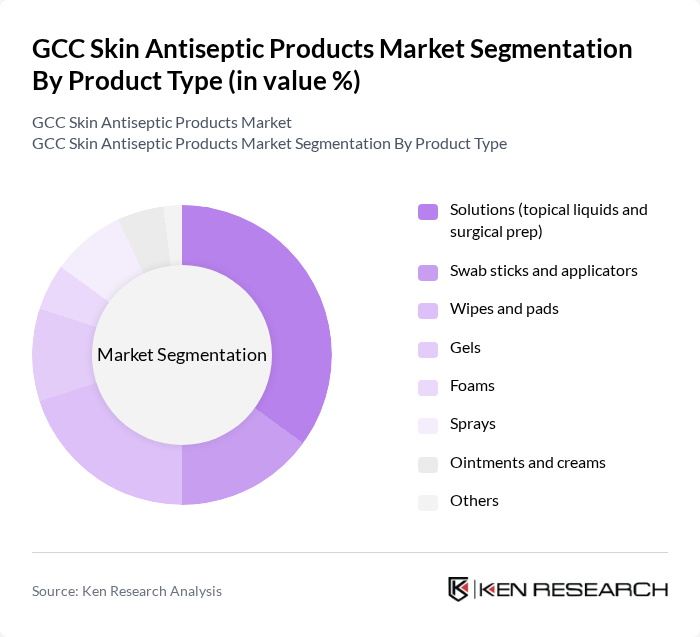

By Product Type:The product type segmentation includes various forms of skin antiseptic products that cater to different consumer needs and preferences. The subsegments are Solutions (topical liquids and surgical prep), Swab sticks and applicators, Wipes and pads, Gels, Foams, Sprays, Ointments and creams, and Others. Among these, solutions are the most widely used due to their versatility and effectiveness in various applications, particularly in surgical settings.

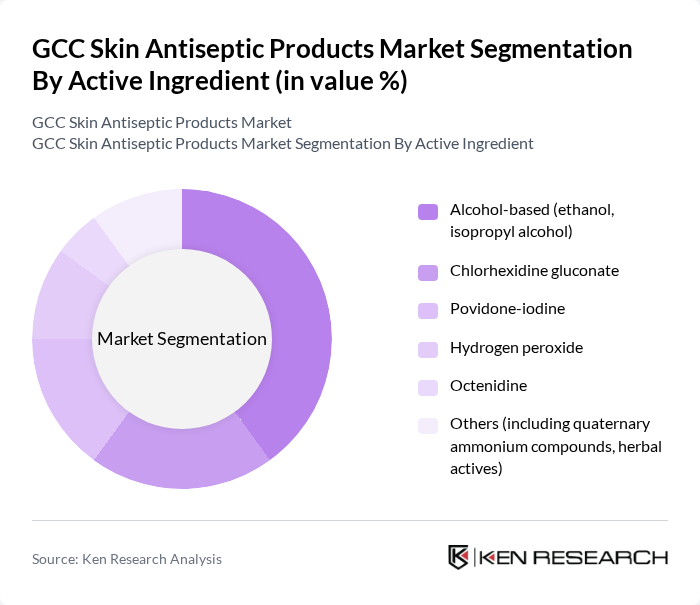

By Active Ingredient:The active ingredient segmentation includes various chemical compounds used in skin antiseptic products. The subsegments are Alcohol-based (ethanol, isopropyl alcohol), Chlorhexidine gluconate, Povidone-iodine, Hydrogen peroxide, Octenidine, and Others. Alcohol-based antiseptics dominate the market due to their rapid action and broad-spectrum efficacy against pathogens, making them a preferred choice in both healthcare and consumer settings.

The GCC Skin Antiseptic Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Reckitt Benckiser Group plc (Dettol), Johnson & Johnson (Savlon, surgical prep), 3M Company (3M Avagard, 3M Cavilon), Ecolab Inc., B. Braun Melsungen AG, BODE Chemie GmbH (a HARTMANN company), GOJO Industries, Inc. (Purell), Kimberly-Clark Corporation, PDI Healthcare (Professional Disposables International, Inc.), Diversey Holdings, Ltd., Schülke & Mayr GmbH, Medline Industries, LP, Clorox Healthcare (The Clorox Company), Sanosil AG, Local and regional GCC players (e.g. Saudi Pharmaceutical Industries & Medical Appliances Corporation – SPIMACO, Julphar Gulf Pharmaceutical Industries) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC skin antiseptic products market appears promising, driven by ongoing trends in health awareness and technological advancements. As consumers increasingly prioritize personal hygiene, the demand for innovative antiseptic solutions is expected to rise. Additionally, the integration of smart technology in antiseptic products, such as app-connected dispensers, is likely to enhance user engagement and product effectiveness, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Solutions (topical liquids and surgical prep) Swab sticks and applicators Wipes and pads Gels Foams Sprays Ointments and creams Others |

| By Active Ingredient | Alcohol-based (ethanol, isopropyl alcohol) Chlorhexidine gluconate Povidone-iodine Hydrogen peroxide Octenidine Others (including quaternary ammonium compounds, herbal actives) |

| By Application | Pre-injection and venipuncture Surgical site preparation Wound cleansing and first aid Catheter and device insertion Routine hand and skin hygiene Others |

| By End-User | Public hospitals and tertiary care centers Private hospitals and clinics Ambulatory surgical centers and polyclinics Home care and individual consumers Long-term care and rehabilitation facilities Others |

| By Distribution Channel | Hospital pharmacies Retail pharmacies and drugstores Supermarkets and hypermarkets Online channels (e-commerce and e-pharmacies) Direct sales and tenders Others |

| By Packaging Type | Bottles and cans Single-use sachets and pouches Pump and dispenser packs Sprays and aerosols Tubes Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Dermatologists, General Practitioners |

| Pharmacy Managers | 90 | Pharmacy Owners, Store Managers |

| End-Users | 150 | Consumers, Caregivers |

| Manufacturers | 70 | Product Development Managers, Marketing Heads |

| Regulatory Bodies | 40 | Health Inspectors, Compliance Officers |

The GCC Skin Antiseptic Products Market is valued at approximately USD 130 million, reflecting a five-year historical analysis. This growth is attributed to increased health awareness, rising infection rates, and a focus on hygiene practices in healthcare settings.