Region:Middle East

Author(s):Dev

Product Code:KRAD5146

Pages:89

Published On:December 2025

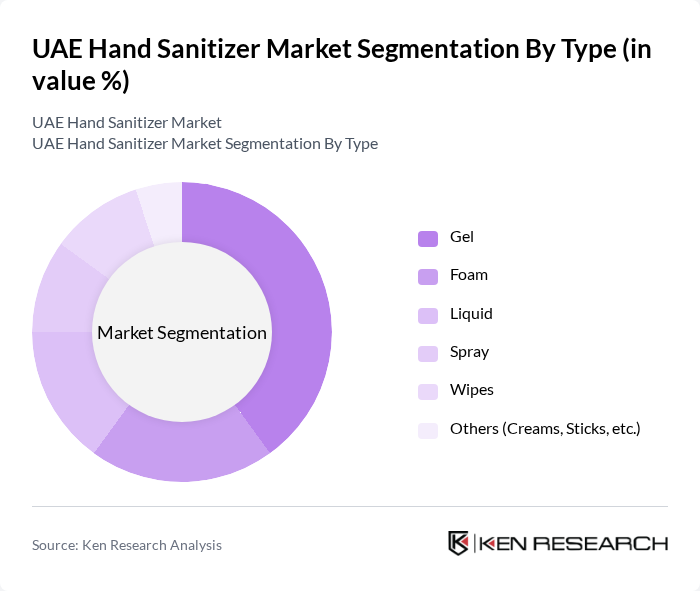

By Type:The market is segmented into various types of hand sanitizers, including Gel, Foam, Liquid, Spray, Wipes, and Others (Creams, Sticks, etc.). Each type caters to different consumer preferences and usage scenarios, influencing market dynamics, with gel and liquid formats together accounting for the majority of regional revenue and foam emerging as a faster-growing format.

The Gel segment dominates the market due to its ease of use, thick consistency, and proven effectiveness of alcohol-based gel formulations in rapidly killing a broad spectrum of germs, making it a preferred choice for both personal and institutional use. The convenience of gel sanitizers, especially in pump and wall-mounted dispensers, has led to increased adoption in hospitals, clinics, offices, retail, and educational settings, where frequent hand disinfection is required. Foam sanitizers are also gaining traction, particularly in healthcare, foodservice, and corporate facilities, due to their pleasant texture, controlled dosing, reduced dripping, and availability in both high-alcohol and skin-friendly formulations with added emollients that appeal to frequent users.

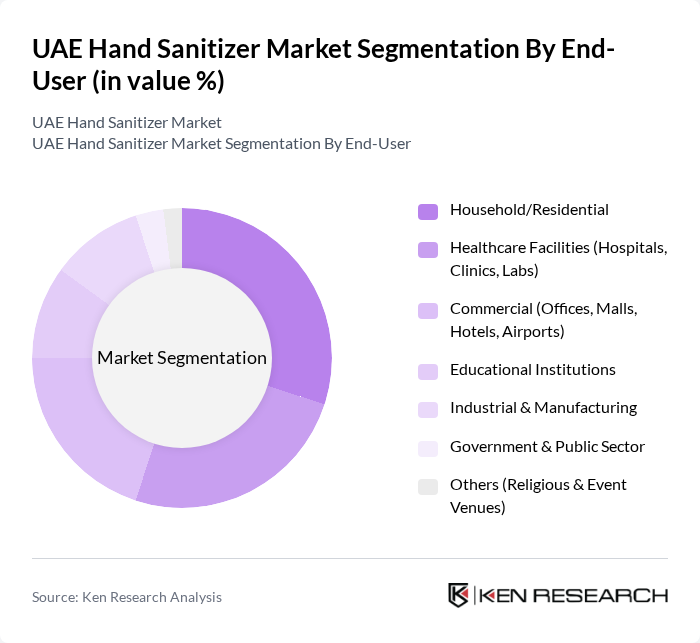

By End-User:The market is segmented by end-users, including Household/Residential, Healthcare Facilities (Hospitals, Clinics, Labs), Commercial (Offices, Malls, Hotels, Airports), Educational Institutions, Industrial & Manufacturing, Government & Public Sector, and Others (Religious & Event Venues). This segmentation reflects the strong penetration of hand hygiene protocols across both consumer and institutional environments in the UAE.

The Household/Residential segment leads the market, driven by elevated consumer hygiene awareness, continued use of personal sanitizers post-pandemic, and the wide availability of branded products through pharmacies, supermarkets, and online channels in the UAE. The Healthcare Facilities segment follows closely, as hospitals, clinics, and laboratories must comply with strict infection prevention and control protocols that require high-volume, hospital-grade hand sanitizers at points of care and throughout patient areas. Commercial establishments are also significant users, particularly in high-traffic areas like malls, hotels, restaurants, offices, and airports, where permanent dispenser installations and touchless systems support visitor safety and corporate health and safety policies.

The UAE Hand Sanitizer Market is characterized by a dynamic mix of regional and international players. Leading participants such as GOJO Industries, Inc. (Purell), Reckitt Benckiser Group plc (Dettol), Unilever PLC (Lifebuoy), The Procter & Gamble Company, Ecolab Inc., 3M Company, Henkel AG & Co. KGaA, Kimberly-Clark Corporation, Johnson & Johnson Middle East FZ-LLC, Amway Corp., Medline Industries, LP, BODE Chemie GmbH, Dabur International Ltd. (UAE), Al Khair Pharmaceuticals & Disinfectants (UAE), Emirates National Factory for Plastic Industries LLC – Hygiene & Sanitizer Division contribute to innovation in alcohol and non-alcohol formulations, skin-friendly and fragrance-enhanced variants, touchless dispensing systems, and bulk packaging tailored to institutional buyers, while leveraging the UAE’s strong retail, e-commerce, and healthcare distribution networks for market penetration.

The future of the UAE hand sanitizer market appears promising, driven by ongoing health awareness and technological advancements. As consumers increasingly prefer eco-friendly products, manufacturers are likely to innovate with sustainable formulations. Additionally, the rise of e-commerce platforms is expected to enhance distribution channels, making sanitizers more accessible. The market is poised for growth as businesses and consumers alike continue to prioritize hygiene in their daily routines, ensuring sustained demand for hand sanitizers.

| Segment | Sub-Segments |

|---|---|

| By Type | Gel Foam Liquid Spray Wipes Others (Creams, Sticks, etc.) |

| By End-User | Household/Residential Healthcare Facilities (Hospitals, Clinics, Labs) Commercial (Offices, Malls, Hotels, Airports) Educational Institutions Industrial & Manufacturing Government & Public Sector Others (Religious & Event Venues) |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drug Stores Convenience Stores & Groceries Online Retail & E-commerce Platforms Institutional/B2B (Hospitals, Hotels, Corporates) Others |

| By Packaging Type | Pump Bottles Flip-top & Squeeze Bottles Sachets & Pouches Wall-mounted & Standalone Dispensers (Manual/Automatic) Refill Packs & Bulk Containers Others |

| By Alcohol Content | Below 60% –70% –80% Above 80% Non-alcohol Based |

| By Brand Type | International Brands Regional & Local Brands Private Labels (Retailer & Pharmacy Brands) Generic/Unbranded |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Hand Sanitizer Sales | 140 | Store Managers, Category Buyers |

| Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Consumer Preferences | 150 | General Consumers, Health-Conscious Shoppers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

The UAE Hand Sanitizer Market is valued at approximately USD 520 million, reflecting its rapid growth driven by increased hygiene awareness and demand for sanitization products across various sectors, including healthcare, hospitality, and retail.